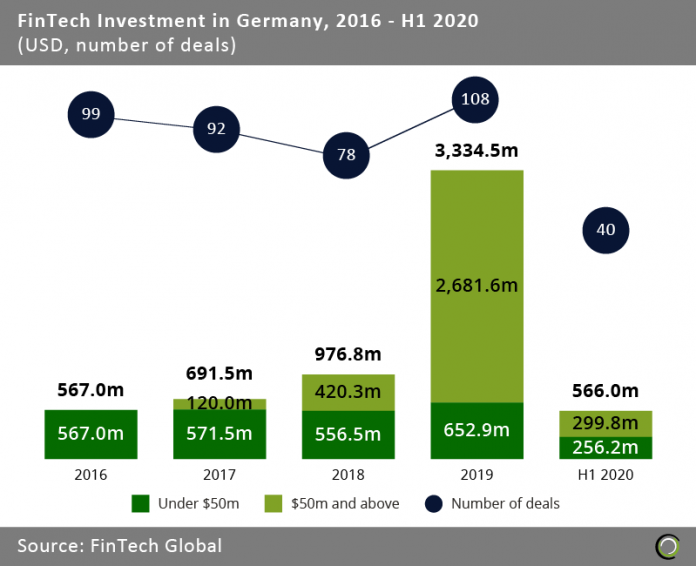

FinTech funding in Germany in H1 declined by 73.3% compared to the opening six months of 2019.

- Germany’s FinTech market has been maturing, evidenced by a rise in average deal sizes from $11m in 2016 to $23m in 2019 and an increasing interest from international investors. In fact, based on findings by Statista Digital Market Outlook, FinTech is the largest recipient of VC investment in Germany, owing to the country’s widespread usage of internet, internationally strong GDP per capita and reputation as the nation that has the highest share of online payment users in the world.

- Another reason for Germany’s ability to attract investment is the support that its FinTech companies receive from government entities. For instance, the Digital Hub Initiative, which was developed by the Federal Ministry for Economic Affairs and Energy, supports the establishment of digital hubs in Germany. According to Statista Digital Market Outlook, there are currently 12 centres of digital excellence promoting partnership between companies and start-ups. Examples include Berlin and Frankfurt, which are home to FinTech clusters, and Cologne and Munich, which contain a prominent InsurTech market.

- Despite Germany’s growing FinTech developments, the nation observed a drop in FinTech funding recently, from $2,079m in H1 2019 to $556m in H1 2020, due to the hardships and economic uncertainty caused by Covid-19. As stated by KfW, in Germany, VC investors’ assessment of future startup performance dipped by 77.9 points to -69.9, which largely diminished the amount of deals worth more than $50m. However, the FinTech landscape will most likely recover in the future due to Germany’s status as the country with the second largest digital payments market and the highest number of digital commerce users in Europe.

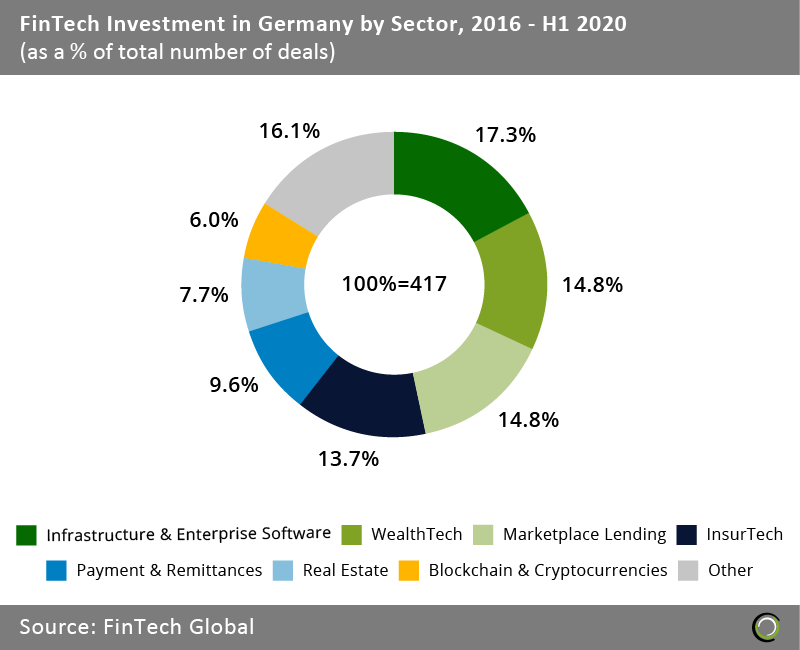

Infrastructure & Enterprise Software leads as the sector with highest deal activity, with WealthTech and Marketplace Lending not far behind

- Infrastructure & Enterprise Software is the FinTech sector that has recorded the greatest number of deals since 2016, with companies in the sector completing 72 transactions or 17.3% of all FinTech deals in the country during the period. Organisations like the Association of German Banks actively promote partnership between banks and FinTech companies, which help these financial institutions implement sophisticated and efficient portfolio analysis, trading platforms, management system and accounting procedures.

- WealthTech is placed second in the list with 62 deals and a 14.8% share. In particular, the challenger bank market is increasing in prominence. For instance, N26, which is the most valuable FinTech start up in Germany currently, is making investing, depositing cash, withdrawing cash and transferring money more seamless than before. Amid Covid-19, digital banking is becoming increasingly important, further boosting N26’s business prospects. That being said, the German challenger bank has recently made headlines due to its protected dispute with some of its employees.

- The German Marketplace Lending sector, which ranks joint second with WealthTech, is expected to show a CAGR of 2.9% for the next four years, resulting in a projected total amount of $243.7m by 2024, according to Statista. Among all of Marketplace Lending’s areas, P2P is one of the most dominating, as it enables individuals to borrow money with reduced interest rates, risk and effort.

