FinTech Global reported on 38 FinTech funding rounds this week, with the industry continuing to go from strength to strength.

The leading light this week funding-wise was ESG firm EcoVadis, who pulled in an eye-watering $500m in their funding round. This reflects the ever-growing investor interest in ESG, with the sector only expected to grow as time passes and the desire for sustainable investments continues.

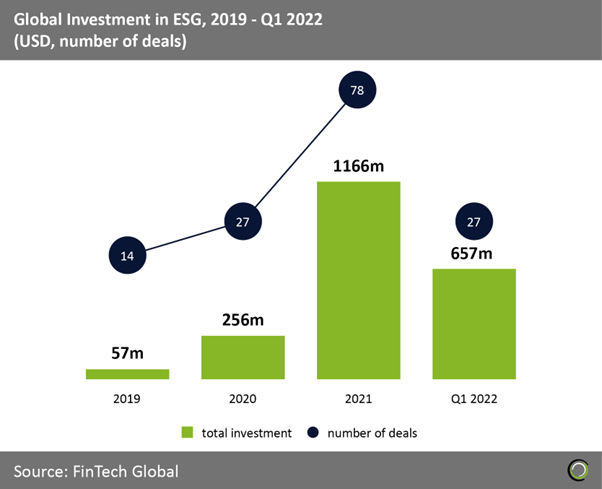

Recent research by FinTech Global lay testament to this – with ESG investments in Q1 alone pulling in a massive $657m. To put this into perspective, the whole of 2021 saw $1116m invested into the ESG market, which shows that not only has investor interest in ESG gone mainstream but that the market is beginning to be taking serious across the board.

The rise of ESG is also being noted by financial services companies, with a recent study led by TisaTech finding that 77% of respondents plan to hire an ESG specialist as they prepare for the UK’s new rules on sustainable investments to come into effect. Elsewhere, a study by ERM found that institutional investors are spending an average of $1.3m annually to collect, analyse and report climate data to inform their investment decisions.

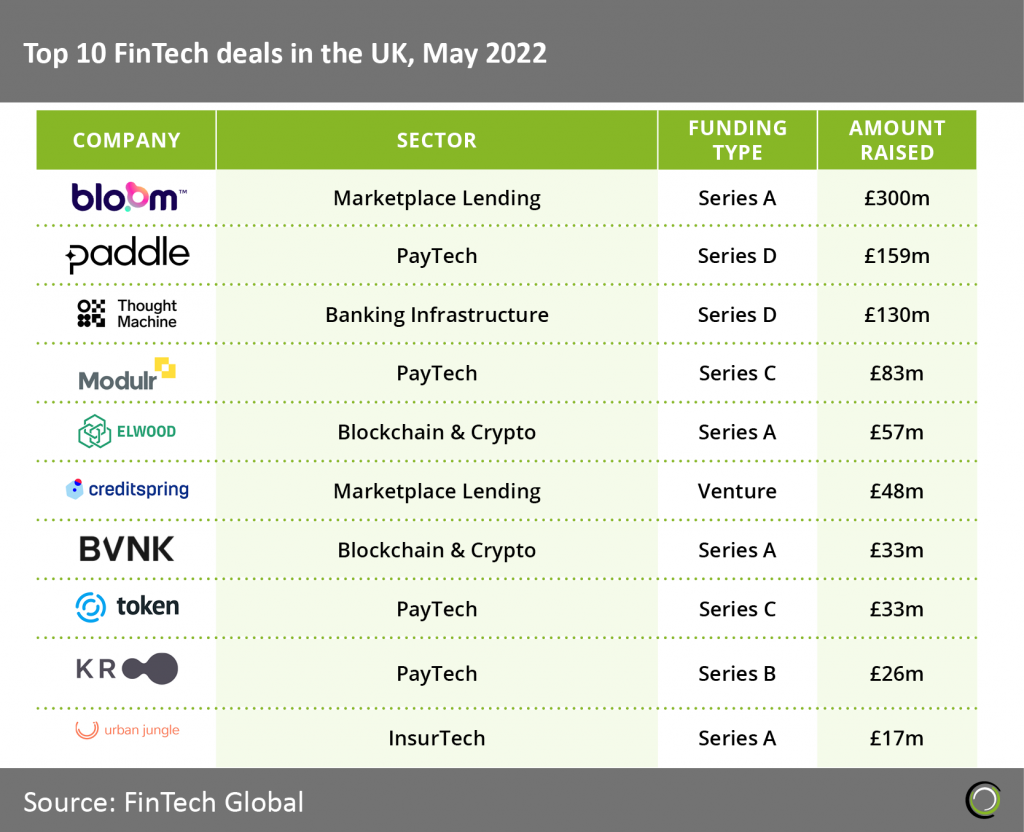

Elsewhere, research conducted by FinTech Global found that PayTech companies raised four of the top ten UK FinTech deals in May, showing that the interest from VCs in the industry continues to go from strength to strength.

