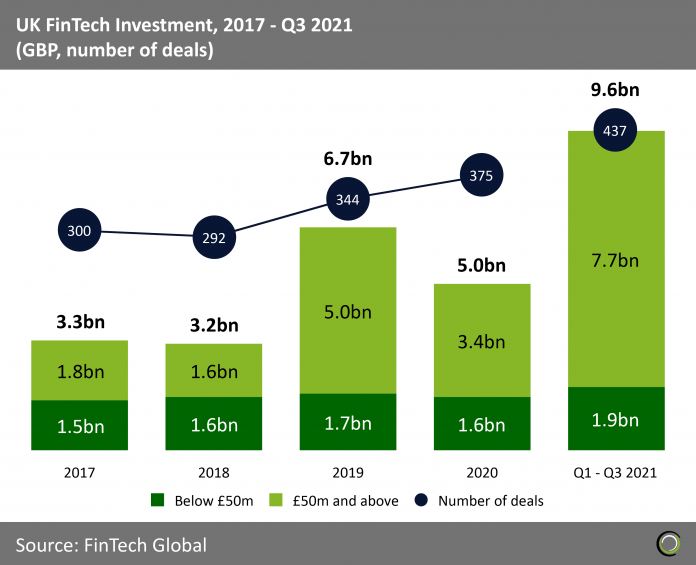

The country’s FinTech sector hit a fresh funding record in 2021 at £9.6bn after capital invested decreased by 25% last year

- The first three quarters of the year have surpassed expectations as UK FinTech funding grew by 92% in 2021. In total £9.6bn was raised across 437 deals even after recovering from a weak investment year in 2020 with £5bn in total capital invested.

- Comparing this growth to the global average of 45% where total funding hit $240bn so far this year (£182bn), up from $166bn (£126bn) in 2020, it is evident that fears such as Brexit have not spooked investors or weakened the UK’s position as a leading FinTech innovation centre. One factor supporting the strong investment interest is the new government scale box that builds on the existing FinTech sandbox allowing for easier innovation with direct regulatory support. The UK government have also followed EU rules closely since Brexit allowing for seamless transactions. Brexit may have caused large financial institutions based in London to set up offices in Europe but still attracts FinTech companies to London. This is due to the large number of financial institutions already established in London and the UK is a good market to test innovation and use as a stepping stone to expand into larger English speaking countries such as USA.

- With 2021 being the largest investment year for UK FinTech, key drivers include large funding deals above £50m by some of the biggest names in the industry, such as SumUp, Revolut and LendInvest. Funding under £50m showed a steady increase throughout all investment periods since 2017, reaching £1.9bn at the end of Q3 2021. It seems that larger companies are benefiting more from the wave of FinTech investment with £7.7bn invested in the first three quarters of 2021. Large companies such as Revolut are using the funding from large investors to expand into new products and markets including the US and India. Revolut raised $800 million in a new funding round led by SoftBank and Tiger Global in 2021.

