It was a big week for sizable FinTech deals and companies reaching unicorn status. A total of 41 FinTech investments deals were completed over the course of the week.

The biggest funding round was raised by Deserve, a real-time credit card platform, and HR software platform Rippling, with both pulling in $250m. The latter reached the coveted decacorn milestone, reaching a $11.25bn valuation. Similarly, global crypto exchange KuCoin also reached the decacorn status after it closed an investment this week.

Another company reaching an impressive valuation was Abnormal Security, which raised $210m at a $4bn valuation.

Several companies joined the unicorn club, including payments infrastructure developer Paddle, fellow PayTech company Dock, digital asset trader Talos and CyberTech Material Security.

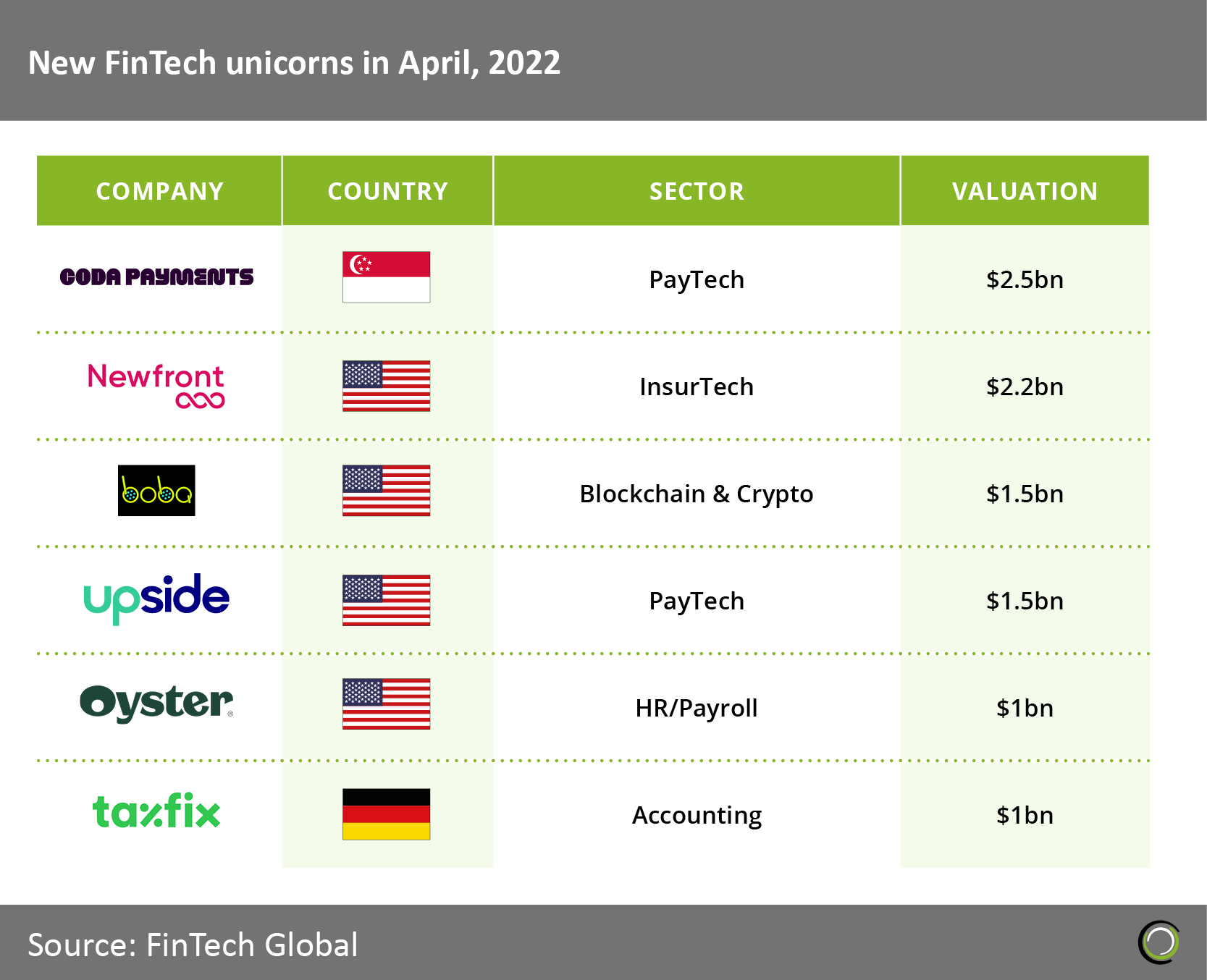

April was not a strong month for FinTech companies reaching the unicorn club. Just six new companies joined the ranking, Coda Payments, Newfront, Boba, Upside, Oyster and Taxfix. This is a 54% reduction from January which saw 13 new unicorns emerge.

Here are last week’s 41 FinTech deals.

Here are last week’s 41 FinTech deals.

Deserve closes $250m credit facility

Deserve, a FinTech aiming to expand the real-time credit card economy, has raised a $250m credit facility with Goldman Sachs, Cross River and Waterfall Asset Management.

