ICEYE, an expert in natural catastrophe (NatCat) solutions, has received an investment from Tokio Marine Holdings to develop insurance products.

Tokio Marine’s investment forms part of ICEYE’s $136m Series D funding, which it raised earlier this month.

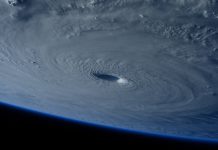

As part of the new alliance between the two companies, ICEYE and Tokio Marine will collaborate on a series of initiatives designed to facilitate the digital transformation of insurance claims capabilities and develop new insurance products and services to address the increasing frequency and severity of natural catastrophes and the growing impact of climate change.

ICEYE said by applying the high-precision imaging capabilities of its satellite constellation and its unique Daily Coherent Ground Track Repeat technology, and working with its dedicated insurance team, the two companies will focus on three key initiatives.

These include the development of advanced insurance claims services for wind-related damage, sing satellite images and auxiliary data to estimate the presence and extent of roof damage in the aftermath of a windstorm event.

The partnership will also see the curation of processes that will accelerate insurance claims payments across all companies within the Tokio Marine Group and support the development of parametric insurance products, as well as the development of more effective ways of detecting potential disasters through satellite data and supporting response efforts by monitoring changes on the ground.

Masashi Namatame, group chief digital officer Tokio Marine Holdings, said, “We have been working with ICEYE since 2020 and jointly developed an insurance claims processing solution for floods, that streamlines and enables quicker delivery of claim payments.

“This collaboration represents both ICEYE and Tokio Marine’s strong commitment to take positive action and initiative against additional risks. By combining ICEYE’s vertically integrated satellite solutions and Tokio Marine’s historical data, we strongly believe that we can develop multiple solutions to address serious natural catastrophe risks and support our customers and society throughout the world in their time of need.”

Copyright © 2022 FinTech Global