FinTech investment in the country is already 15% greater than the whole of 2020, signaling strong COVID-19 recovery

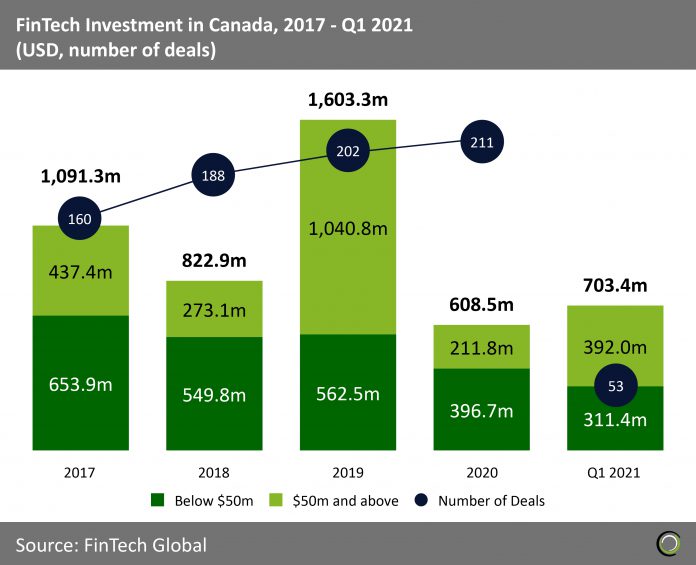

- While 2020 saw a 62% decline in total funding raised by Canadian FinTech companies compared to 2019, deal activity went up from 202 to 211. Given how the pandemic accelerated the shift towards business practices rooted in technology, remote work environments and rapidly changing customer expectations have promoted financial institutions to rely on FinTechs more heavily. Thus, investors have been eager to back smaller early stage FinTech companies solving new challenges brought by the pandemic, as evidenced by the highest deal count of 211 in relation to 2020’s total funding of $608.5m, the lowest from 2017 to Q1 2021.

- Canadian FinTech investment saw a strong recovery in the opening quarter of the year. Total investment has already surpassed the figure recorded for the whole of 2020 by 15%. Deal activity in Q1 2021 of 53 is 20 less than Q1 2020’s 73 deals completed. However, total funding for Q1 2021 was $703.4m compared to Q1 2020’s total of $67.7m, none of which included any deals over $20m.

- The Canadian FinTech sector has seen consistent growth in deals completed since 2017. The highest total sum of money invested came in 2019 with $1.6bn raised, 65% of which came from deals greater than $50m. The $1.04bn raised in 2019 among deals over $50m is largely comprised of three $200m plus deals, all coming in the second half of the year.

Continued rise in the share of deals under $1m sets Canadian FinTech Sector for future growth