With Deserve’s digital-first, mobile-centric, and highly configurable credit card platform, the company will use this new funding to meet the growing demand from financial institutions, FinTechs, and consumers.

In the last year, Deserve said its platform business has successfully launched credit card programmes for partners such as BlockFi, M1 Finance, OppFi, Seneca Women, Notre Dame Global Partnerships, and KrowdFit, among others.

In 2022 and beyond, Deserve said it plans to bring innovative card programmes that help consumers manage subscriptions, augment BNPL, unlock their home equity as well as card programs for SMBs and commercial customers.

HR software firm Rippling reaches decacorn status

Rippling, a HR software firm, has raised $250m in Series D funding in a round co-led by Bedrock and Kleiner Perkins.

The round also saw participation from existing investors, Y Combinator, Sequoia Capital, and more. The round values the company at $11.25bn.

Rippling’s core thesis is that employee data is critical to a surprisingly large number of business systems, including the ones well outside of HR.

According to Rippling, maintaining the fidelity of the same employee data across all these disconnected systems effectively, across multiple separate databases, is the reason it’s a lot of work for companies to have many different business systems in the first place.

Rippling said it solves this problem by giving companies and employees a single place to make changes, which then propagate everywhere automatically.

Email security platform Abnormal reaches $4bn valuation

Email security company Abnormal Security has reached a $4bn valuation in just four years, following the close of its $210m Series C round.

Global software investor Insight Partners served as the lead backer, with commitments also coming from Greylock Partners and Menlo Ventures.

Abnormal has had a stellar year for growth, culminating in tripled annual recurring revenue, and doubled employee headcount.

It claims the shift towards a hybrid working model has caused security leaders to rethink their cybersecurity strategies. As email attacks become more sophisticated and business email compromise losses amounting to around $2.4bn in 2021 – according to the Federal Bureau of Investigation Internet Crime Report 2021 – demand has increased for Abnormal.

The CyberTech company offers cloud-native email security that utilises AI-based behavioural data science to prevent socially engineered and never-seen-before email attacks that evade traditional secure email gateways, it claims.

Its technology can protect against business email compromise, phishing, malware, ransomware, social engineering, spam and graymail, supply chain compromise, and internal account compromise.

Abnormal plans to expand its products across multiple countries and languages, as well as launch new solutions.

The CyberTech company claims to protect over 5% of the Fortune 1000, as well as companies including, Urban Outfitters, Groupon, Royal Caribbean International and Auto Club Group-AAA.

Paddle hits $1.4bn valuation

Paddle, a payments infrastructure provider for SaaS companies, has reached a $1.4bn valuation after the close of a $200m Series D round.

KKR served as the lead investor, with contributions also coming from existing investors FTV Capital, 83North, Notion Capital and Kindred Capital. The company also received debt financing from Silicon Valley Bank.

With the capital injection, Paddle plans to bolster the development of its platform to meet the global needs for its software.

Paddle’s payment infrastructure is leveraged by over 3,000 software companies in over 200 markets around the world.

Its platform integrates with checkout, payment, subscription management, invoicing, international taxes and financial compliance processes.

The company has doubled its revenue growth since November 2020 and has had an average annual revenue growth of over 175% over the past four years. It has also grown its team from 140 to 275 people across New York and London.

With the close of the round, the company has raised a total of $293m in funding. It previously raised $68m for its Series C funding round back in November 2020, with commitments coming from FTV Capital, Kindred Capital, Notion Capital and 83 North.

LatAm-focused FinTech Dock joins unicorn club

LatAm-focused full-stack payments and digital payment platform Dock has reached a $1.5bn valuation after the close of a $110m growth round.

Lightrock and Silver Lake Waterman served as the lead investors to the round, with participation also coming from existing Dock backers Riverwood Capital, Viking Global Investors and Sunley House Capital.

With the capital, Dock plans to accelerate its product development roadmap and international expansion plans. It also hopes to hire more staff to help capitalise on the market size.

Dock offers an open API and cloud-native platform that lets more than 300 clients offer unique user experiences in their payments, credit and digital banking offerings.

Its end-to-end platform allows any business to offer financial services, including the launch and management of custom cards, payment processing, and banking-as-a service with digital accounts, mobile payments and fraud management.

Clients of Dock include FinTechs, retailers, banks, and technology companies focused on improving the customer experience for the currently banked and unbanked population

Blockchain data platform Chainalysis scores $170m Series F

Blockchain data platform Chainalysis has reportedly raised $170m for its Series F round, bringing its valuation to $8.6bn.

The investment was led by Singapore sovereign wealth fund GIC, according to a report from TechCrunch.

The RegTech company previously raised $100m for its Series D round in June 2021. The capital came from Coatue, Altimeter, Blackstone, GIC, Pictet, Sequoia Heritage and several others. This round brought its valuation to $4.2bn, which was double its previous valuation of $2bn.

Chainalysis provides investigations and compliance software to help government agencies and private sector businesses with the ability to detect and prevent cryptocurrency crime and money laundering.

