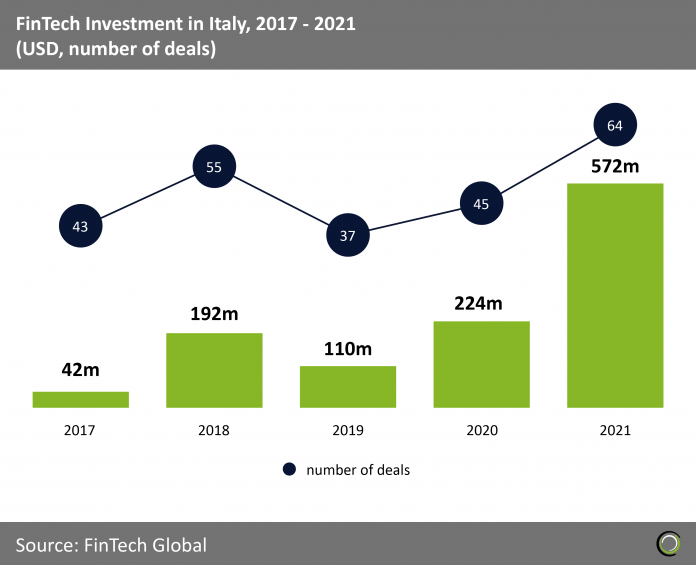

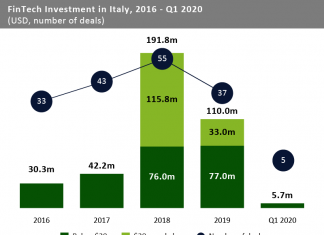

- Italian FinTech sector had a record last year with deal activity surpassing the previous high of 64 deals set in 2018. In addition funding crossed the half billion mark for the first time driven by large deals from Casavo ($180m), a PropTech company and Scalapay ($155m), a buy now pay later service.

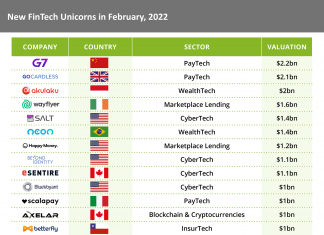

- And the strong performance of the FinTech industry carried over this year as the country recorded its first FinTech unicorn. Scalapay raised $497m in February via a Series B funding round led by Tencent and Willoughby Capital. The potential for future Italian FinTech unicorns is very high with companies such as Casavo who have already received €298.9m in funding, one funding round away from reaching the coveted status.

- Italy has one of the lowest FinTech adoption rates in Europe which stood at 51% in 2019. This adoption has been accelerated by the Covid-19 pandemic where contactless transactions increased from 35% to 55% and the need for easier access to credit also drove increase in usage. With Italy’s internet users who take advantage of FinTech services standing at 51% , the sector is poised for rapid growth in the coming years as it catches to other countries such as Germany and France.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global