Global money-transfer platform Revolut has operationalised its European specialised banking licence in ten additional countries.

Revolut users in Bulgaria, Croatia, Cyprus, Estonia, Greece, Latvia, Malta, Romania, Slovakia and Slovenia can switch to Revolut Bank and have their deposits protected under the deposit guarantee scheme.

Customers in these ten countries can upgrade to Revolut Bank for additional services from within the app. The specialised licence allows Revolut Bank to provide banking services via the Revolut app along with a host of financial services and products offered by other Revolut Group companies.

With the introduction of deposit guarantees alongside the services and functionalities that Revolut already offers, users will experience more control and security than traditional banks, it said.

Last year, Revolut Bank rolled out its services in Poland and Lithuania offering credit products in both countries.

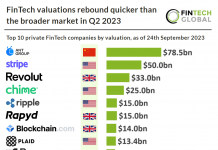

Boasting of having over 15 million customers globally, the FinTech company has also applied for a banking license in the UK. Since its launch, the Revolut Group has raised almost $1bn in investment and was recently valued at $5.5bn.

By using Revolut, users can monitor all their expenditures and set monthly spending budgets for various categories. Additionally, customers can manage fees for subscription services, send and request money from friends instantly and round-up their card payments to build up spare change.

Copyright © 2021 FinTech Global