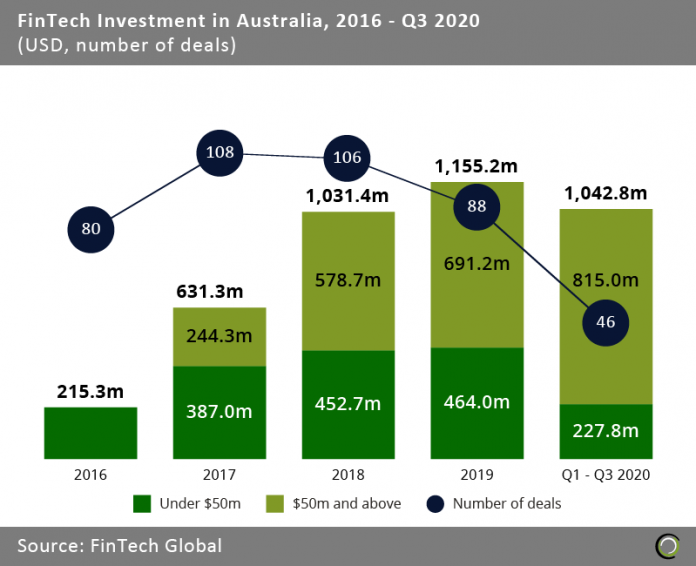

FinTech companies in the country raised over $1.04bn in the first nine months of 2020, just 9.7% shy of the previous annual record set last year

- The FinTech industry in Australia recorded strong growth in total capital invested between 2016 and 2019 as investors increasingly backed innovative startups in the country aiming to disrupt legacy processes in sectors such as banking, lending, real estate and digital payments. Total funding grew at a CAGR of 75.1% from $215.3m to over $1.1bn at the end of last year.

- However, deal activity has been declining since it reached a high of 108 transactions in 2017. The trend of increased funding but declining number of deals suggests the Australian FinTech sector is consolidating and investors are backing established companies in the space. This is further supported by the fact that the strong growth in funding has been driven by deals over $50m, which raised nearly 60% of the total investment in the country in 2019.

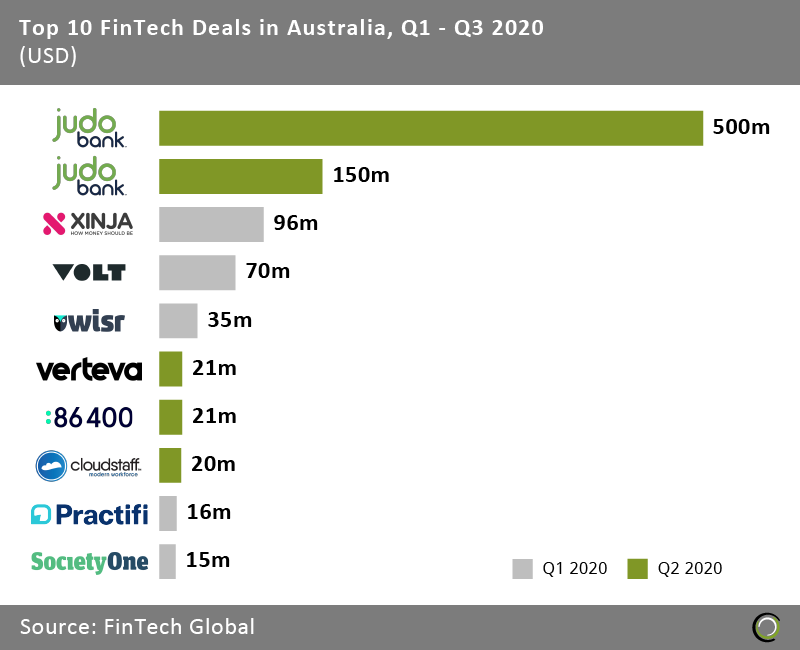

- Investment in the country had a strong first nine months of the year with $1,042.8m capital invested, which is already 90.3% of the total funding recorded for the whole of 2019. That being said, 62% of that funding came from two deals completed by Judo Bank, which raised $650m in aggregate via a Series C round and support from the Australian government.

Large deals dried up in Q3 as no transactions made the list of top 10 deals in 2020

- The top ten Australian FinTech deals in the first three quarters of the year collectively raised $944m, making up 90.5% of the overall investment in the country during the period. However, the strict lockdown measures in Australia in Q3 affected investors’ confidence as they scaled back on large investments. Indeed, no deal completed in the third quarter made the list of top 10 transactions.

- The largest deal in Q3 was completed by Superhero, a digital investment platform, which raised an $8m Series A round in September. The startup intends to disrupt the online investment industry in Australia by making the whole experience more transparent and accessible, as well as offering a $5 flat fee.

- The largest deal so far in 2020 was raised Judo Bank, an SME challenger bank, which secured $500m from the Australian government to help provide loans to small businesses in the country.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global