FinTech companies in Latin America raised nearly $2.9bn with funding in Brazil accounting for $1.84bn

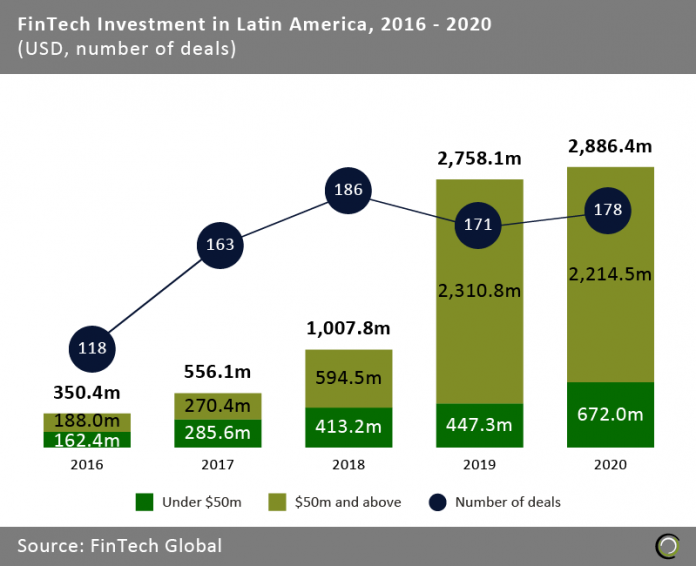

- FinTech investment growth in Latin America continued unabated in 2020 despite the coronavirus-caused economic uncertainty. Companies in the region raised $2.8bn last year, a growth of 4.65% year-on-year compared to 2019.

- Total capital invested grew at a CAGR of 69.41% from $350.4m in 2016 to nearly $2.9bn at the end of last year. At the same time deal activity increased in 2020 with 178 deals completed compared to 171 transaction in 2019.

- Investment in the region has not been impacted by the Covid-19 Pandemic as the region recorded its highest funding ever. The momentum in funding and deal activity was maintained by the increased demand for digital services especially in the WealthTech and Payments & Remittances sectors, which are helping the population pay, transfer, deposit and withdraw cash easier than ever amid a surge for contactless payments and banking services.

- Deals below $50m made up 23.3% of the funding recorded in 2020 with a growth of 50.23% compared to 2019. This further shows the resilience of the FinTech ecosystem in Latin America as investors see ripe opportunities for disruption and didn’t shy away from earlier stage transactions.

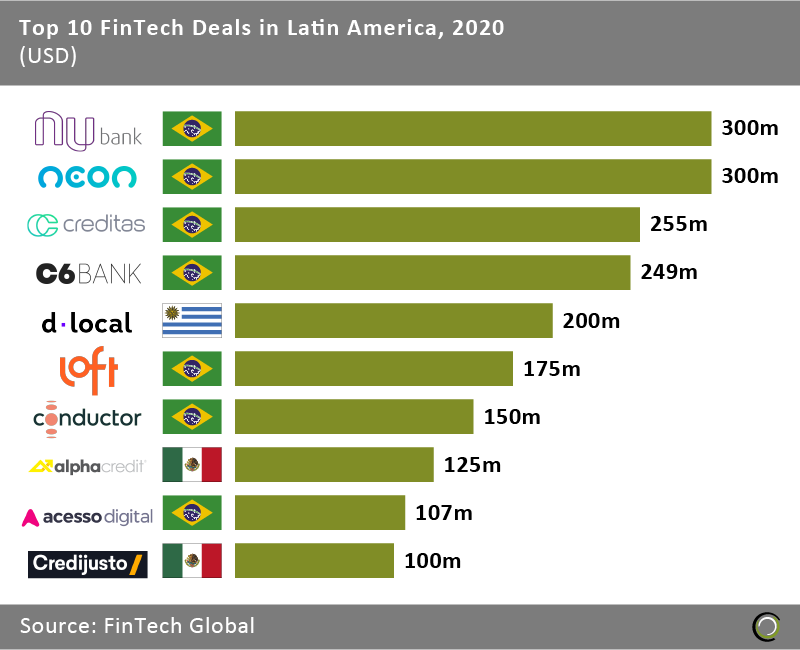

Brazilian Companies raised seven of the top 10 FinTech deals in Latin America in 2020

- The top ten FinTech deals in Latin America completed in 2020 raised in aggregate over $1.9bn making up 67.9% of the overall investment in the region during the year.

