Beanstalk is the latest family-focused FinTech startup attempting to bolster the financial health of families.

The company has just launched an app aimed at making it easier for families and their friends to save up money for their kids’ futures.

Instead of having to drag themselves to the physical bank, parents and their close ones can simply log onto the account to on their smartphones to put aside some cash for the little ones.

Beanstalk offers stocks and shares individual savings accounts as well as junior ISAs, so any returns are tax free and requires no minimum or regular contributions, combined with a 0.5% fee.

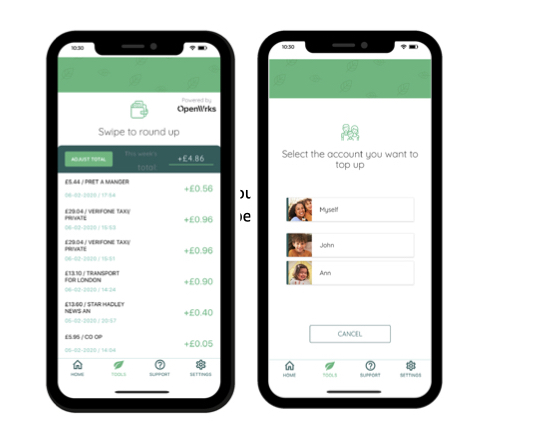

Parents can then invite grandparents and others to link to the children’s accounts and send and receive gift messages. When linked, family and friends can use their own apps to contribute in a way that best suits their own circumstances, including ad hoc top-ups and regular contributions.

Moreover, Beanstalk supports roundups on everyday spending, money back on shopping through a unique integration with KidStart.

“Today’s young adults are facing ever bigger expenses for their education and to get on the property ladder, and this is going the same issue when today’s children reach 18,” said Julian Robson, CEO and founder of Beanstalk. “Junior ISAs offer a tax-free way to save for your kids futures, but the current products are all too complex and hard to set-up. We are bringing kid’s savings into the app-age allowing the whole family to contribute and offering the simplest sign-up making it easier than ever-before to start saving for your children’s futures.”

Beanstalk has been created by the team behind the family-focused loyalty programme KidStart.

The startup is the latest in a string of family oriented FinTech companies that have launched over the past few years such as StorkCard and PCKT Money.

Copyright © 2020 FinTech Global