Global crypto exchange KuCoin scores $150m

Global crypto exchange KuCoin has closed its pre-Series B round on $150m, which brings its valuation to $10bn.

The decacorn will use the capital to expand its presence in Web 3.0, including crypto wallets, GameFi, DeFi, and NFT platforms through investment arms like KuCoin Labs and KuCoin Ventures.

Other plans for the funds include, building the next generation of KuCoin core trading system, support KuCoin’s global regulation efforts and enhance security and risk management systems.

Jump Crypto led the round, with participation also coming from Circle Ventures, IDG Capital and Matrix Partners.

KuCoin, which launched in 2017, is a global cryptocurrency exchange for over 700 digital assets. Its services include, spot trading, margin trading, P2P fiat trading, futures trading, staking and lending.

Pyramid Analytics closes $120m Series E

Pyramid Analytics, a decision intelligence platform provider, has closed a Series E funding round of $120m, exceeding the target by $20m.

The round brings the company’s total venture capital raised to more than $211m. It was led by H.I.G. Growth Partners, the dedicated growth capital investment affiliate of H.I.G. Capital. The round also saw participation from Clal Insurance Enterprises Holdings, Kingfisher Capital, and General Oriental Investments. Early investors who participated in this round also included JVP, Maor Investments, Sequoia Capital, and Viola Growth.

Pyramid said decision intelligence is “what’s next in analytics.” The company delivers data-driven insights to facilitate faster and more intelligent decisions. It provides access to data, enables AI-guided governed self-service and serves any analytics need.

Pyramid said by uniquely combining Data Prep, Business Analytics, and Data Science with AI guidance in a single environment, the Pyramid Platform reduces cost and complexity while accelerating growth and innovation. This enables a strategic, organisation-wide approach to business intelligence and analytics.

Pyramid said the round will be invested to accelerate Pyramid’s first-mover advantage in augmented analytics capabilities and the decision intelligence category.

Opn rebrands from SYNQA after $120m Series C+

Opn, a payment experience solution developer, has rebranded from SYNQA alongside the close of its $120m Series C+ funding round.

Contributions came from JIC Venture Growth Investments, MUFG Bank and Mars Growth Capital.

The funds will help Opn scale its business and expand into new geographies.

Founded in 2013, Opn enables commerce through embedded payment experiences. It supplies companies with tools and technology to build unique customer experiences and grow revenue.

Its technology helps secure payments across all sales channels, online, in-app and in-person, and enables easy management of transactions, including cards, QR codes and other methods. The platform also helps companies create and sell their own NFTs.

Opn, which is based in Thailand, operates across Southeast Asia and Japan.

Africa-focused digitised payment dev Interswitch bags $110m

Interswitch, which is pioneering the shift to digitised payments, has scored $110m in funding.

The capital was supplied by LeapFrog Investments and Tana Africa Capital. A portion of the investment was acquired from existing investors.

With the funds, the company hopes to drive its pan-African strategy and access new customers across the continent. It also hopes to build new products and support its financial inclusion strategy.

Founded in 2002, Interswitch claims to have disrupted Nigeria’s traditional cash-driven payments system, introducing electronic payments processing and switching services to the market.

The company operates under two flagship brands. Verve, a debit card scheme operating across Africa, and Quickteller, a multi-channel consumer and business payments platform.

TIFIN scores $109m in its Series D

TIFIN, which leverages AI to offer personalised investor experiences, has closed its Series D on $109m.

The round was backed by Franklin Templeton investment manager Franklin Resources and Motive Partners, an investment firm focused on technology.

This investment brings TIFIN’s valuation to $842m, nearly double its previously valuation of $447m following its $47m Series C round.

Funds from the round will be used to expand outside of the US.

The company uses AI to drive personalisation for wealth management and digital distribution for investment managers.

Founded in 2018, TIFIN operates across multiple products, including Magnifi, a search-powered marketplace for investments; Financial Answers, a demand and data generation platform for advice and investments; TIFIN Wealth, a collection of personalisation components to advisors, wealth managers and other intermediaries; and Distill, an AI-powered analytics and intelligence platform to drive digital distribution for asset managers and wealth enterprises.

In line with the deal, Motive Partners founder and managing partner Rob Heyvaert will join the TIFIN board of directors.

Digital asset trader Talos joins unicorn club

Digital asset trading technology developer Talos has joined the unicorn club, following the close of its Series B on $105m.

The FinTech company, which is valued at $1.25bn, raised the funds to expand its product line and hire more staff. It claims the Talos team has grown by 400% over the past year.

Talos hopes to accelerate its expansion into APAC and Europe and built products that support the end-to-end trade lifecycle.

Global growth equity firm General Atlantic led the round, with contributions also coming from Stripes, BNY Mellon, Citi, Wells Fargo Strategic Capital, DRW Venture Capital, SCB 10x, Matrix Capital Management, Fin VC and Voyager Digital, Graticule Asset Management Asia (GAMA) and LeadBlock Partners.