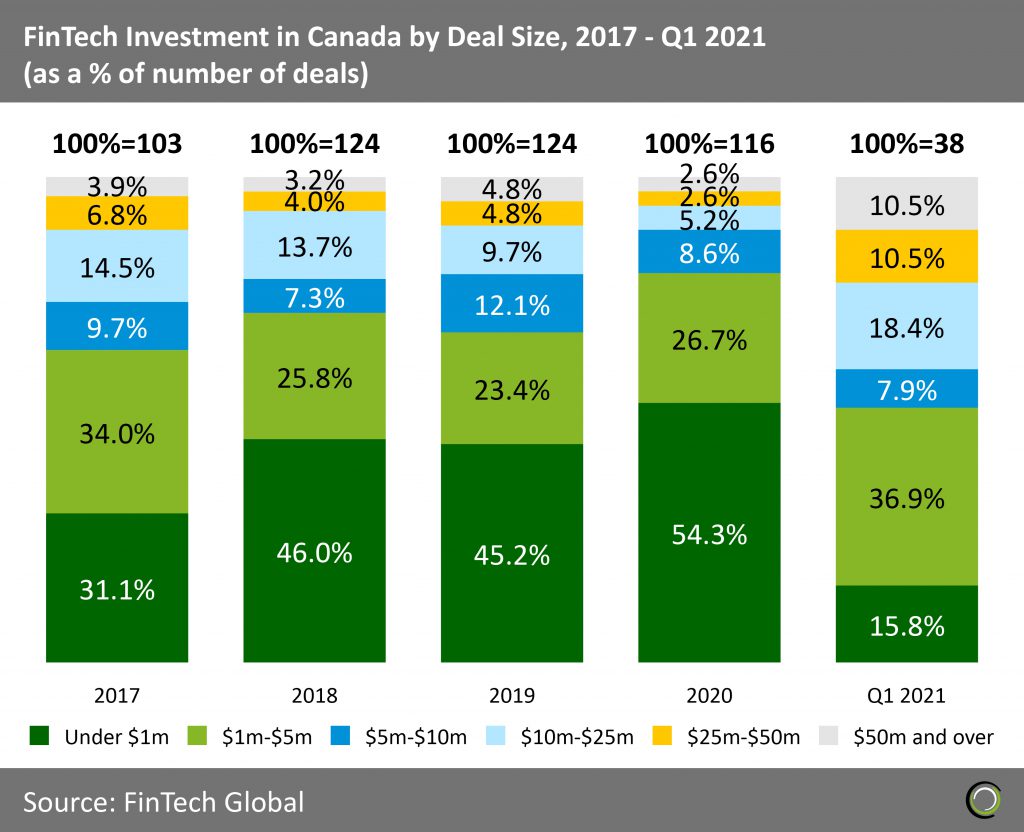

- Investments under $1m have made up an increasingly larger percentage of Canadian FinTech deals from 2017 to 2020. In 2020, 54% of all deals performed were below $1m. Q1 2021 has a significantly lower percentage of deals under $1m with 16%, however this differential is subject to change as more data from later quarters comes in.

- Q1 2021 is comprised of 37% of deals ranging from $1m to $5m, the highest percentage among deal size brackets. The surge in funding in Q1 2021 among deals from $1m to $5m can be attributed to the fact that many early stage companies that received funding from 2017 to 2020 are now maturing into the next investment stages. Investors are either attempting to double-down on their early stage investments into these companies or mitigate risk by investing into larger, inherently less risky, deals.

- The first quarter of 2021 also boasts the highest percentage of deals over $50m completed, making up 11% of its quarterly total. Among the four deals in Q1 2021 above $50m, the greatest investment came from the $227m raised by Fraction, a technology-based lending platform geared towards making residential real estate more affordable. Another notable deal includes $56.4m raised by Coinsquare, a leading cryptocurrency trading platform.

Companies based in Toronto raised half of the 10 largest FinTech deals in Canada

- Canada’s largest city, Toronto, was home to half of the ten largest deals in the country. Toronto is Canada’s business and financial capital, making it an appropriate choice of headquarters for more mature FinTech companies.

- Four out of ten deals were closed in 2019, making it the best year for large FinTech deals in Canada. Three deals were closed during the COVID-19 pandemic, showing that as economic recovery picked up starting in Q3 2020, investor sentiment became more positive.

- Furthermore, two deals are in the Real Estate sector. In the last few years, Canada has experienced a boom in the real estate market, lead primarily by the significant appreciation of properties in large cities and metropolitan areas. Canadian real estate FinTech’s will continue to benefit from the real estate market rallying post–pandemic. With investments into properties and property developments continuing to be high, real estate FinTech companies that facilitate investments into real estate will likely also see growth going forward.

