Mexico-based FinTech startup Creze has reportedly raised MXN $265m ($12m) in a funding round from unnamed investors based in the country.

With this capital injection, the company will update its technology and better cope with the market instability caused by the Covid-19 pandemic, according to a report from Contxto.

It will also look to improve its risk analysis so loan requests can be processed quicker.

The FinTech was founded in 2015 and provides small and medium-sized businesses in Mexico with access to loans.

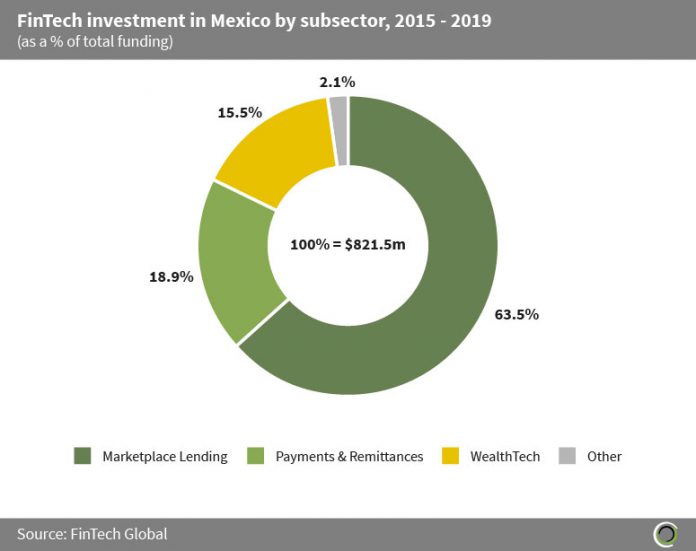

Lending companies have dominated the Mexican FinTech market, data from FinTech Global shows. Since 2015, there has been a total of $821.5m invested into the Mexican FinTech scene, of which, 63.5% has been deployed to companies with a marketplace lending solution.

The next biggest FinTech sector is payments and remittances, which represents 18.9% of the capital invested.

A report from Moody’s claims that around 90% of businesses in Mexico are SMEs but they only account for 9% of all bank loans in the country. This has left a gap for FinTechs to fill.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global