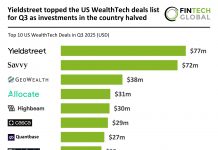

Digital investing platform Yieldstreet secured $100m in a Series C funding round led by Tarsadia Investments.

Investors such as Kingfisher Investment, Top Tier Capital Partners and Gaingels also joined the round, along with Edison Partners, Soros Fund Management, Greenspring Associates, Raine Ventures, Greycroft and Expansion Venture Capital.

The New York City-based company will use the funding to grow its user base, develop new products, expand internationally and go after strategic acquisitions. Yieldstreet is looking into three types of acquisitions, including acquiring companies that help with user growth, investment products and consolidation. The company has over 100 employees and plans on increasing its headcount by 50% by the year’s end.

Founded by Milind Mehere and Michael Weisz, Yieldstreet’s platform provides access to alternative asset classes such as real estate, commercial, consumer, art and others. Founded in 2015, the company has funded more than $1.9bn of investments. Yieldstreet also has offices in Brazil, Greece and Malta.

Investors can invest in single offerings or in funds with multiple transactions. Clients can invest in third-party managers or buy a fund that gives them broad access to everything Yieldstreet offers. The average age of people investing in alternative assets is 65, while Yieldstreet’s average age is in the 30s, it said.

The company recently launched its structured notes product – the multi-trillion-dollar asset class – which allows structured note portfolios to be delivered to individuals through technology.

The funding round comes on the heels of massive growth for Yieldstreet, the company saw investment requests and new investors rise 250% through May this year over 2020 and new investors currently surpassing all of 2020. Yieldstreet is even on track to hit $100m in revenue in 2021.

Over the next decade, Yieldstreet is targeting 50 million investors who are either accredited — those who earn more than $200,000 annually or have a net worth of at least $1m — or high-earning millennials.

Yieldstreet’s growth has come with its challenges, especially due to the risky nature of its investments.

This year, the startup had several debt deals involving shipping vessels that turned south, leaving the firm with investors demanding their money and an SEC investigation.

Plus, Yieldstreet’s plans to launch the Prism Fund with asset manager BlackRock fell through during the pandemic.

Copyright © 2021 FinTech Global