Europe’s most valuable privately owned FinTech company Klarna has officially launched in Italy with the introduction of Pay in 3.

The instalments service will enable shoppers who use Klarna in a retailer’s checkout will be able to buy online and split their purchase into three interest-free equal payments.

“Retail is changing at a rapid pace due to rising expectations from Italian consumers,” said Sebastian Siemiatkowski, CEO and co-founder of Klarna. “More than ever, consumers demand transparent and smart shopping services that meet their daily needs. We believe the future of retail is high tech powering high touch experiences, so regardless of how and when consumers want to shop and pay, we need to be there for them.

“That’s why we focus on unique shopping solutions that allow consumers to take control and shop on their own terms. We are very excited to launch in Italy today and elevate the shopping experience for all Italians.”

Francessco Passone, country manager Italy at Klarna, added, “Klarna is focused on being a true growth partner for merchants in Italy. Across markets we help over 200.000 merchants every day to increase their average order volume, conversion rates and ultimately their revenues by providing seamless checkout experience for consumers.

“We are very excited to officially launch our shopping solution in Italy today, help Italian merchants make the most of the growth in e-commerce and build loyal and satisfied customers in the long term.”

The news comes after Klarna acquired Italian buy now, pay later startup Moneymour in February this year.

Klarna became Europe’s most valuable FinTech in September 2020 after securing a $10.65bn valuation on the back of closing a $650m funding round.

Several market stakeholders noted that the rise of Klarna highlights just how promising the Scandinavean FinTech sector is becoming.

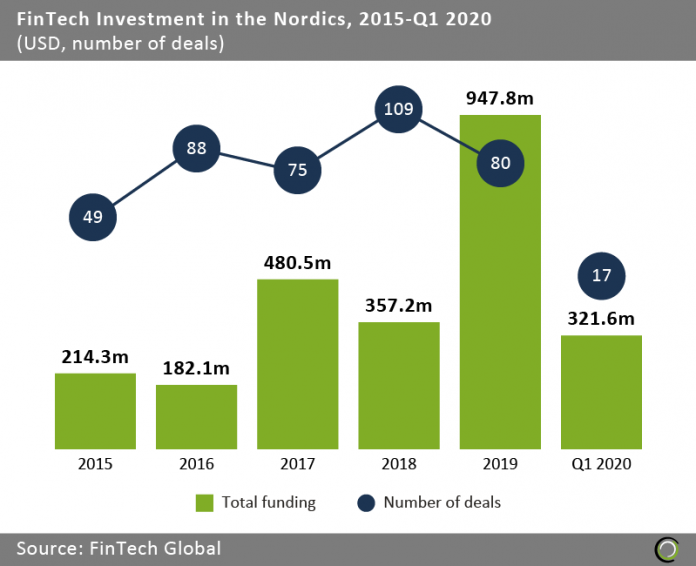

In 2015, the region’s FinTech ventures raised $214.3m across 49 rounds, according to FinTech Global’s data. By 2019, that number had skyrocketed to $947.8m across 80 deals.

The sector was seemingly on track for another record year in the first quarter of 2020, with the sector raising $321.6m across 17 deals. Like everything else in the industry, the future of the sector has been put in doubt due to the coronavirus.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global