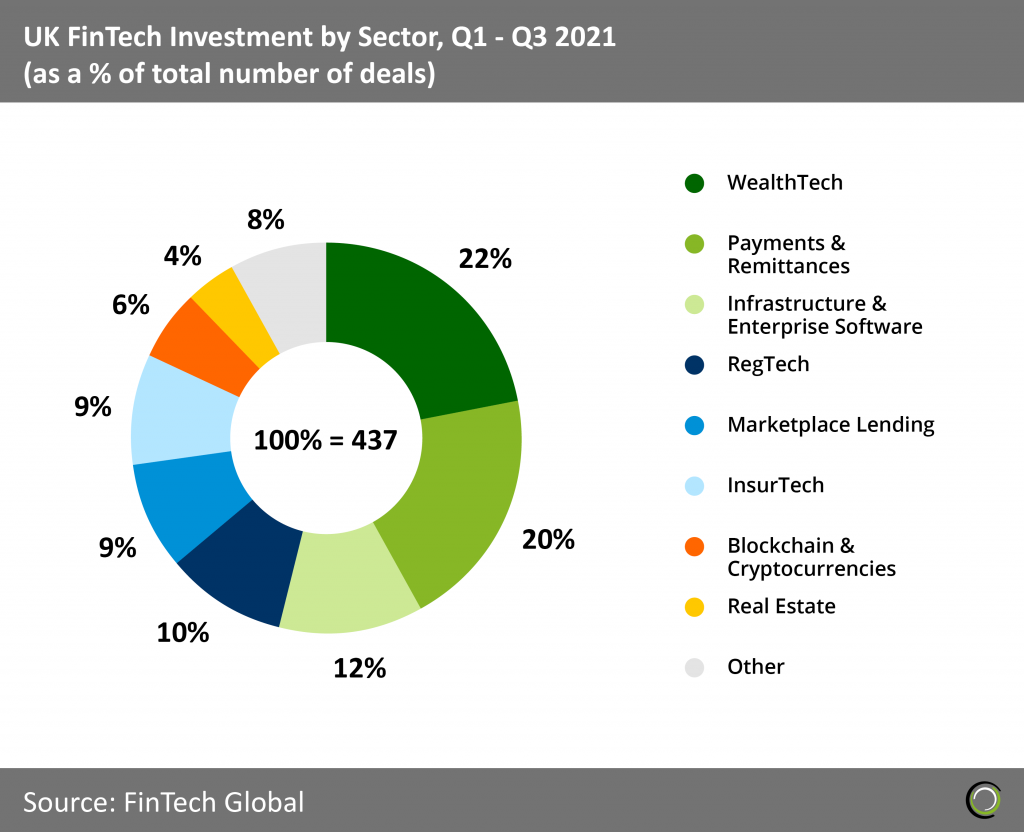

WealthTech and Payment Platforms drive FinTech deal activity in the UK with 180 in the first nine months of the year

- Big names in the WealthTech industry such as Revolut and Starling Bank have raised funding this year as the two companies both gain users. Revolut gained 25% in 2021 to 15m users and Starling bank gained 62% with total accounts at 2.3m. Pressure from other alternative assets such as bitcoin and blockchain platforms may disrupt digital banks’ investment going forward unless they capitalise on the trend like Revolut, which offered crypto trading capabilities to its userbase, giving them an edge with the service now accounting for 15-20% of its revenue.

- The sector responsible for the large uptake of investment in 2021 has been payment platforms which include SumUp, SaltPay and Checkout.com with £1.3bn combined. They benefited from sudden change in consumer behaviour as the public chooses card and online payments over cash, freeing up personal wallets and filling payment platform pockets. UK consumer behaviour has also shifted to buy now pay later (BNPL) solutions and are now the fastest growing online payment method in 2021.

- Marketplace Lending platforms continue to grow as well in 2021 with LendInvest, Prodigy Finance and MarketFinance having a combined investment of £1.1bn. LendInvest and Prodigy are taking advantage of consumer demand for low interest loans as their funding rounds were debt financing with capital channelled via their platforms. Consumers also start to go back to normal spending behaviour benefiting LendInvest and Prodigy greatly although fears of inflation reaching 4% may cause an interest rate increase and slow down the demand for this sector.