Existing Talos investor, Andreessen Horowitz, PayPal Ventures, Castle Island Ventures, Fidelity Investments, Illuminate Financial, Initialized Capital, and Notation Capital, also backed the fresh investment.

Talos provides buy-side institutions and service providers with the technology infrastructure to adopt crypto. Its services include trading platforms, marketplace, data and analytics, and portfolio and settlement tools, which are all offered white-labelled and enable clients to transact end-to-end.

Its institutional trading volume has increased by over 20-times year-over-year.

Solfácil collects €100m ($103m) for solar energy investing platform

Brazil-based Solfácil, which lets people invest into solar energy, has reportedly raised €100m in a funding round.

The capital injection was led by QED Investors, with commitments also coming from SoftBankVEF and Capital Value, according to a report from Global Happenings. .

With the funds, the company hopes to expand its financing offer, grow its marketplace and bolster its technology.

Founded in 2018, the company allows people to invest into solar energy, with consumers able to switch their monthly electricity payments into an investment into solar energy systems.

Solfácil previously raised $30m in its Series B last year.

CyberTech Material Security lands $100m to hit billion-dollar valuation

Material Security, a CyberTech that helps companies protect their emails, has scored $100m in new Series C funding.

According to Material, the Series C raise values the company at $1.1bn just two years after Material rolled out its first product.

Founded by ex-Dropbox engineers, Material was started following the 2016 US presidential election after the fragility of private data was shown front and centre during the campaign.

The company claims it protects accounts even after they’re compromised or harmful messages get through. The offering is completely entirely cloud-based, deploys in 30 minutes, and can be exclusively managed by the customer.

Material said it offers security trams the ability to redact sensitive content in email and make them available only after a two-factor verification step. This enables the firm market tools to help with email data leak prevention, phishing herd immunity, account takeover and other visibility and admin controls.

Mothership pulls in $76m for freight technology

Mothership, a short-haul freight-technology company dedicated to same-day delivery, has raised $76m in a funding round.

The capital was raised from Benchmark, WestCap, Bow Capital, former Con-way Freight CEO Douglas Stotlar and other leading investors. The company expects to use the capital to expand its on-demand freight platform nationwide.

Mothership describes itself as a trusted logistics system for leading companies including DoorDash, GoPuff, Harbor Freight Tools, PayPal-owned returns-logistics business Happy Returns, and others.

Mothership allows businesses to deliver freight same day through automatic dispatch to the nearest carriers within their vast network. Its technology then optimally routes carriers on the most efficient route so that freight travels faster, costs less and reduces overall emissions.

Coherent secures $75m to redefine software-building

Coherent, a global no-code software-as-a-service (SaaS) provider, has raised $75m in Series B funding.

The round was led by Maverick Capital, including Maverick Ventures, with participation from Owl Rock, a Blue Owl division, GreatPoint Ventures, and existing investors Cathay Innovation and Franklin Templeton. Coherent’s total funding now amounts to $89m.

Coherent said it is redefining how business and IT teams build software together.

Coherent’s core technology Spark automatically converts any business logic within a spreadsheet – such as rules, formulas, and data models – into an Application Programming Interface (API) that can easily connect to other front and back-end applications. Spark’s no-code service delivers in minutes what takes months with the current business software development cycle.

As a result, Spark said it not only maximizes the impact of existing investments in intellectual capital, tools, and employee expertise, but also frees up already stretched IT teams to focus their specialized and scarce resources on truly innovating for the business.

Coherent said the funding will support its continued expansion across the global insurance industry and capitalise on the momentum in new industry vertical, such as capital markets, banking and asset management. The investment will also allow the company to meet increasing demand by fuelling the growth of product, engineering and sales teams in the US and Asia Pacific regions.

Indonesian InsurTech Qoala scores $65m

Indonesia-based InsurTech startup Qoala has secured $65m in its Series B funding round.

The InsurTech company claims to have grown by 30-times since its Series A in 2020, which closed on $13.5m.

Qoalo distributes retail insurance products to consumers for bike, car, home and health through its omni-channel platform.

The platform expanded into Thailand and Malaysia in 2021. It claims to have acquired over 50,000 insurance marketers and provides a platform supported by over 50 insurers for them to sell insurance from multiple insurers, while managing pre-sale and post-sale services.

It also provides several micro-insurance products through partnerships with Traveloka, Redbus, DANA, JD.ID, Shopee, Kredivo, Investree and others.

The InsurTech company is also looking to hire over 250 employees this year to expand its engineering and product management teams. Furthermore, it hopes to give employees equity compensation and the right to acquire shares in the company.

Mashgin collects $62.5m for touchless technologies

Mashgin, a touchless self-checkout system powered by AI and computer vision, has raised $62.5m in Series B funding at a $1.5bn valuation.

The round was led by global venture capital firm, NEA, and brings Mashgin’s total funding to date to $74.7m. Existing Mashgin investor, Matrix Partners also participated in the Series B round.

Founded in 2013 and headquartered in California, Mashgin providea a touchless checkout system which identifies items for any angle and does not require barcosed of RFIDs. The company said it allows checkout lines to move at high speed without interruption, reduces wait times, and allows retailers to invest more in the overall customer experience.

