Embedded insurance technology company Salty Dot has launched out of stealth mode, alongside the close of a $16m funding round.

The company offers a software-as-a-service solution that enables carriers and distribution partners to offer a personalised policy to insure a product or service in real-time during the purchase process. Its services are licensed in all 50 US states.

With the capital from the round, the company hopes to extend its intelligent systems and continue to support recruitment of its distribution network.

Plans for the future also include launching new products and entering new markets in 2021.

Elefund managing partner Serik Kaldykulov said, “Salty is creating the new category of Embedded Insurance. This presents an opportunity to fundamentally change insurance underwriting and distribution, to the benefit of consumers and insurers alike.”

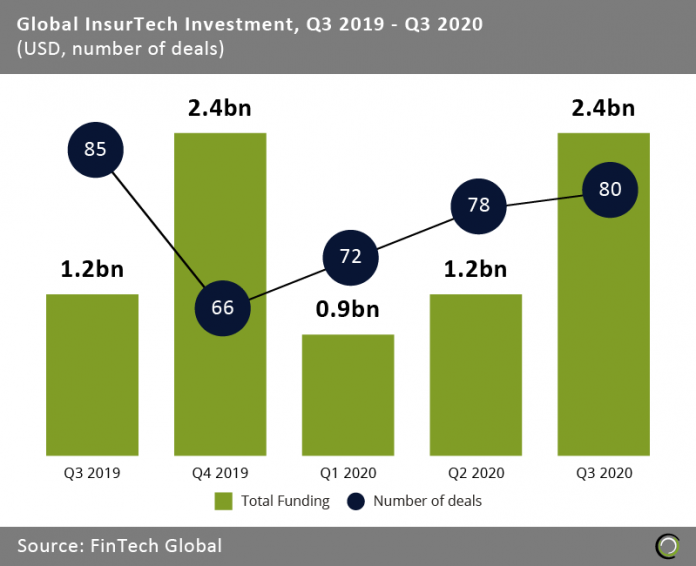

The InsurTech sector has managed to maintain investor interest despite the pandemic putting pressures on many industries. In Q3 2020, global investment into the InsurTech sector reached $2.4bn through 80 transactions, FinTech Global’s data shows. In the first three quarters of the year, the sector has seed $4.5bn invested.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global