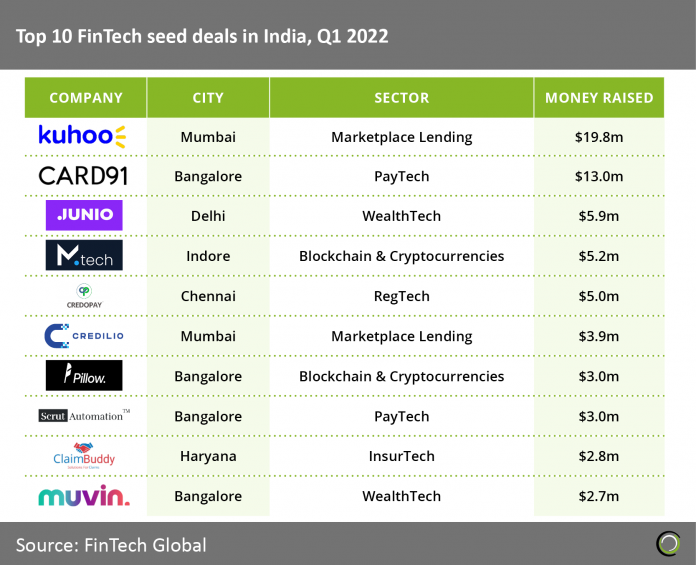

- Kuhoo, a platform providing digital student loans for the education of economically disadvantaged communities, was the largest FinTech seed deal in India in the first quarter of 2022. The eight-month-old startup is now looking to partner with banks and non-banking finance institutions (NBFCs) along with top colleges in India to provide credit to students.

- Bangalore was home to the highest number FinTech seed deals with 16 in total (39% of overall seed deal activity in the country). Reserve Bank of India (RBI)’s recent decision on 24 March to create an innovation hub in Bangalore will likely further boost the city’s FinTech success. RBI has set up RBIH as a wholly owned subsidiary with an initial capital contribution of ₹100 crore ($12.9m). RBIH says it “aims to create an ecosystem that focusses on promoting access to financial services and products for the low-income population in the country”.

- Marketplace Lending companies completed the most FinTech seed deals in India with nine in total (21% of total deal activity). PayTech was the second most dominant sector with seven deals in total (17% of total transactions). Digital payments in India is projected to reach $143bn in 2022 with a CAGR of 14.63% from 2022-2026.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global