Mashgin said it will use the new funding to grow its team, accelerate expansion and scale internationally.

Paymob bags $50m in largest ever Egyptian FinTech Series B

Egyptian FinTech Paymob has raised $50m in a Series B funding round headed by Kora Capital, PayPal Ventures and Clay Point.

Also taking part in the round were Helios Digital Ventures, Nclude, British International Investment, A15, FMO and Global Ventures. Following the raise, Paymob has raised $68.5m in total funding.

Paymob is a payment service provider and payment aggregator that helps businesses get paid wherever their customers are. The firm’s services facilitate both online and offline payment channels with a set of tools to accept payments whether online, via mobile, on delivery or in store and whether paid by card, mobile wallet, cash or in instalments.

The company saw strong growth of its platform last year, with the number of merchants and monthly volumes growing by 4x year-on-year as of December. Paymob also onboarded over 100,000 merchants in less than two and a half years.

According to Paymob, the proceeds will be used to turbocharge the firm, by expanding its product range, reinforcing its leadership in Egypt and expanding into new markets across the Middle East and Africa.

Crypto banking firm BVNK snares $40m

BVNK, a banking and payments platform targeting firms that are seeking crypto integration, has raised $40m in a Series A funding round.

The round was headed by Tiger Global and also included participation from digital asset custodian Anchorage Digital, Coinlist and CEO of TrueLayer Francesco Simoneschi.

According to CoinDesk, BVNK launched last October with the aim of appealing to firms looking to offer crypto services not currently served well by existing payment and settlement providers.

To date, BVNK processes $2bn in annualised payments which it hopes to grow to serve cross-border companies with fast payments and banking in crypto and fiat.

The firm’s API-based platform allows merchants and other companies to integrate crypto payments into their operations.

BVNK will use the new funds to accelerate its push for regulatory licences and expand into new markets including the US.

European open banking PayTech Token.io nets $40m

Open banking payments platform Token.io has scored $40m in its Series C funding round, as it looks to boost the shift to open banking.

Cota Capital and TempoCap co-led the round, with commitments also coming from Element Ventures, MissionOG and PostFinance. Existing Token.io investors Octopus Ventures, Opera Tech Ventures and SBI Investment, also joined the round.

Funding will be used to support the transition from traditional payment methods like cards and wallets to open banking-enabled account-to-account payments. It hopes to this by differentiating its purpose-built platform for existing payment providers and expanding open banking connectivity across Europe.

Token plans to enhance its application programming interfaces for variable recurring payments and open finance functionality.

Founded in 2016, the company offers open payment and data connectivity in Europe, spanning 16 EU countries. It claims to process tens of millions of open payments each year for over 80% service providers, gateways, banks and large merchants.

AgriDigital harvests $25m for digital grain management

AgriTech AgriDigital, which is on a mission to grow the value of grain by building the best digital grain management and finance platform for the world’s farmers, grain buyers and traders, has raised $25m.

Started by farmer co-founders Bob McKay, Ben Reid and Emma Weston, AgriDigital said it powers trust in the global grain supply chain through its combined inventory management software and finance platform.

Since its founding, AgriDigital said it has grown to be the largest digital grain management platform in Australia with 15% of all grain produced here being transacted at the sale, delivery or storage point through the platform; and over 14,000 users.

CEO and Co Founder, Emma Weston confirmed that the round, which is a mix of debt and equity, enables the company across both the technology and finance landscapes.

Weston added that the capital will support AgriDigital to improve the experience for its existing customers to accelerate onboarding for new users so that they can get their work done as efficiently as possible for the lowest cost in terms of time, reduced errors and training time, improved decision-making and reporting.

CyberTech StackHawk bags $20.7m in Series B raise

StackHawk, an application security startup, has raised $20.7m in a Series B funding round headed by Sapphire Ventures and Costanoa Ventures.

Also taking part in the round were Foundry Group as well as a number of other investors. To date, StackHawk has raised a total of $35.3m.

Founded in 2019, Colorado-based StackHawk claims to make it simple for developers to find, triage, and fix application security bugs. Users can scan their application for AppSec bugs in the code a team wrote, triage and fix with provided documentation, and automate in your pipeline to prevent future bugs from hitting prod.

The new funding will be used to speed up product development and continue its rapid growth.

WealthTech Tumelo scores $19m Series A funding round

Tumelo, which claims to enable investment platforms and pension providers to engage with investors, has reportedly raised $19m in its Series A.

The round was led by US-based FinTech venture firm Treasury, with commitments also coming from Legal & General, Fidelity International Strategic Ventures, Nucleus Adventure Capital, Lance Uggla and several angel investors, according to a report from FinTech Finance News.

With the funds, Tumelo is looking to bolster its platform so more investors can execute their rights. It also hopes to extend its reach in the UK, as well as expand into the US, Australia and other markets.

Tumelo’s mission is to enable retail investors and pension members to create and benefit from a more sustainable investment system. It achieves this by partnering with investment and pension firms and give them the tools that let customers voice the issues they care about, such as gender equality and climate change.