According to the research, the total transaction value of digital payments in the UK is expected to reach $436bn in 2022 with a projected CAGR of 15.7% to hit $782bn in total by 2026. This places the United Kingdom third globally for projected total transaction value of digital payments in 2022.

The PayTech sector has recorded a strong 2022 to date. Earlier this year, B2B payments infrastructure-as-a-service TransferMate reached a $1bn valuation after it closed a funding round on a handsome $70m.

Elsewhere, LatAm-focused full-stack payments and digital payment platform Dock reached a $1.5bn valuation in May, after the company closed a $110m growth round. Research earlier this year also found that PayTech companies topped the list for the biggest UK FinTech deals in 2021, with payments firm SumUp taking the prize with a staggering £642m raise. Last year, SumUp partnered with the Zoological Society of London (ZSL) to develop a digital in-house fundraising technology to make contactless donations.

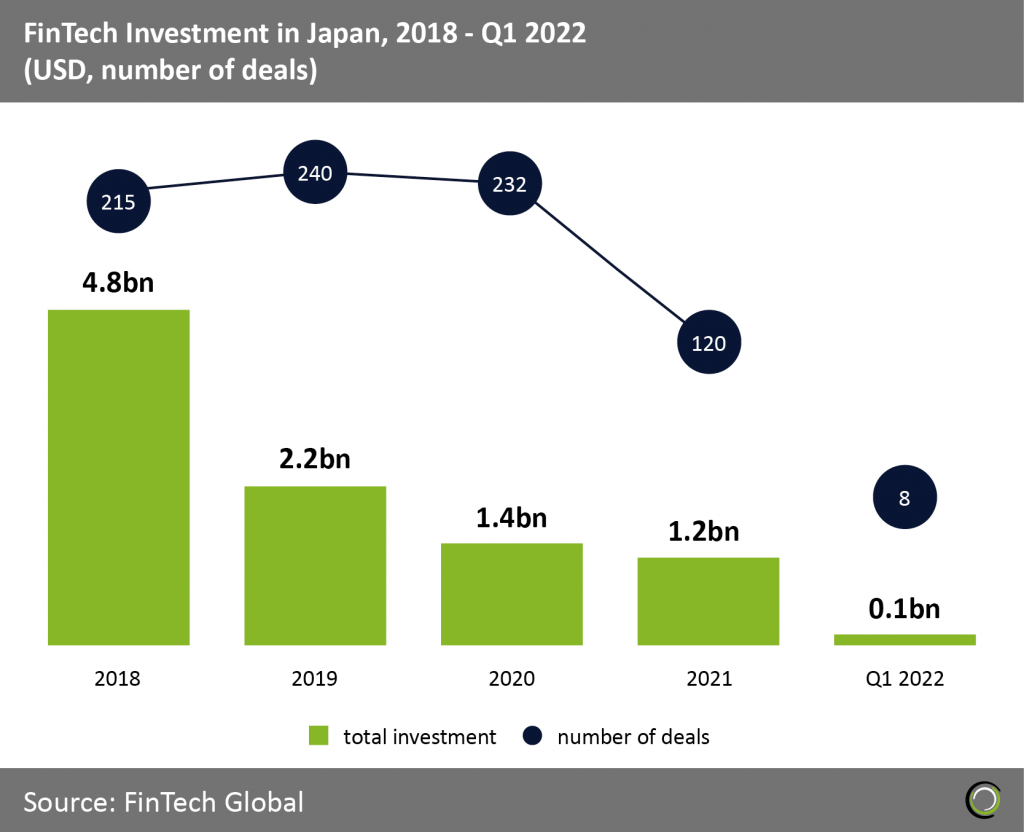

While funding in FinTech continues to rise in most global locations, research by FinTech Global this week found that FinTech investment in Japan has plunged in the first quarter of this year.

According to the research, Japanese FinTech investment reported its lowest quarter for the last five years in 2022 with investment reaching $100m during the first three months of the year. In addition, deal activity, also fell significantly from last year’s levels to a total of eight transactions in the first quarter of the year.

Here are this week’s funding deals.