- Brazilian companies had a strong representation taking seven out of the ten top deals, including the top three deals which are occupied by Nubank, Neon and Creditas. Neon, a digital challenger bank, raised a $300m Series C round led by General Atlantic and BlackRock Innovation Capital. The funding will be used to support hiring efforts, grow Neon’s user base across consumer and business clients, enhance the platforms technology capabilities, and invest in product development. While Creditas, a secured loans platform for consumers, completed a $255m Series E round to expand its home and auto lending portfolio as well as a payday lending and a retail option to sell through buy now, pay later loans based on its costumers’ salary.

- The largest deal of the year was completed by Nubank, one of the world’s leading challenger banks, which raised $300m from Kaszek Ventures, Ribbit Capital and Sequoia Capital. The company added six million new users in the first three months of 2020 which helped increase its transaction volume by 54%. This helped the challenger bank reduce its losses from $25m to $17m.

- The largest deal outside Brazil was completed by dLocal, a Uruguayan cross-border payment platform, which raised a $200m Venture Round led by Addition and General Atlantic. The funding was earmarked to accelerate global expansion, targeting 13 new markets over the next 18 months, including Central America, Africa, and Southeast Asia.

Deals under $1m see their lowest share to date

- In 2020, the share of deals sized under $1m declined 8.5 percentage points (pp) to just 38.5%, the lowest share since 2016. This reduction was due to the Covid-19 Pandemic as investors backed out from transactions in newly established start-ups or small companies to manage their portfolio risk.

- The share of deals valued between $10m and $25m saw the biggest increase as it hit 17.0% compared to 10.6% in 2019 as investors preferred to back companies with well established facilities who can quickly take advantage of the new opportunities brought by the Covid-19 pandemic.

- Deals at $50m held a similar deal share last year as they did in 2019. Meaning that investors stayed in course with their investment strategy to support the frontrunners and help them expand to other countries in the region.

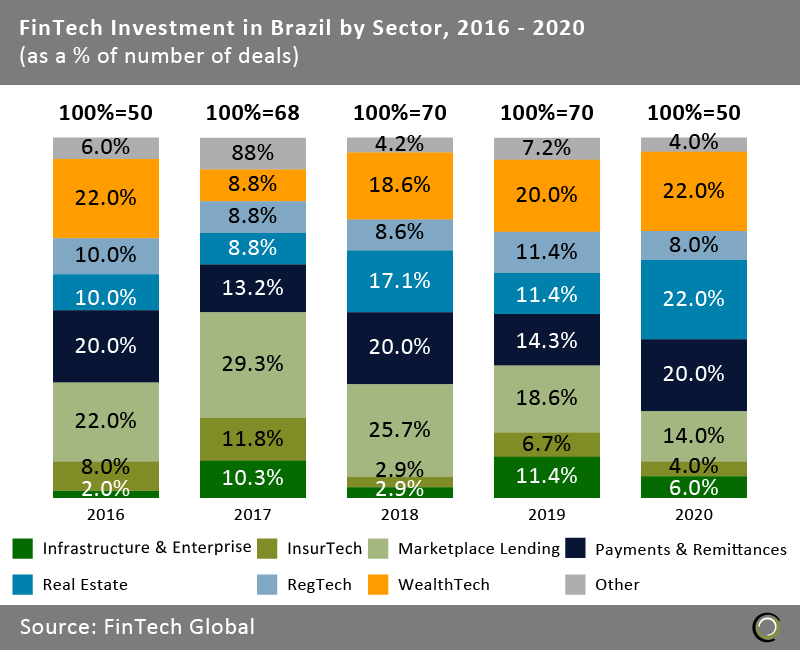

Real Estate sees the biggest growth in Brazil

- While the Brazilian Fintech industry saw a decline in deal activity last year, several sectors saw growth as Covid-19 created new demand for digital services.

- The sector that saw the biggest uplift was Real Estate, with its share growing 10.6 percentage points (pp) reaching an all-time high of 22%. Property demand grew with a boom in the market for luxurious home outside the urban area and the low interest rates in the country which are factoring in when buying homes. This translated to PropTech deal activity as the Covid-19 pandemic forced transactions to be carried out online.

- Payments & Remittances is the second area that saw the highest growth with its share growing 5.7 percentage points (pp) as the pandemic caused reduction in cas payments and physical banking services. The transition to digital banking and contactless payments attracted investors to invest in companies like Conductor Technology, a leading next-gen payments processor and banking-as-a-service infrastructure provider, which raised $150m through a Private Equity Round.

- The sector that recorded the biggest decline was Marketplace Lending which saw a decrease of 4.6 pp. The decrease comes as the pandemic caused many SMEs failed to pay or receive a loan last year amid deteriorating cashflow projections. Additionally, various SMEs had to close due to the lack of funding and government help.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global