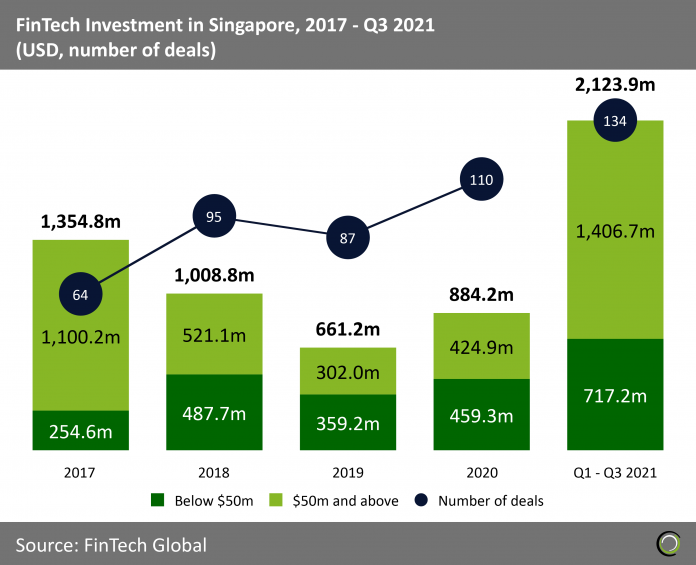

FinTech companies in the country raised more than $2.1bn across 134 deals during the first nine months of the year.

- On the back of a record2017, the FinTech sector in Singapore experienced a decline in funding for two consecutive years in a row. The decline in funding was brought on by a lack of deals over $50m which can be volatile over time. However, deal activity increased strongly to 95 in 2018 and 87 in 2019 suggesting that investors did not lose interest and backed early stage FinTech companies in the country.

- Post pandemic the sector has grown more quickly as the Monetary Authority of Singapore announced a $125m support package for the FinTech sector to deal with immediate challenges from Covid-19 and position strongly for the recovery and future growth. Despite the uncertainty last year total funding and deal activity increased by 33.7% and 26.4% YoY, respectively, to reach $884.2m capital invested across 110 transactions.

- FinTech funding growth in the country continued its strong upward trend in 2021as the sector recorded new annual funding and deal activity records just nine months into the year.FinTech companies raised just over $2.1bn in the first three quarters, going above the $2bn mark for the first time ever.The total capital invested record was boosted by eight deals over $100m which made up 57.8%of the funding for the period. In comparison there was only one deal of that size last year.

Singapore’s FinTech scene comes of age as the country records eight deals over $100m