Sustainability ratings business EcoVadis becomes latest FinTech unicorn

Sustainability ratings business EcoVadis has raised $500m in a funding round, which makes it the latest sustainability impact unicorn.

This funding round, which EcoVadis claims is the largest equity fundraising for a sustainability data SaaS company to date, brings its total equity raised to $725m.

With the capital, the FinTech company hopes to scale-up globally, deepen its AI and machine learning capabilities, make strategic acquisitions and more.

Its services are used by over 95,000 businesses across 200 industry categories and 175 countries, leveraging it to monitor and improve the sustainability performance of their own business and trading partners. Its use cases include Scope 3 carbon emissions management, private equity, ESG-linked loans, supply chain finance, third-party risk and resilience and more.

B2B payments firm Settle raises $280m in credit facility

B2B payments firm Settle has reportedly raised $280m in a revolving credit facility from Citibank and Atalaya.

This multi-year facility will help Settle increase its support for emerging and high-growth e-commerce companies, according to a report from Forbes.

Settle stylises itself as a provider of “cashflow management for the modern business.” Its platform offers tools for bill payments, accounts payable and flexible financing.

One of its features sees Settle pay a client’s vendors upfront, and the client then repays this over a period of 30 to 120 days.

Logistics payments service PayCargo collects $130m

PayCargo, a logistics payments and data infrastructure platform, has collected $130m in a funding round from funds managed by Blackstone Growth.

This capital burst will help PayCargo expand domestically in the US and internationally. Funds will also be used for the development of new products and pursuing growth opportunities through M&A activity.

PayCargo is a cloud-based payments network that enables payers to pay their transportation companies, including air and ocean carriers, maritime ports, ground handlers, freight forwarders, and customs brokers quickly and securely.

Its technology integrates with 50 transportation management systems, enterprise resource planning and terminal operating systems.

PropTech Homelight raises $115m in troubled real estate market

PropTech firm HomeLight has reportedly raised $60m in capital and $55m in debt financing, as other real estate companies announce mass layoffs.

Alongside the close of the funding round, the company has acquired Denver-based lending startup Accept.inc in an all-stock transaction. The FinTech company helps homebuyers quickly and easily get a mortgage with an all-cash offer.

HomeLight hopes this acquisition will allow more of its agents and clients to benefit from the power, speed and certainty of contingency-free transactions.

Based in Arizona, HomeLight aims to let homeowners sell their property quicker and for more money.

Indonesian payments platform Flip closes $100m Series B

Indonesian consumer payment platform Flip has secured the second close of its Series B, which brings the round’s total to $100m.

Flip initially closed its Series B at $48m in December 2021. Sequoia Capital India, Insight Partners, and Insignia Ventures Partners co-led the capital injection.

With the funds, Flip hopes to hire more staff in its engineering and product teams, invest into new product and technology development initiatives and accelerate its business expansion efforts.

In the first half of 2022, the company increased its team by 30% to reach more than 400 employees. It has also seen a “significant” growth in user volume and served over ten million users.

Sana raises $60m to take on health insurance

Sana, a health care company that provides health benefits to small businesses at affordable prices, has raised $60m in Series B funding.

The Series B close follows Sana’s $20 m Series A Extension funding round close in October 2021. Sana has raised $107m to date.

Sana said it is revolutionising health care options for small businesses. Headquartered in Austin, Sana provides small businesses with health insurance and benefits. The company said its customers often up save up to 30% compared to legacy insurers and most customer receive 0% increase renewals.

The company added that this latest capital from top investors in the InsurTech industry speaks to its trajectory and challenging the incumbent health insurance companies.

UK SME loan provider Allica Bank closes £55m Series B

UK business challenger bank Allica Bank has secured £55m in fresh funding, just seven months after raising £110m in its Series B.

Of the fresh capital injection, £30m was supplied by British Business Investments, a subsidiary of the British Business Bank.

With this fresh £55m, Allica Bank plans to bolster its growth efforts.

The FinTech company supplies UK SMEs with lending options. In 2021, the company issued over £560m in SME loans, which was 12-times higher than 2020. It expects to complete £3bn of lending in the next three years.

Acrew Capital backs HYCU in $53m Series B

HYCU, a company that helps organisations protect their data, has raised $53m from a Series B funding round.

The round was headed by Acrew Capital and saw participation from investors including Atlassian Ventures and Cisco Investments. Following this round, HYCU has raised a total of $140.5m since inception.

Established in 2018, HYCU claims it is the fastest-growing leader in the multi-cloud backup and recovery as a service industry. By bringing SaaS-based data backup to both on-premises and cloud-native environments, the company provides data protection, migration and disaster recovery to more than 2,000 companies worldwide.

