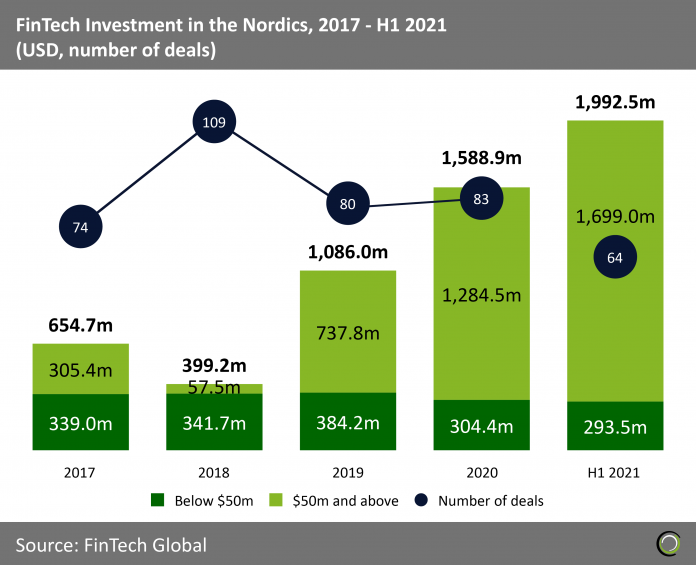

FinTech companies in the region raised nearly $2bn across 64 deals during the first half of the year

- The FinTech industry in the Nordics recorded strong funding growth between 2017 and 2020 as investors backed innovative startups in the region developing digital solutions to tackle some of the pressing legacy challenges financial institutions and customers in the region were facing. Total capital invested grew at a CAGR of 34.4% from $654.7m to nearly $1.6bn at the end of last year.

- Deal activity also increased during the period, peaking at 109 transactions in 2018 before slowing down to 83 in 2019. However, with 64 FinTech deals completed in the first half of 2021 the sector is on track for a new record if the pace continues.

- At the same time, FinTech funding growth in the region continued it strong upward trend in 2021 as it only took six months to set a new funding record. FinTech companies raised $1.99bn in the first half of the year, a growth of over 400% YoY compared to the same period in 2019. That being said, 82.3% of that funding came from two large deals completed by Klarna, which raised $1bn and $639m in March and June, respectively.

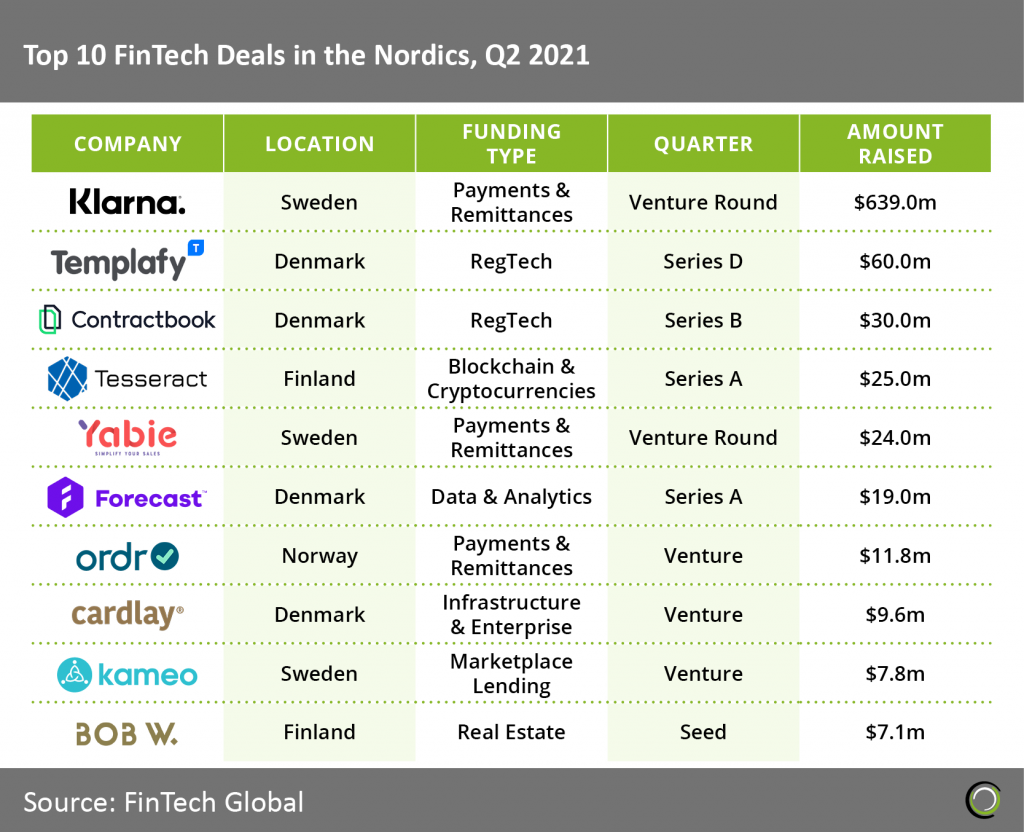

Danish FinTech companies had a strong Q2 completing four of the top 10 deals raised during the quarter

- The top ten FinTech deals in the Nordics completed during the second quarter of 2021 raised in aggregate $833m, making up 98.1% of the overall investment in the region during the quarter. The high levels of concentration of capital in large deals is to be expected given the massive deals raised by Klarna so far this year.

- Danish companies took two of the top three spots on the list with Templafy and Contractbook raising large rounds. Templafy, a B2B SaaS content enablement platform for banks and insurance firms, secured a $60m funding round led by Blue Cloud Ventures. The company has more than 600 customers and saw a 121% increase in net new ARR additions during the first quarter this year compared to the same quarter of 2020.

- Finland also had two representatives in the ranking with Tesseract, a provider of digital asset lending solutions to institutional clients, such as hedge funds and retail trading platforms, completing the largest deal raising $25m in a Series A funding led by Augmentum Fintech. The funding will be used to develop the company’s industry-leading institutional offerings, hire new talent to develop new and existing partnerships, and to boost innovation in new undisclosed financial products.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.