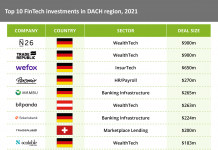

German stock-trading app Trade Republic raised $900m in Series C funding which valued the company at over $5bn – a figure that soared from $600m from last April.

The round was led by Sequoia with participation from new investors TCV and Thrive Capital as well as existing investors Accel, Founders Fund, Creandum and Project A.

The company intends to use the funds to continue to expand operations and its business reach.

Founded in 2015 by Christian Hecker, Thomas Pischke and Marco Cancellieri, Trade Republic enables people across Europe to invest money into capital markets with a commission-free offering. A European equivalent of US unicorn RobinHood, the firm enables users to invest in stocks, ETFs, and derivatives – mobile and commission-free. With more Europeans flocking to financial markets as they struggle to make a decent return on their savings due to ultra-low interest rates, the firm has witnessed a growth in customers.

Trade Republic also recently added cryptocurrencies so people can adjust their portfolio to reflect inflation and negative interest rates. With over a million users and over $6bn in assets under management, the firm seeks to close Europe’s pension gap by expanding its suite of investment products and geographical reach.

Earlier this year, usage of online trading platforms like Trade Republic spiked due to market frenzies like the Gamestop saga which was promoted on the Reddit board WallStreetBets.

Commenting on the round, Hecker said, “Within just 24 months, we have empowered over one million people to put their money to work. For many Germans, French and Austrians, Trade Republic is the home screen app to manage their wealth.”

Pischke added that 50% of Trade Republic’s customers have never invested in capital markets before in their life and that’s what the firm aims to target. He said, “We empower people to start with wealth creation, who have been neglected by big banks for too long, with high fees and opaque products. With over €6B in assets under management, we are the core savings account for our customers.”

VC giant Sequoia has a track record in backing success stories. In the past, it backed Silicon Valley giants like Apple and Google and more recently in Stripe, the payments company founded by two Irish brothers, as well as Klarna, the Swedish buy now, pay later FinTech which is also eyeing a stock market listing.

Commenting on the sector, Sequoia partner Doug Leone said, “The democratisation of financial markets will be one of the most important consumer trends of the next decade.

“Trade Republic is on the leading edge of this trend and has attracted an untapped generation of European savers who demand increased financial accessibility.”

Copyright © 2021 FinTech Global