Crypto platform Xangle lands $17m in Series B haul

Xangle, a crypto data and research platform, has scored $17m in a Series B investment round led by KB Investment, Shinhan Capital, Premier Partners and IMM.

Xangle – a part of the wider CrossAngle company – noted that amongst its investors, Shinhan Capital entered a strategic partnership with Xangle. The two firms are aiming to launch crypto-related services that are expected to be available on each firm’s platform.

Founded in 2018, Xangle is a global crypto assets platform based in South Korea. Xangle is behind the Xangle Crypto Rating, a full business audit report for crypto projects used by exchanges, corporations and institutions such as the Korean Commercial Banks to Evaluate Cryptocurrency Exchanges.

Since its inception, CrossAngle has raised around $4m through a Series A funding round prior to this recent raise.

CrossAngle claims it will continue to strengthen and develop new and existing areas of service to build a globally leading presence and pursue its efforts in cultivating global talent as well.

Healthy lifestyle reward credit card Ness scores funding and launches debut product

Ness, a FinTech that builds credit cards to reduce the cost of wellcare, has raised $15.5m alongside the official launch of its first product, Ness Rewards App.

The seed round was led by Will Ventures, with commitments also coming from Core Innovation Capital, Accomplice, Digitalis, GFC, Portage Ventures, Refactor Capital, RiverPark and Atypical.

This round was also supported by the founders and senior executives from health and wellness companies, including Sweetgreen, Mirror, Headspace, Thrive Market, Whole30, Oura, Quartet Health, Four Sigmatic, RXBar, Everly Health, Pillpack, Ginger, One Medical, Galileo Health, Oscar Health, Noom and Hungryroot.

Funds have been earmarked to grow the product, team, user base and compliance.

Ness Rewards App lets consumers earn points for spending on healthy products. These “healthy actions”, which range from fitness activity to physician visits, will be rewarded. Users can redeem points for offers at wellness brands, such as Sweetgreen and Thrive Market.

In addition to all of this, Ness revealed it acquired WellSet’s 4,000-person nationwide network of practitioners. As a result, users will soon be able to redeem points to see health coaches, dieticians, therapists and doulas.

With eyes on the future, Ness is looking to release a suite of credit cards that accelerate those rewards and give cardholders exclusive access to unparalleled benefits from their favourite health and wellness brands.

It also plans to offer medical benefits, supplemental insurance and comprehensive health insurance on top of its credit cards.

Voxel lands $15m for proactive workplace safety

Voxel, a startup using computer vision to transform safety and operations in the workplace, has raised $15m in Series A funding led by Eclipse Ventures.

The round also saw participation from MTech and World Innovation Labs. This latest round of funding brings total equity raised to $18m.

Voxel integrates with existing security cameras to identify hazards, risky behaviours and operational inefficiencies across a diverse range of workplaces. Once an event such as a spill, speeding vehicle, or ergonomics issue is identified, a real-time alert is sent to on-site personnel who can take immediate action.

Voxel said its analytics help sites identify operational inefficiencies and design policies to prevent future issues. These proactive measures allow businesses to significantly reduce worker’s compensation and general liability costs, while improving their operations.

Since raising its seed round in September, Voxel said it has grown by decreasing on-site injuries by upwards of 80% and increasing operational productivity by over 20% at its initial customer sites.

Industry-first no-code insurer CoverGo receives Series A backin

CoverGo, a no-code SaaS insurance platform, has closed its Series A funding round on $15m, as it eyes international growth.

The round was led by California-based SemperVirens VC, with contributions coming from SixThirty, Tribeca Early Stage Partners and Fresco Capital.

Pan-African insurance group Old Mutual, Asia-based insurance group Asia Financial Holdings, US-based XN Worldwide Insurance and Middle East and African insurance fund Noria Capital joined the round as strategic investors.

With the funds, the company plans to hire more sales and engineering staff for its Us and Asia Pacific teams. Additionally, CoverGo plans to expand internationally and bolster its partner network.

CoverGo claims to be the insurance industry’s first out-of-the-box modular, no-code insurance platform. It helps streamline an insurance ecosystem from end-to-end with fully configurable API-driven insurance services. It supports health, life and P&C insurance.

It works with major insurers, including AXA, MSIG, Dai-ichi Life and Bank of China Group Insurance. The company claims to have increased its annual recurring revenue by ten-times since January 2021.

Cushion scores $12m in its Series A

Cushion, which claims to be a leader in bank and credit card fee negotiation, has scored $12m for its Series A funding.

Rose Park Advisors led the round, with commitments also coming from Flourish Ventures, Vestigo Ventures, TSEF, Green Cow Venture Capital, and CMFG Ventures Discovery Fund.

This capital injection will help Cushion hire more staff for its product, engineering, data analytics, and marketing teams as it looks to launch its bill pay solution to the general audience, following a beta test. The service aims to stop consumers accumulating unnecessary bills from late payments by keeping them updated with upcoming expenses.

