London-based InsurTech startup Hometree has collected £7m in a funding round designed to allow it to capitalise on skyrocketing demand amid Covid-19.

Investment firm Anthemis led the round that also enjoyed cash injections from existing investors DN Capital and Literacy Capital, the Irish Times reported.

Gumtree founder Michael Pennington, several unnamed existing shareholders and Silicon Valley Bank also participated in the round.

Hometree raised a €7.2m (£6.5m) round in 2018. The startup has raised £18.6m to date from venture capital backers.

Having started life in 2016 by offering services in the home heating market, the company has since expanded into the emergency insurance market.

Co-founder Simon Phelan is expecting growth of up to 300% this year by leveraging the growing concern of home emergencies brought on by the Covid-19 pandemic.

“Our objective in the next two to three years is to become the leading challenger brand in the home cover market,” Phelan told the Irish Times. “This new funding will help us accelerate our plans at a time when homeowners across the UK need peace of mind more than ever. We are incredibly excited to be able to help homeowners have one less worry at this incredibly stressful time in all of our lives.”

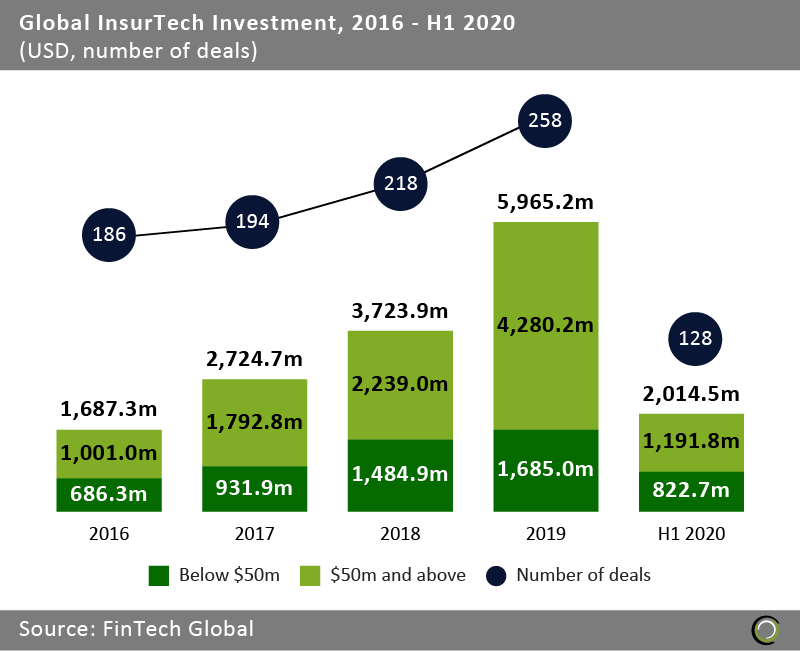

While Hometree is looking to capitalise on the coronavirus crisis, it seems as if the raise comes at a perilous period for the global InsurTech industry. The total global InsurTech investment dropped by 13.3% in the first half of 2020 compared to the same period in 2019, according to FinTech Global’s research. Although, at the same time there was a 5.4% increase in the number of deals compared to the same period last year. The InsurTech industry raised $2.01bn across 128 deals in the first six months of 2020.

This follows after a period where the sector had enjoyed a 52.3% annual compound annual growth rate between 2016 and 2019. In that period, the total amount raised by the industry grew from $1.68bn to $5.96bn.  The Hometree round follows from lead investor Anthemis announcing in March this year that it had raised $90m for the Anthemis Insurance Venture Growth Fund I.

The Hometree round follows from lead investor Anthemis announcing in March this year that it had raised $90m for the Anthemis Insurance Venture Growth Fund I.

“This is a huge milestone for Anthemis as we approach the close of our first decade as a business,” Sean Park, founder and chief investment officer at Anthemis, said at the time.

“Insurance and risk management will propel much of the true transformation we see in financial services. With the maturation of our portfolio companies and the industry more broadly, it is a natural evolution for us to be active participants in the venture growth space. I’m very proud of the team that we have assembled and look forward to our next chapter.”

Copyright © 2020 FinTech Global