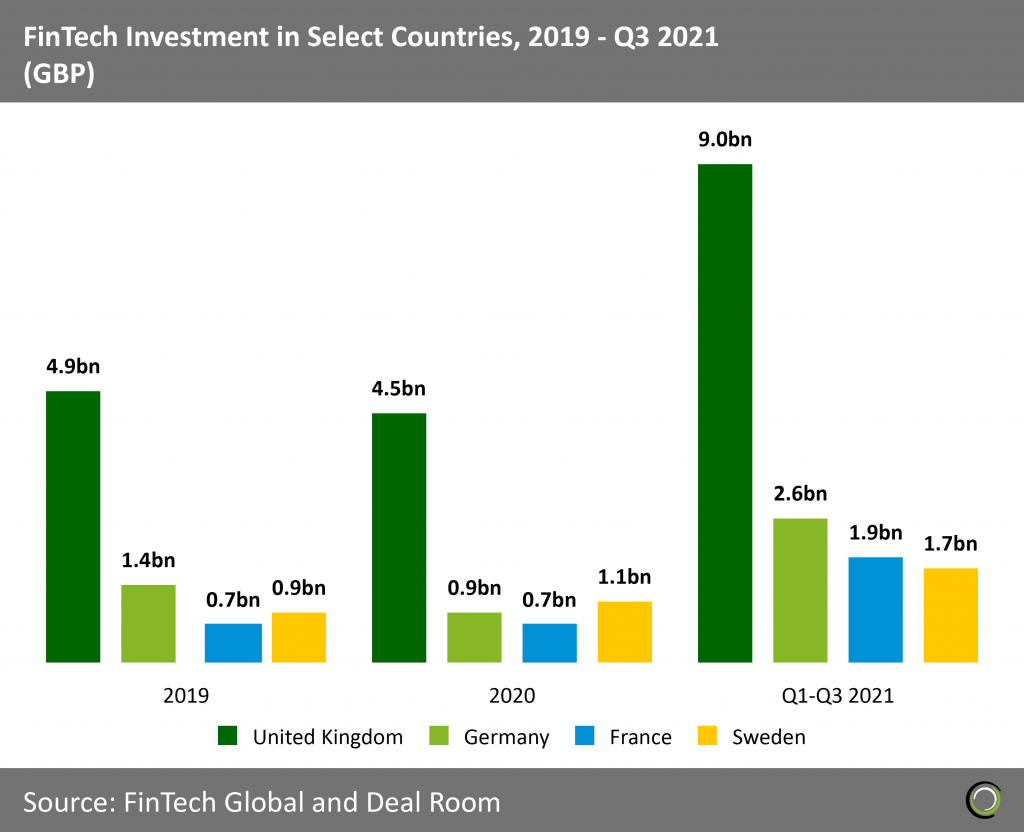

FinTech funding in Germany and France nearly tripled in 2021 challenging the UK’s top spot

- Some of leading countries vying for the UK’s top spot in Europe include Germany, France and Sweden. It is important to point out that in 2021 France overtook Sweden as 3rd largest in Europe with £1.9bn. The French government have also taken steps to improve the sector by overhauling tech visas and dedicating $4.56bn (£3.45bn) to bail out startups due to Covid-19 which has definitely helped as capital invested grew by 270%.

- Germany has increased funding by 288% in 2021 outpacing the UK, France and Sweden. Germany’s Covid-19 response has provided small and medium business’ with a temporary monetary aid scheme but no separate funding for FinTech startups, so it is impressive that they are able to attract such a large amount of funding. A reason for Germany’s success is FinTech adoption by big banks such as Commerzbank and Deutsche Bank. In the 2000s Germany did something similar with quick adoption of direct banking and it feels like history is repeating itself with digitisation. For example, Deutsche Bank have partnered with Fincite for robo-advising services and Figo for multi-account aggregation. Germany also has a well-established banking sector that is attractive for FinTech startups.

- As London and the UK establishes itself as the key hub for FinTech, increased backing by the UK government announced in April 2021 propels this into reality in the Kalifa Review. The UK government has committed to a new FCA ‘scale box’ and centre for finance, innovation and technology (CFIT) to boost growth and support FinTech firms to scale up. This ‘scale box’ will come in the form of a regulatory ‘nursery’ where firms that have been recently authorised by the FCA are given extra support. This additional support is due to new ideas and innovation often met with regulatory hurdles which the FCA wants to reduce as this keeps companies competitive whilst still within regulatory boundaries. The CFIT has been created to improve the current regulatory framework around FinTech and create a level playing field across the UK.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global