It claims the solution is being awaited by over 100,000 current customers.

Cushion offers tools to manage, pay and finance bills from a single location, enabling users to track bills, avoid late fees and overdrafts, and borrow money when needed. It also helps users to build their credit scores.

Video telematics developer SureCam scores $11.5m

SureCam, a provider of video telematics technology for small and midsized businesses, has closed a $11.5m funding round.

The round was led by Lewis & Clark Capital, SureCam’s majority shareholder, with participation from existing shareholders, and the addition of Virginia-based CCA Financial, one of America’s largest independent technology and equipment financing companies.

Since its inception in 2014, SureCam has provided video telematics solutions via connected dash cameras for busy fleets in organisations ranging from family-owned businesses up to some of the world’s most recognised fleets in field services, utilities, transportation, distribution, construction, taxi service, and home delivery.

SureCam said the funds from the round will go towards product development and expanding the company’s customer-base.

Irish FinTech Irish FinTech raises $10m

Irish FinTech company Stanhope Financial Group has received an excess of $10m for its Series A funding round.

Gate Ventures led the investment round.

Capital from the round will help Stanhope develop product offerings, bolster its management team, increase its market share and prepare for the launch of its upcoming affiliate digital assets division, SH Digital.

The FinTech company claims to have experienced strong growth since it launched operations in October 2021.

Its SH Payments division, which is licensed as an electronic money institution, provides banking services to efficiently send and receive money globally, including FX, multi-currency accounts and innovative payment solutions.

Its SH Capital division, which is licensed in the DIFC, Dubai, allows institutions and family offices to game access to premium global investment products across all capital markets. Finally, its SH Digital solution offers cryptocurrency liquidity and trading services.

BNPL firm Cashew bags $10m

Buy now, pay later provider Cashew has reportedly raised $10m in a mixture of debt and equity to support its expansion plans.

The capital was supplied by Mashreqbank PSC, which has acquired a minority stake in the business that could increase to 20% in future rounds, according to a report from Reuters.

Cashew’s platform will be integrated on to Mashreq’s payments business.

The FinTech company is targeting 5,000 merchants and 500,000 users by the end of the year, it said. Furthermore, the company hopes to increase its transaction volume by ten-times to reach $10m.

UAE-based Cashew is planning to raise a further $30m this year and is speaking with banks in Saudi Arabia and Oman to get their system on their payment businesses. Furthermore, Cashew plans to expand into Egypt.

Cashew provides consumers with the ability to pay for products over three, six or 12 instalments.

Backflip closes $8m for seed round

US-based Backflip, which helps investors find the right property to invest into, has netted $8m for its seed round and a $27m debt investment.

Vertical Venture Partners and LiveOak Venture Partners co-led the funding round, with contributions also coming from Revel Partners, Great Oaks VC, and Greg Waldorf, former founding investor and Board Member at Trulia and Zillow.

With the capital, the company plans to expand its product development team and accelerate its 2022 public launch in Texas and Colorado.

Backflip was created to resolve the housing shortage in the US and help the rejuvenation of aging homes. It claims that more than 60 million houses (around 75% of all homes) were built over 30 years ago and need updating to meet modern needs.

The company’s founders believe “local entrepreneurs, rather than Wall Street institutions, are best positioned to restore and modernise neighbourhoods in a way that maintains their charm and authenticity.”

Backflip is building an end-to-end platform that up-levels individual real estate investors with purpose-built technology and capital products to source, analyse and finance residential real estate investments. Its app includes property insights, data, education and community. It claims it is also more flexible and faster than banks.

Its Backflip Capital division provides companies with the capital to fund investments into properties.

Since it launched its private beta in 2021, users have analysed around $2bn of investment properties. Furthermore, it has funded tens of millions of loans for its user to acquire and renovate homes.

Travel insurer Faye scores $8m

Whole-trip travel insurance startup Faye has scored $8m in its seed round, which was led by Viola Ventures and F2 Venture Capital.

Contributions to the round also came from Portage Ventures, Global Founders Capital (GFC) and former NBA player Omri Casspi.

Faye claims to set a new standard in insurance, with its platform able to cover travelers’ trips, health, belongings, and even their pets. Its app has real-time alerts, provides 24/7 access to customer experience specialists, enables users to digitally file a claim and quickly pays approved claims through electronic transfers.

Through the Faye Wallet, travellers can also receive speedy reimbursements for travel inconveniences, such as delayed bags and flights. The app is available on iOS and Android.

This funding round comes hot off the heels of Faye’s launch out of stealth mode last month.

Zero-trust company Xage Security nets $6m

Xage Security, a zero-trust company, has raised a $6m top-up to the $30m it previously raised in its Series B in January 2022.

The new funding comes from SCF Partners and Overture Venture Capital, the latter of which specialises in startups in government, climate and energy.

Following this recent top-up to the Series B, the company has now raised a total of $60m since inception. The company previously raised $16m in its Series A funding round in 2018.

