FinTech companies in the region raised over $1.1bn in the first quarter of the year with Klarna closing a massive investment

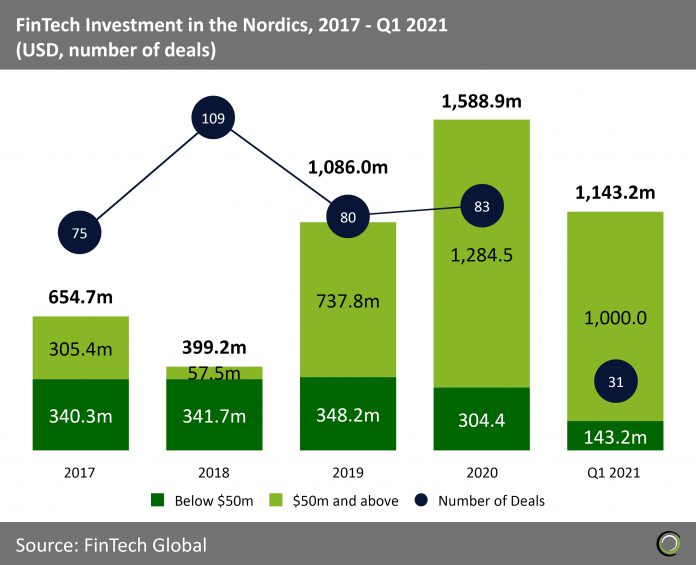

- The FinTech industry in the Nordics recorded strong funding growth between 2017 and 2020 as investors backed innovative startups in the region developing digital solutions to tackle some of the pressing legacy challenges financial institutions and customers in the region were facing. Total capital invested grew at a CAGR of 34.4% from $654.7m to nearly $1.6bn at the end of last year.

- Deal activity also increased during the period, peaking at 109 transactions in 2018 before slowing down to 83 in 2019. However, with 31 FinTech deals completed in the first quarter of 2021 the sector is on track for a new record if the pace continues.

- FinTech funding in the region had a strong start to the year with $1,143.2m capital invested, a growth of 3.5x YoY compared to Q1 2020. That being said, 87.5% of that funding came from one deal completed by Klarna, the Swedish digital payments and e-commerce giant, which raised $1.0bn in March making it the highest-valued private FinTech company in Europe with a valuation of $31bn.

Swedish companies raised six of the top 10 FinTech deals in the Nordics in Q1 2021

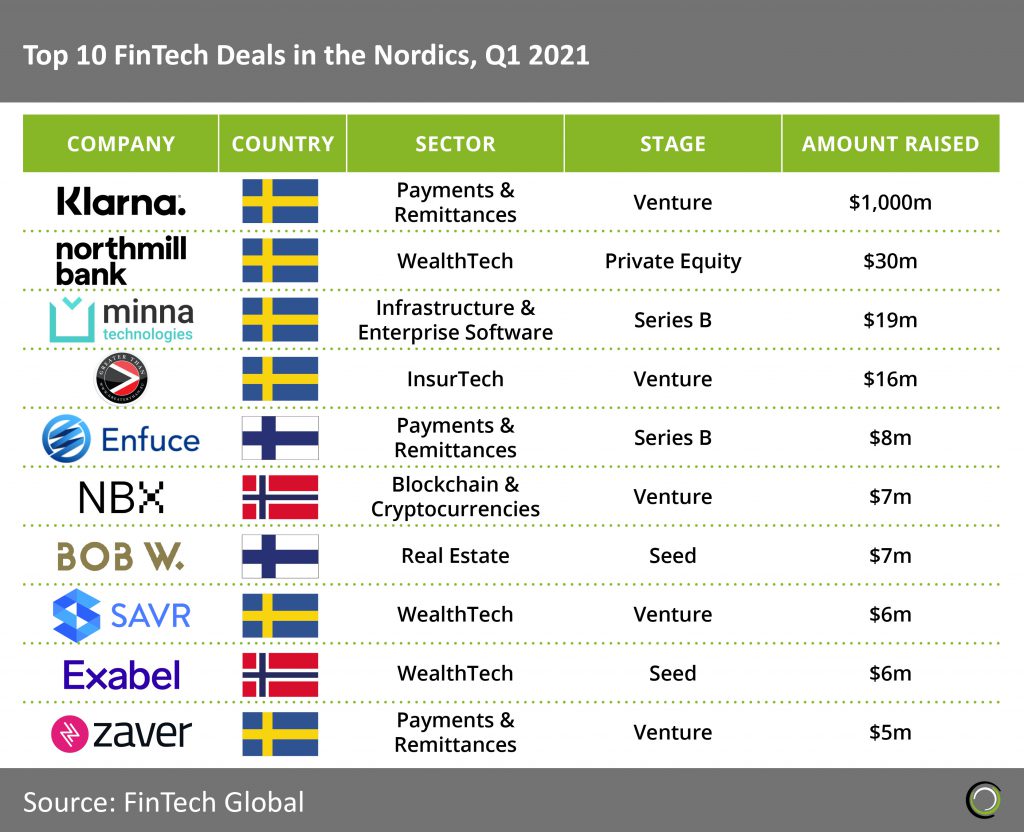

- The top ten FinTech deals in the Nordics completed during the opening quarter of 2021 raised in aggregate $1,105m, making up 96.6% of the overall investment in the region during the quarter. The high levels of concentration of capital in large deals became more prevalent in 2020 due to the declining number of riskier early-stage deals caused by the economic uncertainty amid the pandemic.

- Swedish companies took the top three spots on the list with Klarna, Northmill Bank and Minna Technologies. Northmill Bank, a digital challenger bank, secured a $30m funding round from M2 Asset Management to support the company expansion into Norway.

- Norway and Finland also had representatives in the ranking with Enfuce, a payment processing and open banking provider, completing the largest round outside of Sweden raising $8m in a Series B round led by Tencent. With the investment, Enfuce is set to set to pursue growth in Europe as well as globally, and explore the opportunities of company acquisitions.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright ? 2021 FinTech Global