FinTech companies in the Nordics raised nearly $1.2bn in the first three quarters of the year with Klarna and Tink closing large investments.

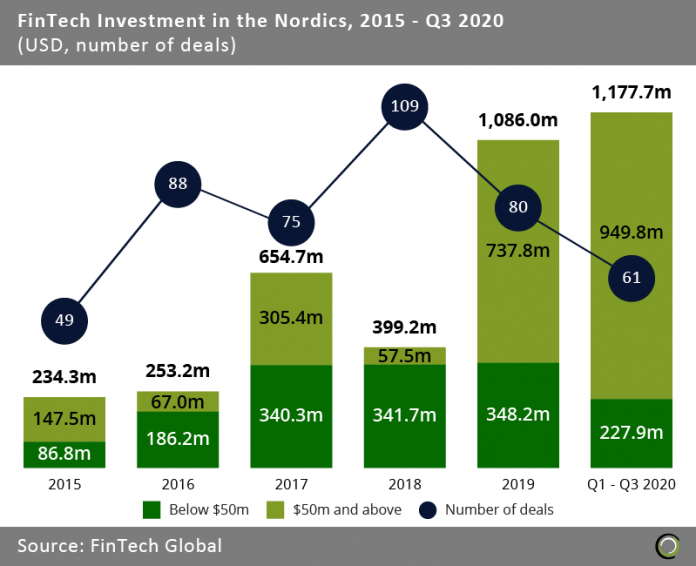

- The FinTech industry in the Nordics recorded strong growth in investment between 2016 and 2019 as investors backed innovative startups in the region developing digital solutions for established financial services firms. Total funding grew at a CAGR of 62.5% from $253.2m to over $1bn at the end of last year.

- Deal activity also increased during the period, peaking at 109 transactions in 2018 before slowing down to 80 in 2019. However, that year FinTech companies in the region raised a record amount of capital, nearly 1.1bn, mainly driven by a massive $460m funding round completed by Klarna, the Swedish digital payments and e-commerce giant.

- FinTech investment growth in the region continued unabated in 2020 as it only took nine months to set a new funding record despite the coronavirus uncertainty. FinTech companies raised $1.17bn in the first nine months of the year, a growth of 20.6% YoY compared to the same period in 2019. That being said, 72% of that funding came from two large deals completed by Klarna, which raised $650m and $200m in September and January, respectively.

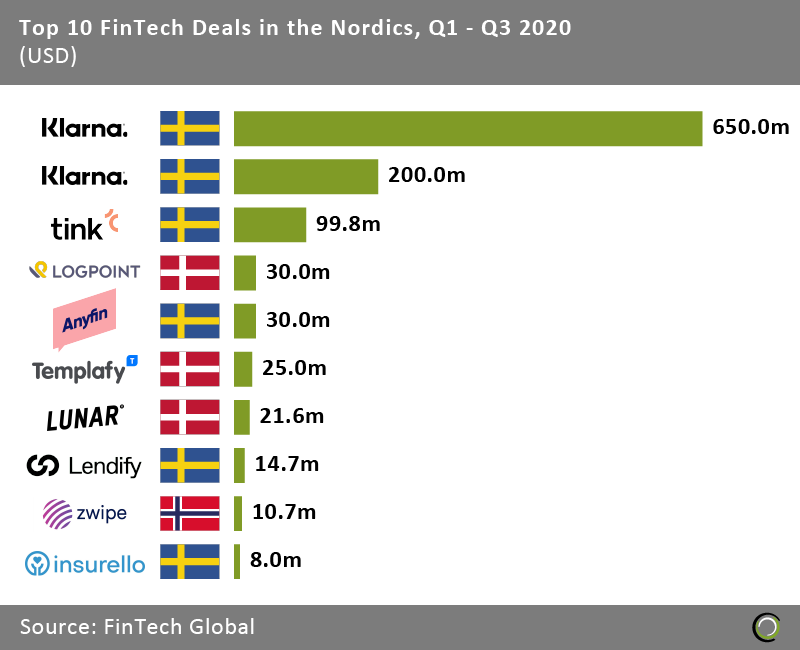

Swedish companies raised six of the top ten FinTech deals in the Nordics in the first three quarters

- The top ten FinTech deals in the Nordics completed during the first nine months of 2020 raised in aggregate $1.09bn, making up 92.5% of the overall investment in the region during the quarter. The high levels of concentration of capital in large deals is to be expected given the massive deals raised by Klarna and investors scaling back on early stage investment risk due to increased economic uncertainty post Covid-19.

- Swedish companies took the top three spots on the list with Klarna raising the two biggest deals so far this year. The top three was rounded off by Tink, an API provider for open banking, which raised €90m to expand its client base already consisting of over 2,500 banks and FinTechs.

- Danish FinTech companies also had a strong representation on the list with three funding round taking place in the country. The largest deal was raised by LogPoint, a cybersecurity startup, which closed a $30m Series B round led by Digital + Partners. Funds from the round will be used to help the company enter new markets and further the development of its platform. The company’s previous capital raise was a $10m round back in 2017.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2020 FinTech Global