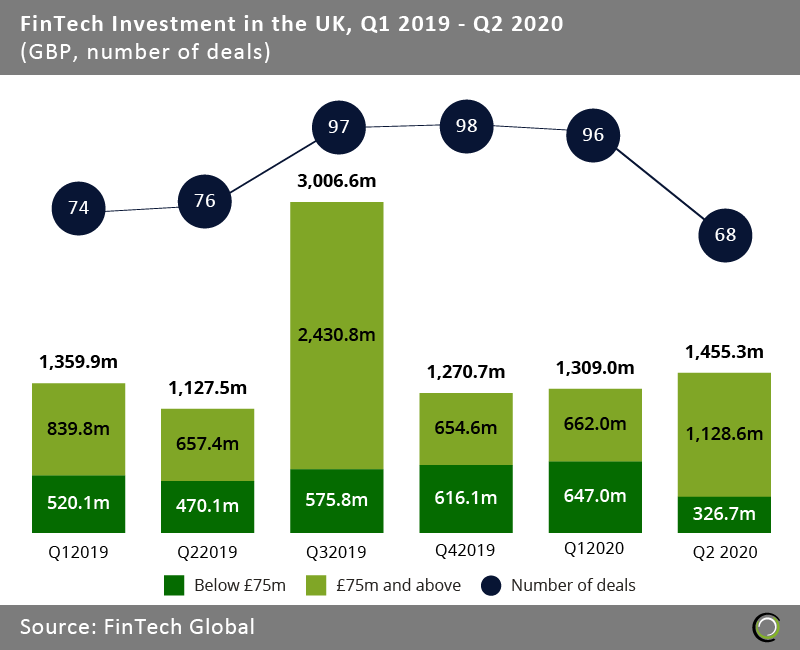

FinTech deal activity in Q2 hit a five-quarter low as deal pipelines are drying up and investors taking a more cautious approach due to economic uncertainty.

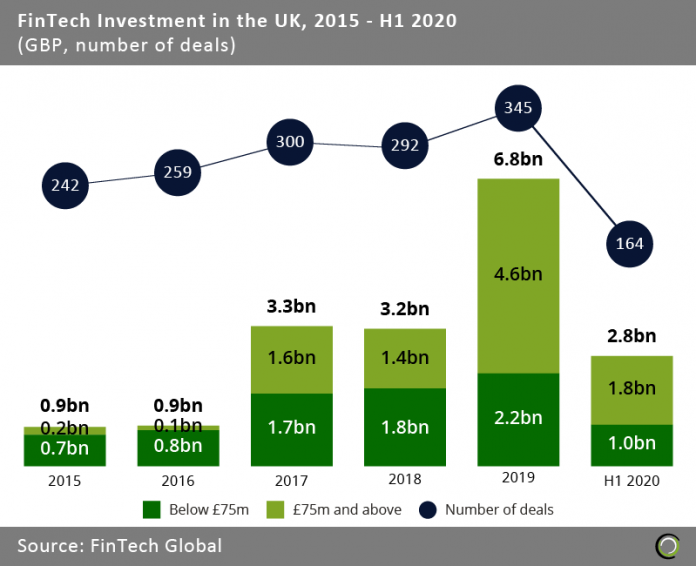

- While 2019 was the UK’s best year, the nation’s FinTech sector is expected to have a down year despite strong investment numbers in the first six months. Total investment in H1 2020 totalled just under £2.8bn via 164 completed deals, a record funding total for a first half year period to date. The strong investment in the first six months of 2020 was driven by deals sized over £75m with an increase in both funding and the number of deals completed from H1 2019. The UK’s explosive start to H1 2020 despite economic turmoil resulted in a 11.1% increase from the same period last year.