Toronto is the FinTech Hub of Canada, Driving 49% of Total Canadian FinTech Deals

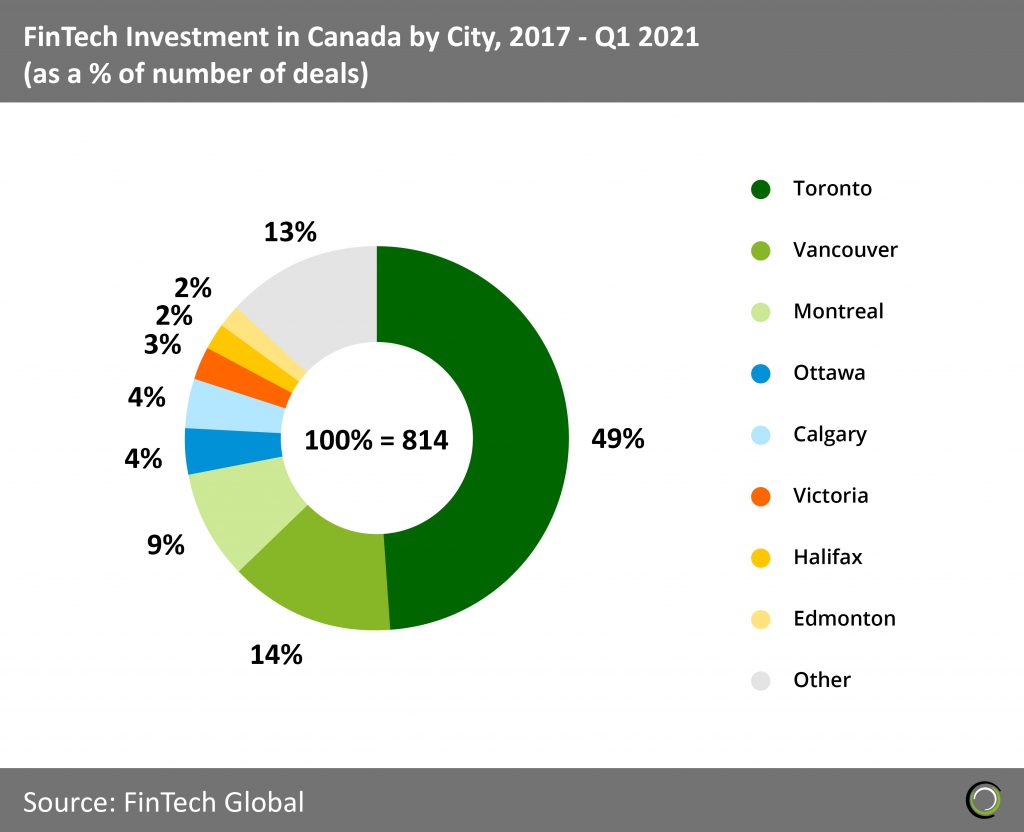

- Toronto represents a little less than half of Canada’s FinTech deals. FinTech deals in Toronto are 35% higher than the next biggest city, Vancouver. This number can be factored toward Toronto’s attractiveness as a start-up hub and a financial service leader. Toronto has a growing reputation for its symbolic relationship of highly qualified FinTech innovators and globally recognized financial services.

- Toronto is an attractive location for Fintech innovators due to its leading companies in banking, asset management, and insurance alongside significant investments by the financial service industry into technology. According to Jennifer Reynolds, CEO of Toronto Finance International, the largest Canadian banks alone invest over $13bn on technology annually.

- Three Canadian cities represent 72% of Canada’s total FinTech deals. Vancouver comes in second with 118 FinTech deals (14% of all FinTech) and Montreal in third with 71 deals (9% of all FinTech). While Toronto has the largest FinTech ecosystem in Canada, Vancouver’s smaller community is an effective breeder of high growth companies, and Montreal is popular for pre-launching a start-up. Montreal’s distinctively collaborative startup community having established network of organizations, bountiful talent pool, and affordable cost make it an attractive location for start-ups.