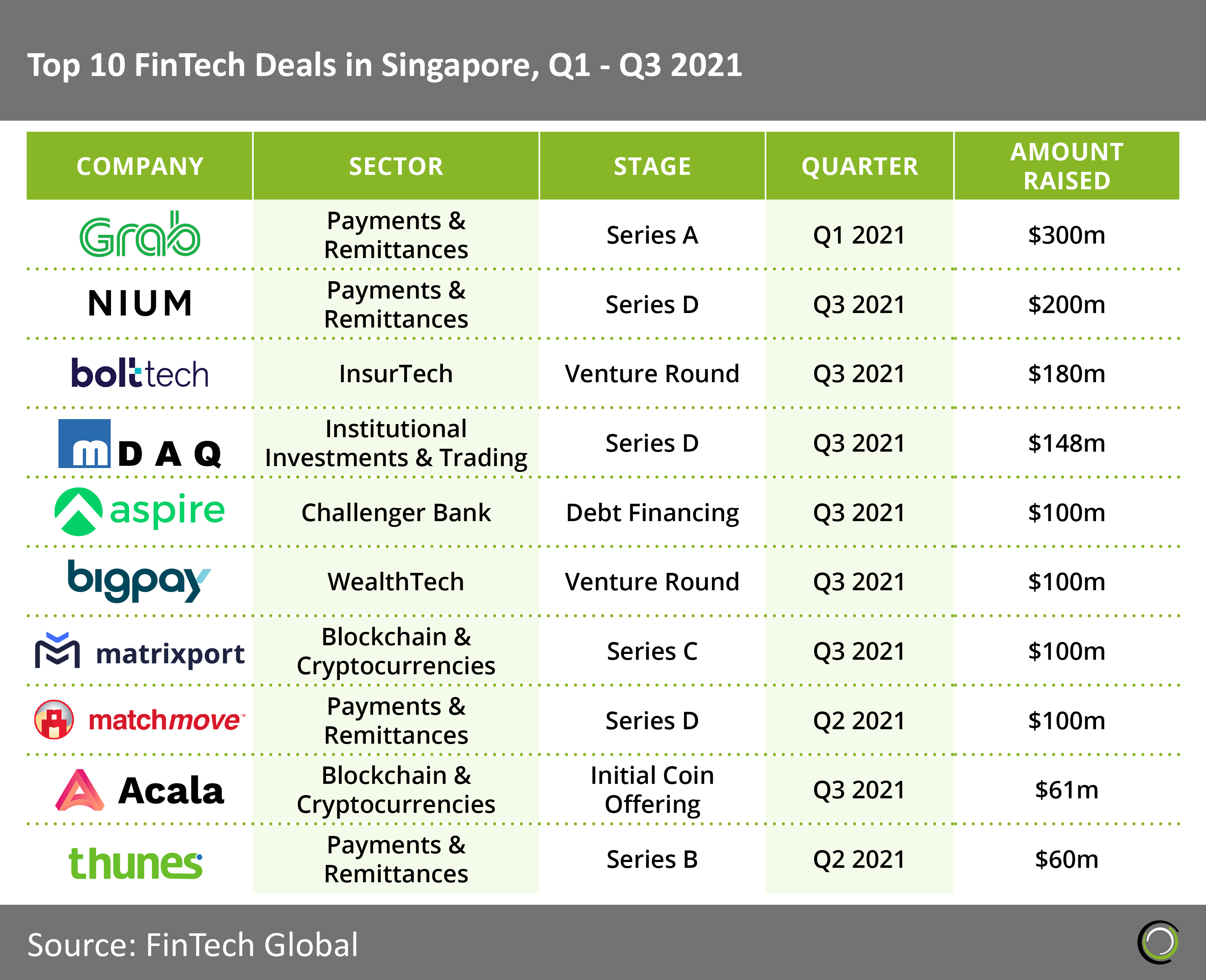

The top ten FinTech deals in Singapore completed so far in 2021 raised in aggregate $1.3bn, making up63.5% of the overall investment in the country during the first three quarters. As mentioned earlier the country’s FinTech sector has come of age so far this year recording eight transactions over $100m and the first Series D since 2019.

The top ten FinTech deals in Singapore completed so far in 2021 raised in aggregate $1.3bn, making up63.5% of the overall investment in the country during the first three quarters. As mentioned earlier the country’s FinTech sector has come of age so far this year recording eight transactions over $100m and the first Series D since 2019.- Grab Financial Group, a subsidiary of the car sharing and delivery giant which provides financial services across payments, rewards, lending and insurance, raised the largest deal of the quarter after collecting $300m Series A funding led by Hanwha Asset Management. The company will use the new funds to continue helping more individuals and SMEs access the benefits of financial services. It will do so by further investing in talent, and expanding its offerings in SEA with more affordable, convenient and transparent financial solutions.

- The second largest deal of the period was completed by bolttech, a company offering online platform serving as a matchmaker between insurance companies, allowing them to offer customers products that may not be in their area of specialisation.The company raised$180m in a funding round, led by private investment firm Activant Capital Group, which valued it at more than $1bn. The proceeds will be used by the company to accelerate its growth and bolster its presence in the US. Funds will also be used to enhance technological and digital capabilities.

The top ten FinTech deals in Singapore completed so far in 2021 raised in aggregate $1.3bn, making up63.5% of the overall investment in the country during the first three quarters. As mentioned earlier the country’s FinTech sector has come of age so far this year recording eight transactions over $100m and the first Series D since 2019.

The top ten FinTech deals in Singapore completed so far in 2021 raised in aggregate $1.3bn, making up63.5% of the overall investment in the country during the first three quarters. As mentioned earlier the country’s FinTech sector has come of age so far this year recording eight transactions over $100m and the first Series D since 2019.