Hot on the heels of reporting a tripling of its losses in the last year, UK neobank Revolut is now launching a new feature to make it easier to track, split and settle up expenses.

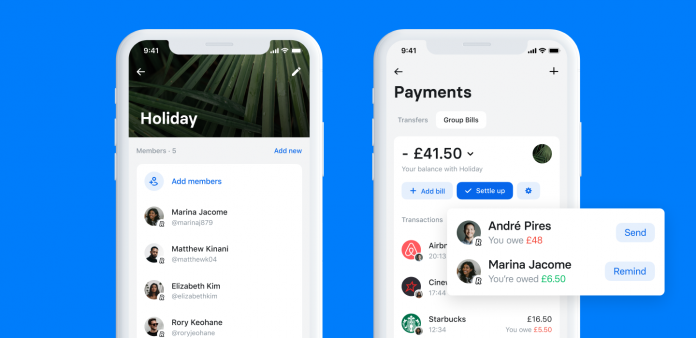

The bill-splitting tool Group Bills enables people to more easily stay on top of those big things like household expenses with flatmates, or holidays with friends.

It does so by enabling customers to add bills to their group and track them all in one place. And when it’s time to settle up, Group Bills can be settled in the app, with instant transfers when customers are both on Revolut. No need to have those awkward conversations, simply send a payment reminder and Revolut will send an automatic notification to your friend about payback.

Earlier in August Revolut announced that its annual losses had jumped from £32.8m in 2018 to £107.4m in 2019, but it was still hoping to break even by 2021.

It was not alone in reporting big losses as both Monzo and Starling Bank had doubled their losses in the last year. Monzo’s pre-tax losses grew to £115.4m and Starling’s to £53.6m.

Copyright © 2020 FinTech Global