- The surprise jump in investment at the start of the year given Covid-19 uncertainty comes hot off H2 2019 as deals rolled over into H1 2020. The majority of deals completed were in the pipeline before Covid-19 and the ensuing economic uncertainty. It is largely expected that H2 2020 will be slower compared to the same period last year as economic downturn and reduced spending are plaguing the world economy, causing investors to be more risk averse resulting in shortage in the deal pipeline for the remainder of the year.

- Since the word FinTech has burst into business acumen, London has established itself home as the FinTech capital of the world through a large level of country-level consumer adoption, a surge of venture capital investment, a high number of FinTech unicorns, and large support from the UK government. The growth, in spite of all of the criticism over Brexit, has been extraordinary with total funding growing at a CAGR of 64.6% from 2015 to 2019.

- The steadfast numbers in H2 2019 stem from the UK’s diverse array of talent with a large spread access to financial institutions. Regulatory policies from the FCA have eased the barriers into FinTech. Recently the FCA made enhancements to its Financial Services Register by including clearer navigation and design, simpler language, more information on the Register’s purpose, how to use it and avoid scams, and optimization for mobile devices.

Investment in UK FinTech companies in the first half of 2020 beats last year’s levels to show resilience in the face of Covid-19 uncertainty

- The second half of 2019 was the best funding period for the UK FinTech to date. It was also the crowning six months of the best funding year in total to date. Funding for the second half of last year was up 21.6% compared to H1 2019. The strong end to 2019 carried over into the healthy investment numbers in H1 2020 since many venture capital deals closed during the period have been in the pipeline since late 2019. As these deals have been completed or near completion, funding for H2 2020 will likely begin to decline as deals have been limited along with investor confidence over the continued restrictions from Covid-19.

- The sector’s strong level of investment in H1 2020, was driven by a 5.1% increase in the total number of deals and a 11.1% increase in total funding compared to the same period last year.

- UK FinTech investment in the first half of the year has consistently grown from H1 2017 to H1 2020. The increase in funding has been driven by large deals over £75m. Deals of this size have increased nearly three-fold in the three-year period.

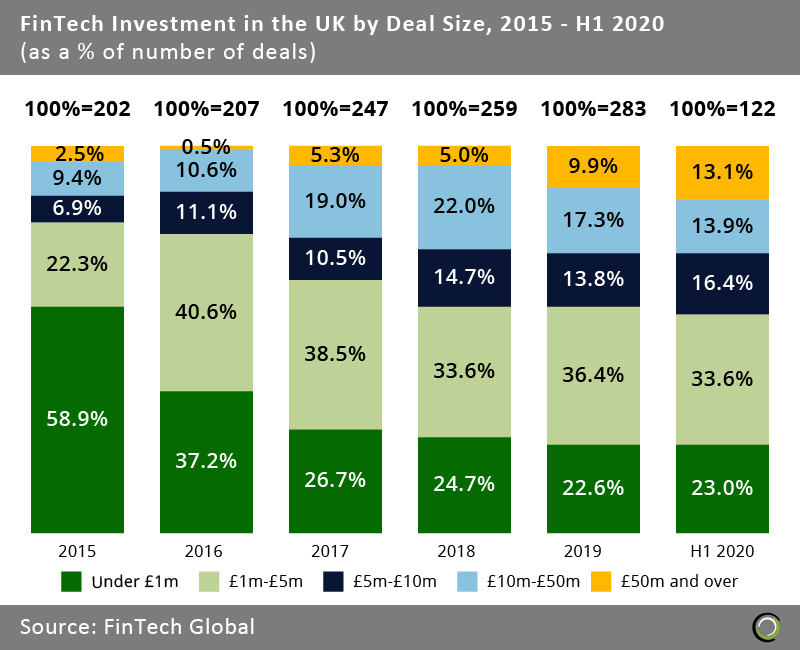

The first half of 2020 ends with a surge of deals over £50m following the sector’s hottest year

- In H1 2020, the share of deals sized £50m and over increased 3.2 percentage points (pp) to an overall 13.1%, the highest share to date for the sector. In just under two years, the deals sized over £50m have nearly tripled. On the flip side, since 2015 the share of deals under £1m has fallen two-fold to a sector low of 22.6% at the end of last year.

