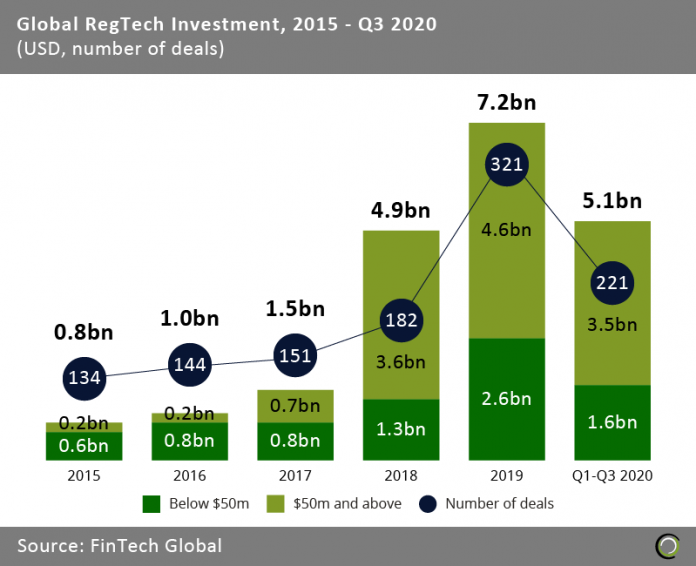

RegTech companies raised $5.1bn across 221 deals in the first three quarters of 2020

- Total investment in the RegTech sector rocketed from 2017 to 2019 growing at a compound annual growth rate (CAGR) of 119.1%, as investors increasingly backed companies looking to solve and bring efficiency to outdated compliance processes as well as take advantage of the new complex regulations coming into effect such as MiFID II and GDPR. The rise in total funding in 2019 was mainly driven by large deals over $50m which made up 63.9% of the total funding for the year.

- The first three quarters of 2020 saw a 3.4% decline in total funding compared to the same period last year along with a 4.3% decrease in deal activity. The lower investment numbers were mainly caused by a poor second quarter where $1.5bn was invested across 51 deals as global lockdown measures took its toll. In comparison, RegTech companies raised $2.4bn via 106 transactions during the opening quarter of the year.

- While deal activity recovered in Q3 2020 with 85 completed funding rounds, funding declined further to $1.2bn as new RegTech innovation to tackle post Covid-19 challenges is being funded at the early stage. This trend is expected to continue as investors are cautious of writing big cheques and are reassessing their portfolios and as such the RegTech sector is on pace to record its first decline in investment activity since 2015.

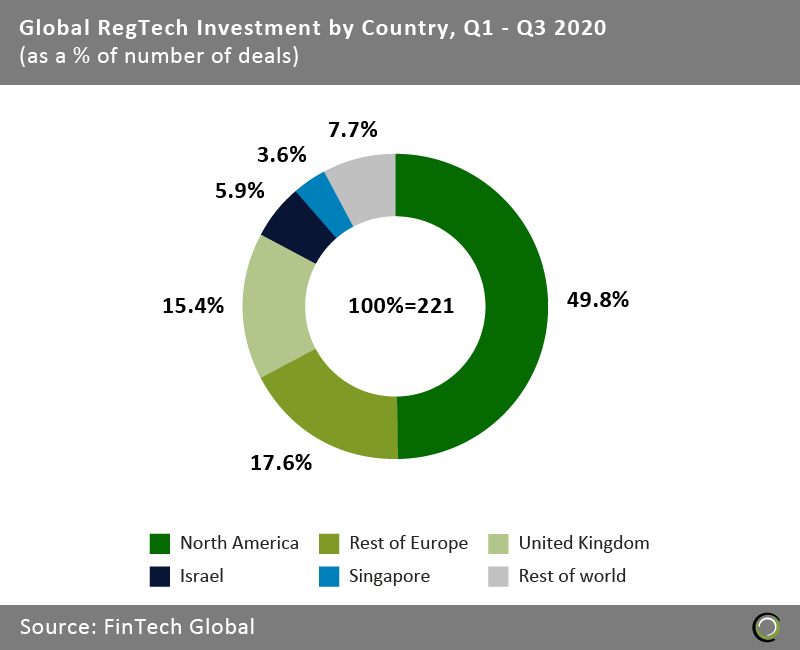

European companies increased their share of RegTech deal activity in Q3 2020

- Total investment in the RegTech sector rocketed from 2017 to 2019 growing at a compound annual growth rate (CAGR) of 119.1%, as investors increasingly backed companies looking to solve and bring efficiency to outdated compliance processes as well as take advantage of the new complex regulations coming into effect such as MiFID II and GDPR. The rise in total funding in 2019 was mainly driven by large deals over $50m which made up 63.9% of the total funding for the year.

- The first three quarters of 2020 saw a 3.4% decline in total funding compared to the same period last year along with a 4.3% decrease in deal activity. The lower investment numbers were mainly caused by a poor second quarter where $1.5bn was invested across 51 deals as global lockdown measures took its toll. In comparison, RegTech companies raised $2.4bn via 106 transactions during the opening quarter of the year.

- While deal activity recovered in Q3 2020 with 85 completed funding rounds, funding declined further to $1.2bn as new RegTech innovation to tackle post Covid-19 challenges is being funded at the early stage. This trend is expected to continue as investors are cautious of writing big cheques and are reassessing their portfolios and as such the RegTech sector is on pace to record its first decline in investment activity since 2015.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global