Brazilian challenger bank Nubank has acquired digital investment platform Easynvest for an undisclosed sum as the Latino FinTech decacorn moves into the investment space.

The deal willm see Nubank add Easyinvest’s 1.5m customers to its 30 million customers.

“The current investments market in Brazil is filled with complex, expensive products and surrounded by conflicts of interest,” said David Vélez, CEO and founder of Nubank. “The less income and financial education a customer has, the worse her investment options are.

“This creates an enormous opportunity to replicate Nubank’s approach to bringing simplicity and efficiency to a complex market and using technology and customer focus to democratize access to great financial services products for everyone.”

The deal marks Nubank’s third acquisition in 2020, having acquired Cognitect and PlataformaTec earlier in the year.

Two weeks ago, FinTech Global reported that the neobank had raised $300m in new funds, according to a filing with the U.S. Securities and Exchange Commission. While five investors had participated in the raise, none of them were named.

The raise came almost a year after Nubank passed the $10bn valuation mark and landed itself a spot in the prestigious decacorn club.

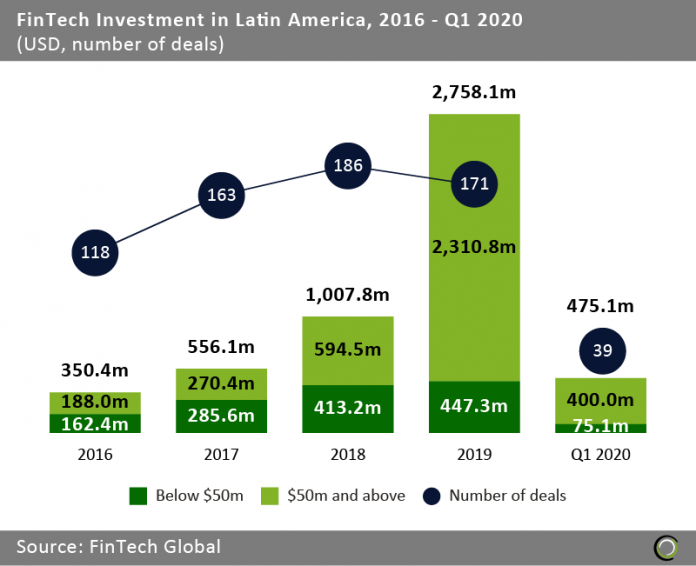

The news about Nubank’s new acquisition comes as the growth of Latin America’s FinTech industry seems to be slowing down due to Covid-19. Back in 2016, ventures in Latin America raised $350.4m in total, according to FinTech Global’s research. That figure skyrocketed to $2.74bn in the record year of 2019.

However, the first quarter of this year gave little assurance that they would be able to achieve same results. The sector only raised $475.1m in the first six months of 2020. Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global