Tag, a digital banking platform for consumers in Pakistan, has reportedly collected $12m in a funding round it claims to be the largest in seed round in the South Asian market.

The investment was supported by Liberty City Ventures, Canaan Partners, Addition, Mantis, and Banana Capital, according to a report from TechCrunch.

This seed round, which only took two weeks to close, puts Tag’s valuation at $100m.

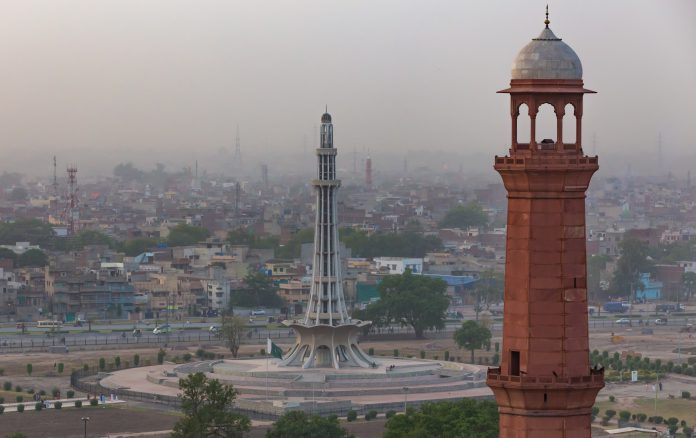

Tag was founded by Talal Gondal, with the aim of becoming Pakistan’s Revolut and Paytm. The FinTech platform provides consumers with mobile app that enables them to receive and send money from anywhere and anytime.

Its features include a personal IBAN account to receive funds and the tools to make transfers to banks or individuals. In addition to sending money, the app helps the user pay their utility bills, top-up their phone and receive notifications on account spending.

In addition to the mobile banking app, the service comes with Visa-powered virtual and physical debit cards.

Speaking to TechCrunch, Gondal explained how after working in Europe as an investor for seven years, he had a desire to return to Pakistan and create a company. He was waiting for the market to be ready, and now is that time.

Gondal said, “Each country’s startup ecosystem goes through various waves. In India, we saw e-commerce firms like Flipkart flourish in the first wave. Firms like Ola, Zomato and Swiggy and fintech firms like PhonePe and Paytm made inroads in the waves after that,” he said, adding that he saw a similar trend in Berlin. I had the conviction that a similar thing would play out in Pakistan.”

With the close of the round, Tag has raised a total of $17.5m in funding.

Copyright © 2021 FinTech Global