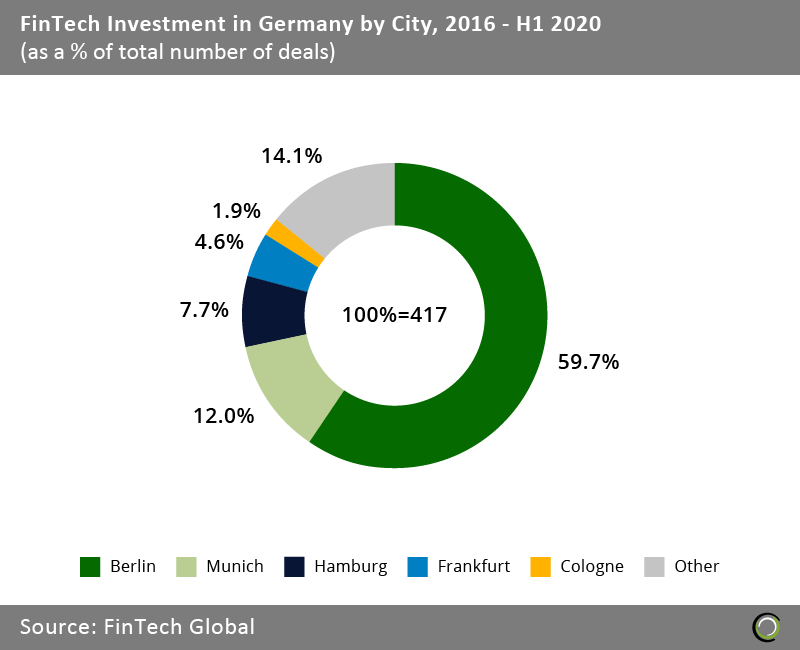

Berlin tops the list of German cities for FinTech deal activity, followed by Munich and Hamburg in second and third place, respectively

- FinTech companies based in Berlin have completed nearly 60% of deals in Germany since 2016. The capital, which has seen 249 deals over the period is becoming an important FinTech hub, as its relatively cheap cost of living compared to other major cities in Europe, dynamic labour market and sound knowledge of English continue to attract a wide array of talent and foster new FinTech startups and ideas.

- Munich, the Bavarian capital, ranks second in the list with 50 deals. As one of the leading insurance locations in the world, Munich provides favourable conditions for firms to develop innovations within the InsurTech space. For instance, the InsurTech Hub Munich e.V. program was founded by some of the city’s most prominent insurance companies and aims to digitise the insurance industry, enabling customers to obtain insurance policies more easily and take better control of them.

- Although Frankfurt has a much lower number of FinTech deals than Berlin, as Germany’s financial center, it has the necessary infrastructure and labour skills to attract increasingly more FinTech funding in the years to come, as Frankfurt Main Finance Executive Committee member Tarek Al-Wazir claims that “the continent’s leading financial centre must also take the lead in the highly innovative FinTech sector”.

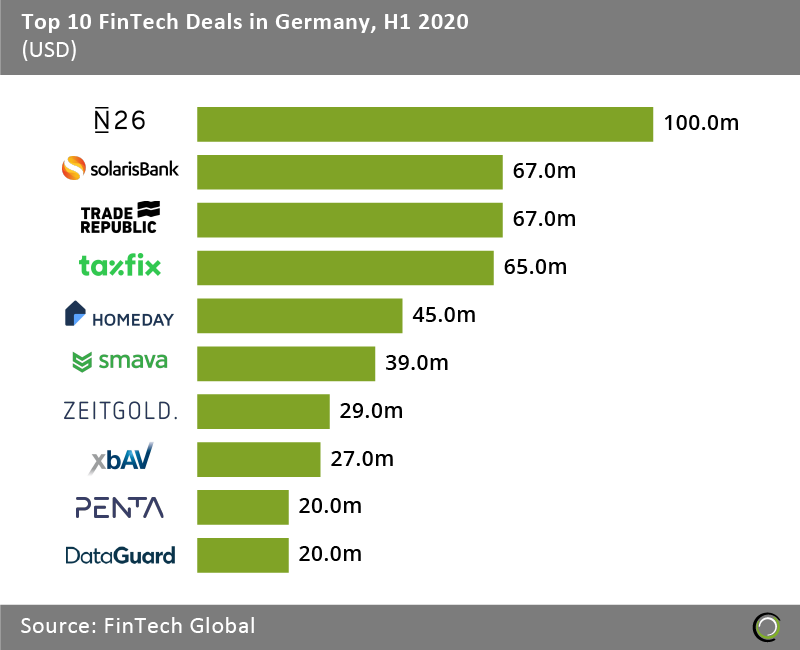

WealthTech as well as Infrastructure & Enterprise software companies dominate the list of largest FinTech deals

- N26 tops the list as the FinTech company that raised the largest amount of capital in a single funding round this year. During these turbulent times, the adoption of digital banking is accelerating as people move toward contactless payments and e-commerce. As one of the world’s leading challenger banks, N26 is using its latest funding of $100m to help people bank seamlessly on their phones, facilitating processes such as money transfer.

- FinTech companies within the Infrastructure & Enterprise software sector, like Taxfix and SolarisBank, have attracted a growing amount of funding. Taxfix intends to use the funds that were raised recently to expand to more European nations and further develop its app, helping its customers maximize their tax returns. Meanwhile, SolarisBank is advancing its banking platform, allowing financial services to better access and integrate its banking service modules.

- Based on a study by FinTech Futures, Trade Republic has more than 150,000 customers and collectively manages more than €1 billion through its app. It will use its latest funding of $67m to extend its reach, encouraging more customers to use its platform to invest in shares, ETFs and derivatives.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global