- Along with the increase of the number of deals over £50m, deals between £5m-10m have seen a healthy growth as well. Transactions in this range increased 2.8pp from last year. Although small, the increase is quite stellar compared to other countries such as Italy who saw a 42.6% decline in total funding in just one and a half years.

- The surprising level of funding for H1 2020 stemmed from a surge over deals over £50m. An abundance of deals in this deal size range were WealthTech deals, highlighting the continued desire for personal finance platforms, trading platforms, online banking, and more. The surge in demand clearly reflects WealthTech’s purpose as banking will shift to more contactless/virtual platforms following Covid-19’s effect on personal banking being done in person. However, H1 2020 still saw promise as FinTech firms are a bit more resilient to the effects of Covid-19 as working remotely goes hand in hand with the digitalisation model most FinTech companies have adapted.

H1 2020 churns out massive deals from the pipeline, leading to the largest period of funding the UK has seen to date

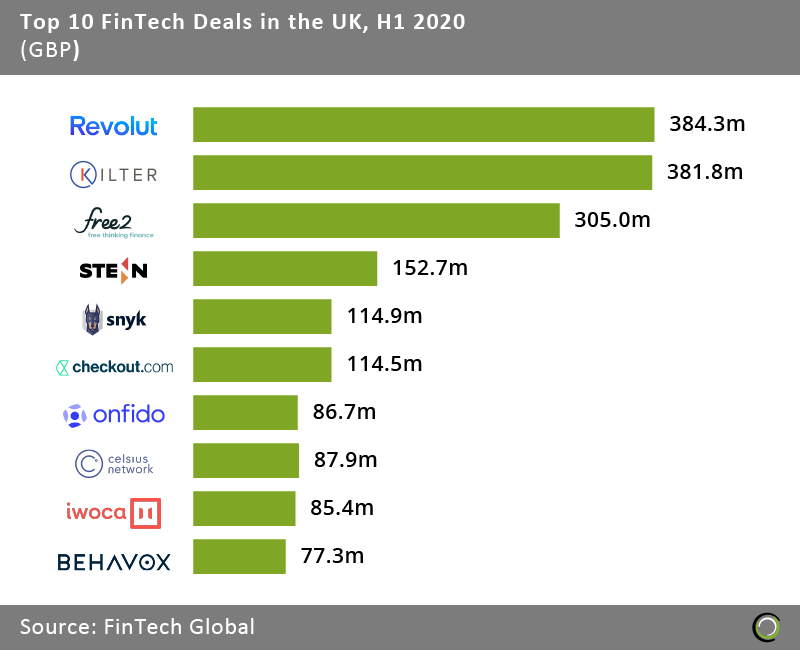

- Revolut raised the largest deal of the period after closing a $500m (£384.3m) Series D round led by TCV in February. The deal valued the UK challenger bank at $5.5bn and the company now has over 10m active users.

- The top ten FinTech deals in the UK raised in aggregate £1.7bn, making up 69.1% of the overall investment in the country during H1 2020.

- Out of the top ten deals in the UK, three came from the RegTech sector. RegTech has been gaining exponential interest and traction as regulations have become more volatile and companies look for solutions to avoid fines and comply. Snyk, a company that builds security into the application development process, completed the largest RegTech deal in H1 2020. The deal was closed in a Series C funding round to the total of £381.8m.

- The top ten deals in H1 2020 all totalled over £75m. Funding of this magnitude was crucial to drive up funding for the sector along with investor faith. While the UK government has come under scrutiny for its handling of the corona virus outbreak, one thing remains clear: the UK continues to be the capital of the world for FinTech and continues to prove so with a year that looks to be only a minor setback in the long run.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global