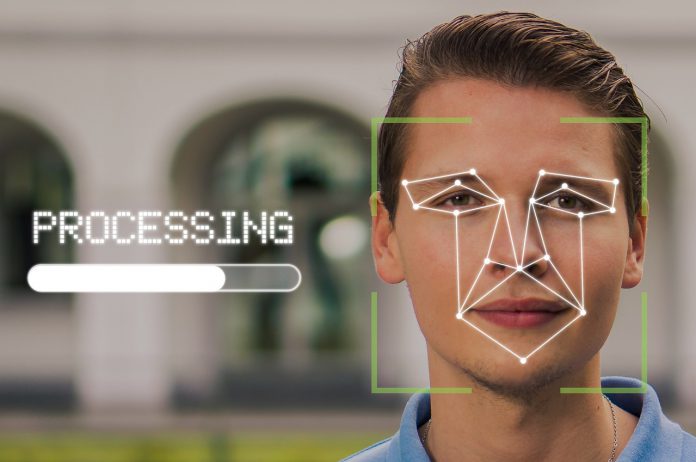

Veriff unveiled Face Match, an AI-powered feature that authenticates a person online with the aim to mitigate fraud and identity theft.

Veriff’s facial biometric technology matches the person’s face to an identity document that is already previously verified by the firm, therefore, creating an easy online method to verify identities digitally.

The video feature in the Face Match software detects liveness through images captured in the SDK. Veriff then compares the new face to the reference document-front image in the system after which real-time response is used to confirm the identification of a person. The entire verification software comes at a reduced cost compared to a full IDV session, the firm said.

The firm claims to have over 9,000 government-issued IDs from over 190 countries in 36 different languages, enabling it to mitigate fraud more efficiently.

Given that the digital identity industry is forecasted to be worth $12.8bn by 2024, up from $6bn in 2019, Veriff aims to capitalise on the growing demand and offer a seamless service with its video-first approach to identity verification.

Moreover, Face Match can prove to be quite beneficial for a variety of actions. For starters, resetting credentials where users could reset their account settings once they’ve gone through the two-factor-authentication with face ID making future logins seamless.

Secondly, to track high-risk customers in the event of them trying to open a new bank account, making a large withdrawal request or a suspicious login from a different region.

Furthermore, companies can leverage the Face Match software to verify employees before they’re able to access high-risk or sensitive company data. The employee will need a new access code to ensure they are verified multiple times to eliminate any theft concerns.

Commenting on the launch, Veriff co-founder and CPO Janer Gorohhov said, “With Face Match, Veriff utilizes the person’s images to re-verify their identity based on the original session images and data as a reference point, which improves the user experience immensely.

“Consumers have become so accustomed to a fast, seamless experience online in this digital-first world, and based on the great ideas from our first-ever hackathon, we’re now able to deliver this innovative offering to our customers.”

Copyright © 2021 FinTech Global