Founded in 2016, Xage offers zero trust identity, data security and local or remote access for physical and digital operations spanning OT, IT and cloud. The company markets Xage Fabric, which it claims is designed to bring zero trust to complex environments such as those that exist in a range of critical industries.

BalkanID nabs $5.7m for its seed

BalkanID, a company focused on the identity, governance and administration (IGA) space, has landed $5.75m in a seed funding round.

BalkanID is financially backed by firms such as Uncommon Capital, Sure Ventures and Afore Capital amongst others.

The company emerged from stealth this week and launched a subscription-based product that harnesses data science and machine learning to provide defenders with visibility into risky entitlements and a simplified way to manage access review and certification processes.

BalkanID claimed that by helping organisations find and fix problematic entitlements across their SaaS and cloud landscape, the company enables IT and security teams to integrate the principle of least privilege into security and IT operations.

The company aims to ‘disrupt’ the IDA market and is looking to help companies find and remediate risky privileges across SaaS and public cloud infrastructure.

BalkanID claims it plans to target the mid-market with a tool that leverages AI and workflow automation to provide visibility into risky entitlements and simplify the access review and certification process.

Mentum raises $4.2m for its investment API

Mentum, which stylises itself as the investment API for Latin America, has raised $4.2m in seed funding led by Gradient Ventures.

This capital will help the company launch in four markets. The platform is already live in Colombia and Chile.

With its API, Mentum aims to help Latin American companies offer digital investment services in a few lines of code.

Mentum was founded by Simon Avila, Gustavo Trigos and Daniel Osvath. The trio realised the retail investing servies they were using in the US could easily brought to Latin America. They examined the options in the countries where they grew up and realised there were only a handful of services.

It continued to state that only the top 2% in Latin America had access to wealth management and the rest of the market was incentivised to spend and get indebted, it claimed.

Mentum operates under the belief that the right solution for helping regional economic development can start from the wise spectrum of products that exist in each of the countries.

Israel’s Sunday Security picks up $4m

Sunday Security, an Israeli startup that claims to revolutionse cybersecurity for the enterprise, has exited stealth with $4m in seed funding.

The round was led by MoreVC, with participation from renowned security executives and serial entrepreneurs including John Donovan, former CEO at AT&T and chairman of the President’s National Security Telecommunications Advisory Committee; Amit Singh, CBO, Palo Alto Networks ; Shailesh Rao, president, Global Go-To-Market at PANW; Tom Kemp, founder and former CEO at Centrify and more industry leaders.

Founded by security veterans Zack Ganot, CEO and Shaked Barkan, CTO, Sunday Security defends key personnel from attacks on their personal security, including online accounts, their devices, and identity fraud.

Sunday Security said as executives are increasingly targeted by hackers as a means of penetrating the enterprise, Sunday’s Personal Cybersecurity stands to protect everything private and personal in digital worlds.

InsurTech startup SALT secures $2m Series A

SALT, an InsurTech built for the home and auto insurance market, has scored a $2m Series A investment.

The capital injection was led by Eagle Venture Fund, a global seed and Series A investment firm.

With the capital, the company plans to hire four to six new team members, bolster its product development with feedback from agent customers, and attend industry conferences.

SALT claims that by enhancing the prospect data acquisition process, SALT accelerates the time it takes to move a prospect through the sales pipeline, whilst equipping the independent agent with ways to connect with referral partners.

Some of the company’s recent milestones include growing its agent subscriber base by 40% in Q1 2022 and integrating its services with PL Rating and EZLynx.

Alongside the close of the investment, SALT has welcomed IIAT Board past chairman Robert Nitsche and Stakwise owner Casey Nelson to its board of directors.

Italian travel InsurTech BeSafe raises €1.2m ($1.2m)

Italian travel InsurTech BeSafe Group has raised €1.2m to accelerate the development of tech and insurance services for European tourism.

According to a report by EU Startups, the round was jointly underwritten by CDP Venture Capital Sgr, through its Acceleration Fund, and Prana Ventures SICAF.

BeSafe Group was created to remove the stress for travellers when booking a trip. When using BeSafe, it is the insurance company that refunds the guest in case of cancellation, and the accommodation provider is relieved of this refund burden so its revenues are guaranteed when a reservation is cancelled.

ABAKA closes investment round

London-based ABAKA, which offers an AI-recommendation engine and digital retirement solutions, has received an investment round to bolster its research and development.

In addition to this, the company plans to bolster the development of its AI technology to offer deliver hyper-personalised digital customer experiences. The company is also expanding across Southeast Asia and Greater China.

Its AI engine has been trained through over ten million retail customers and policyholders and is used by global organisations, including HSBC and Prudential Asia.

The platform collates a financial institution’s relevant customer data and augments it with other sources of data for enhanced insights. This information empowers the AI to predict what “next best action” or “intelligent nudge” will resonate and activate customer responses.

Its technology is also used by banks and insurers to offer customers with personalised experiences and retirement planning tools.

ABAKA previously raised $6.5m in its Series A funding round back in 2019. The funds were supplied by Thames Trust, Ace&Co and Downing Ventures.

Copyright © 2022 FinTech Global