HYCU said it will use the new funding to invest in go-to-market initiatives to meet increasing demand for its products. It will also launch a new developer-led SaaS service. The company also plans to expand widen alliances, product marketing and customer success teams.

Paul Pogba joins $50m Series B of Sharia-compliant investing app Wahed

Sharia-compliant ethical investing platform Wahed has received $50m in its Series B funding round as it plans to launch an ethical neobank.

The investment was led by Wa’ed Ventures, the venture capital division of Saudi Aramco Entrepreneurship Center. Its Series B was also backed by strategic family offices and institutions.

Former Manchester United Midfielder Paul Pogba also joined the funding round. As part of his investment, Pogba has become Wahed’s lead ambassador.

This funding round will help Wahed with its next growth phase, which includes the launch of an ethical neobank on its platform. This will allow its users to fulfil their banking and investing needs from a single app.

Israeli startup Jit inks huge $38.5m

Jit, an Israel-based firm looking to help developers simplify security during the development of cloud apps, has landed $38.5m in a seed round.

The company said its intent is to build a super simple and highly concise developer experience that makes owning security easy and effortless.

In a note following the funding announcement, Jit stated that its self-serve platform for open source and cloud security tools can provide a simplified way of bringing security into DevOps.

The company claims it will use the investment to speed up product development and expand its integration and support for open-source security controls.

WealthTech Narmi rakes in $35m from Series B

Narmi, a provider of open digital banking technologies, has raised $35m in a Series B financing raise.

Narmi claims it is one of the fastest growing companies servicing financial institutions in the US. The company offers an API-driven platform that grants financial institutions access to its products including consumer and business digital account openings, business digital banking and consumer digital banking and an administrator console.

Narmi plans to use the new funding to develop its digital banking solutions more broadly, partner with new financial institutions and accelerate the digital modernisation of the banking industry.

The firm also intends to ramp up hiring prior to the launching of its business account opening platform and further build out openness – a key product pillar. It will additionally plan to widen the reach of its business digital banking platform.

Danish RegTech Keepit locks up $22m in debt funding

Data protection platform Keepit has reportedly collected $22.5m in a debt financing facility as part of a partnership with Vaekstfonden, a Danish growth fund.

With the capital, Keepit plans to further its international expansion efforts, hire more staff and bolster its product development, according to a report from FinTech Finance News. Funds will also be used for strategic growth initiatives, such as cash runways ahead of other funding rounds.

Denmark-based Keepit protects SaaS data in cloud services like Microsoft 365, Azure Active Directory, Salesforce, Dynamics 365 and Google Workspace. Its services enable teams to easily meet compliance with GDPR and other data security regulations.

AirBank receives $20m Series A funding

Airbank, which stylises itself as the all-in-one finance management platform for business, has received $20m in its Series A round.

Funds have been earmarked to expand the Airbank team, invest into product and technical developments and expand into new markets.

Airbank has supported over €1.5bn in annualised transactions in the first six months after its launch.

Companies leveraging Airbank have a range of solutions, ranging from tracking cash flow and automating payments to handling expenses and accelerating accounting, at their disposal. The platform also offers instant insights into finances.

Siply secures $19m to serve India’s savers

Siply, a startup that has positioned itself as a micro-savings app for underserved Indians, has raised $19m in a pre-Series A funding round.

Founded in 2020 by Sousthav Chakrabarty and Anil Bhat, Siply offers individuals savings products on its app, including smallcase investing. The company also works with corporates to offer micro-loans to employees.

Siply will use this latest funding to achieve triple-digit Average Revenue Per User (ARPU) and to turn operationally cash-flow positive by the coming year by offering its solutions for specific savings instruments. It will also target acquisitions in the space.

Investment in India remains strong. Kuhoo, a platform providing digital student loans for the education of economically disadvantaged communities, was the largest FinTech seed deal in India in the first quarter of 2022, raising $19.8m.

NovoPayment scores $19m

NovoPayment, a Latina-founded banking-as-a-service provider, has scored $19m in its Series A funding round.

The FinTech company plans to increase its capabilities, release new features and functionalities, bolster security and capitalise on US market opportunities.

As part of its growth plans, NovoPayment will expand its network of partners, which currently sits at 60, to build more integrations that streamline the enablement of products and services via APIs.

Hiring efforts are also increasing, with the plan to add over 100 engineers, business development, and product experts to support growth and open hubs in Austin and San Francisco.