- Five Canadian cities hold 15% of all Canadian FinTech deals. These cities include Calgary, Ottawa, Victoria, Halifax, and Edmonton. Smaller FinTech ecosystems exist in cities like Waterloo, Quebec, Kelowna, and other cities making up 13% of deals in the other category

WealthTech is the top investment segment in Toronto, led by Wealthsimple’s $86.7m investment round

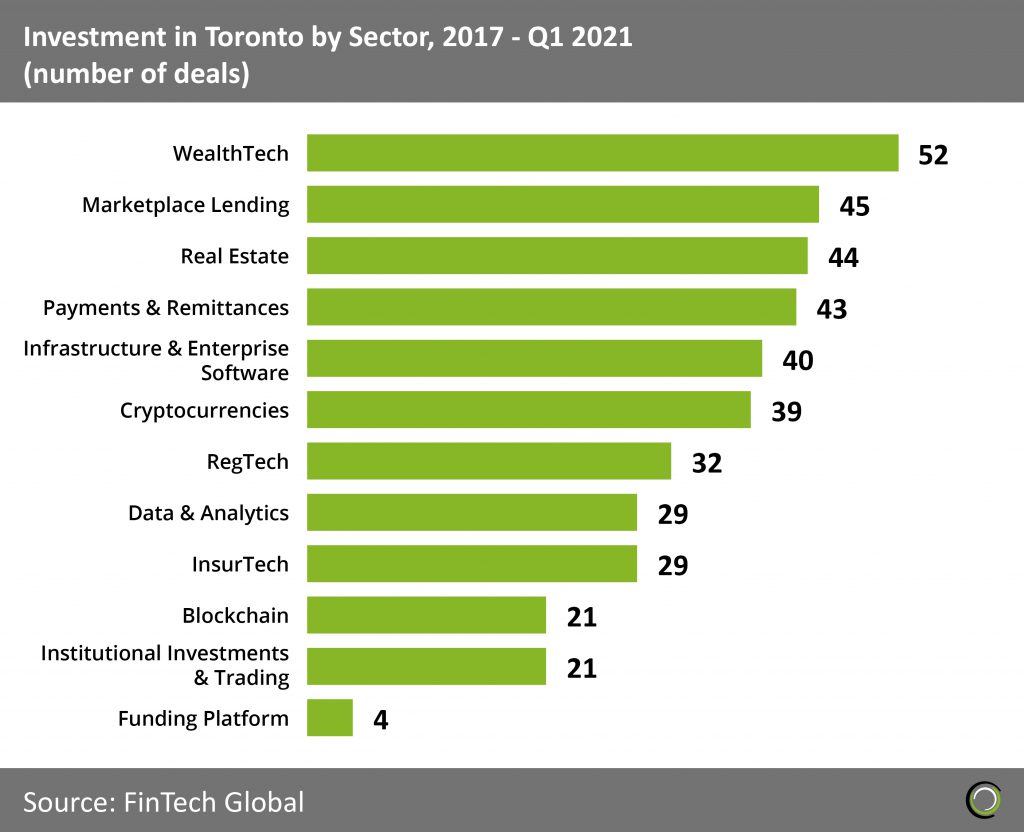

- WealthTech is leading Toronto’s FinTech sector with 52 deals raised between 2017 and Q1 2021. According to Accenture, Wealth Management industry is expected to hold $89tn in AUM in 2019 making it an enormous industry. Advice is progressively becoming the core offering of Wealth Management and there is demand for personalized investment recommendations supported by digital tools. This led to the launch of robo-advisors and AI data-driven technology in Canada, remodeling consultancy, money management, and fueling ultra-efficient goal planning.

- Another important subsector for WealthTechs in Toronto is online banking. The Canadian retail banking sector is dominated by on oligopoly of the “big 5“Canadian banks. For this reason, this sector lacks innovation and competition compared to other markets around the world. Poor service, high fees, and a lack of product innovation are just come of the complaints that customers have. Online banking FinTech’s have the ability to disrupt a market where dissatisfied consumers may be inclined to switch to more innovative services.

- Marketplace Lending and Real Estate raised 45 and 44 deals, respectively, during the same period. Marketplace Lending is gaining traction in Toronto for eliminating the long waits, high rates, and paperwork hassles of traditional loans offered by the big banks. Virtual showrooms, staging, and contactless contract signing caused by the pandemic have accelerated investments in Real Estate.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global