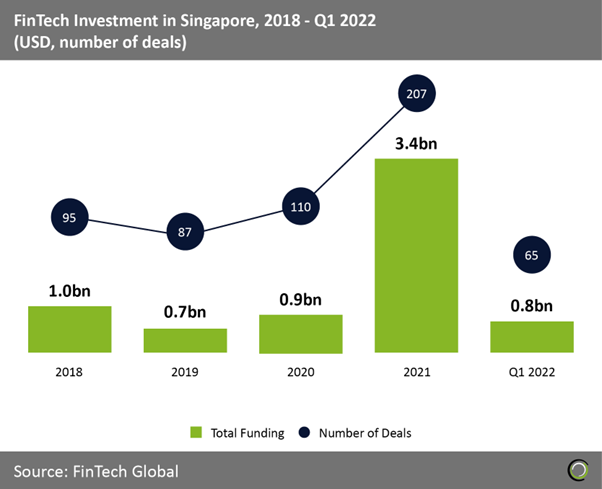

- Singapore FinTech sector saw nearly a four-fold increase in funding last year driven by large deals. While overall capital invested is on track to remain stable this year, a spike in deal activity in Q1 2022 indicates that 2022 will surpass last year levels to hit 260 in total.

- Investment in 2021 was bolstered by large deals from Atome ($500m), a buy now pay later service, Grab Financial Group ($300m), who offer payments, finance, insurance and investment solutions, and Nium ($200m), a global embedded payments provider. So far the largest deal in 2022 was from Funding Societies ($144m), an SME digital financing and debt investment platform. Singapore will need to see similar deal sizes in 2022 if it is to surpass 2021 investment levels.

- Insignia Ventures, East Ventures and Sequoia Capital India were the most active FinTech investors in Singapore during Q1 2022 with 4 investments each in total. Overall these 3 venture capital firms were involved in 14% of all deals in Q1 2022.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.??2022 FinTech Global