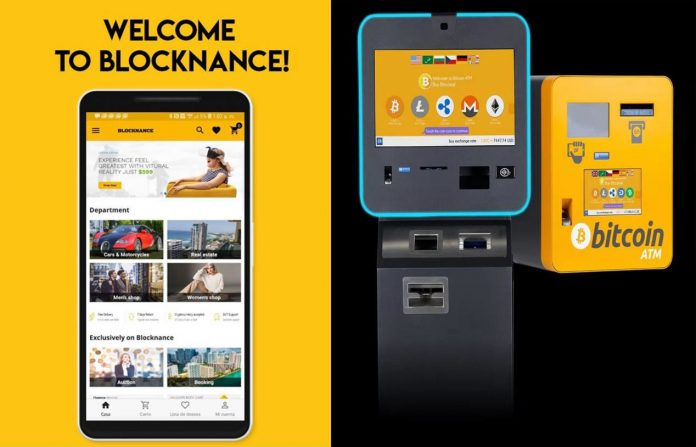

Blockchain e-commerce company Future FinTech has signed a term sheet to become the majority owner of Blocknance.

As part of the deal, Future FinTech will buy 60%of the shares of the Dominican company.

Blocknance provides services for transactions between bitcoin and other cryptocurrencies and fiat currencies such as Dominican pesos, US dollars, euros and Russian rubles for customers through bitcoin ATM machines and physical offices.

All ATMs and physical offices are currently located in Santo Domingo, Punta Cana, La Romana and Santiago de los Caballeros in the Dominican Republic.

“Blocknance is one of the most advanced, semi-decentralised cryptocurrency exchange platforms on the market today,” said Emmy Jude Fortune, the general manager of Blocknance.

“It provides a safe way to exchange bitcoin and cryptocurrency with fiat currencies for individuals who want to use them to buy and sell goods or services and is the largest Bitcoin transaction service provider in the Caribbean.

“With the help of our new ATMs, more and more people use cryptocurrency for transactions. Our Punta Cana and Santiago office provides services to more than 10,000 tourists every year, because most tourists do not have local bank accounts. Our physical offices or ATMs provide convenient two-way exchange services of bitcoin and other cryptocurrency to fiat currencies for tourists.”

On the back of the deal, Blocknance plans to increase its number of bitcoin ATMs and expand them to Europe, Asia and other regions pursuant to local regulatory requirements in 2021.

“We have been looking for valuable blockchain technology companies to dock with our existing resources,” said Shanchun Huang,CEO of Future FinTech. “When bitcoin holders could convert bitcoin into cash at ATM as Blocknance does in Dominican Republic, cryptocurrency will be gradually accepted by more and more people.

“We believe that the investment in Blocknance can further expand our business, bring additional income to the Company, and we hope to eventually create a channel that can connect Bitcoin and other cryptocurrencies with the services of mainstream financial institutions under applicable laws and regulations.”

Copyright © 2021 FinTech Global