Finally, the FinTech company is looking to accelerate its growth in existing markets, with a focus on the US and countries in Latin America and the Caribbean.

GreyNoise scores $15m in Series A haul

GreyNoise Intelligence, a firm that specialises in threat intelligence, has landed $15m in a Series A round headed by Radian Capital.

Also taking part in the funding round were CRV, Inner Loop, Stone Mill Ventures and Paladin Capital. Since it launched in 2017, CyberTech GreyNoise has raised a total of $21m.

According to Security Week, GreyNoise markets technology and data to help security teams and SOC analysts to cut through the noise of excessive alerts. The company manages a global network of massive sensors that ‘listens to the internet’ and identifies IP addresses that are mass scanning and crawling the internet.

GreyNoise claims it plans to use the funding to expand its threat data collection capabilities and speed up go-to-market initiatives.

VEON backs Dastgyr for Pakistani e-commerce with $15m

Dastgyr, a Pakistan-based B2B e-commerce marketplace platform, has raised $15m in Series A funding led by VEON Ventures.

Dastgyr offers what it calls a “one-stop-shop” application to businesses that connects thousands of retailers with suppliers to give them access to teal-time visibility on pricing and financing rates. The platform’s partners have included Coca-Cola, Nestle, and Reckitt.

The backing from VEON Ventures represents the company’s largest investment to date in a Pakistani startup. Dastgyr said this reflects the growth of Pakistan’s digital economy.

Dastgyr will remain an independent entity, with a minority position being taken by VEON Ventures. The new investment round will support Dastgyr’s expansion into 15 new cities in Pakistan, alongside its existing network in Karachi, Lahore, Sialkot and Gujranwala.

Valkyrie Investments picks up $11.5m strategic investment

Valkyrie Investments, an investment manager focused on digital assets, has closed an $11.5m strategic investment round.

With the round closed, the FinTech company hopes to deepen its technology infrastructure and hire more staff.

Valkyrie Investments is an investment manager with eight protocol trusts, a DeFi hedge fund, three Nasdaq-traded ETFs and a protocol treasury management business.

The FinTech company recently surpassed $1bn in assets under management across all divisions.

CapIntel pulls in $11m to fuel US expansion

CapIntel, a FinTech that strives to improve day-to-day workflow and fund analysis for financial advisors, has raised $11m in Series A funding led by New York-based FinTech Collective.

The Canadian FinTech is on a mission to “elevate personal finance” and help families meet their financial goals. Its platform aims to help advisors provider a better service to their clients.

Following this latest round of funding, CapIntel said it plans to hire at least 150 new team members over the next two years, focused on building out the sales and product teams after the recent expansion into the US market.

CapIntel said its solutions solves two key challenges to advisors in the wealth management industry. The first is the necessity for advisors to focus on engaging and presenting investment solutions to clients, in addition to financial planning. Advisors’ ability to communicate recommendations efficiently and transparently to clients has become increasingly importing in building trust.

Clausematch concludes $10.8m strategic investment fund

RegTech firm Clausematch has closed a $10.8m strategic funding round headed by Lytical Ventures.

The funding round also saw participation from investors Flashpoint and Sony Innovation Fund.

According to Clausematch, the new financing will be used to boost the company’s commercial activities in the US and invest in its product, technology and data science teams. Following this round, the company has raised more than $20m.

The company claims its presence in North America has grown substantially since its participation in the New York-based FinTech Innovation Lab. With over 180,000 users, the firm has more than doubled its customer base in 2021 and counts several Tier 1 banks in North America and Europe as clients.

Real estate crowdfunding platform Foxstone scores $10m

Switzerland-based Foxstone, which offers a real estate crowdfunding platform, has reportedly raised CHF 10m ($10m) in its Series A.

Foxstone is a crowd investment platform for real estate, with everyone able to invest from as little as CHF 10,000 ($10,000). Through the co-ownership of properties, people earn quarterly returns to their bank account, with a full management report regarding the income and expenses of the property.

The daily management of the buildings are delegated to property management companies, which handle rent collections and building maintenance.

The report claims Foxstone hopes to consolidate its business in the German speaking part of Switzerland and implement tokenisation of real estate assets.

Automated coaching tech Cloverleaf pulls in $9m

Cloverleaf, an automated coaching technology that aims to “bring out the best in workers and teams”, has raised $9 in Series A funding.

Founded by CEO Darrin Murriner and COO Kirsten Moorefield, Cloverleaf is on a mission to help companies develop and retain staff and teams by “unleashing” their best work.

The platform leverages respected psychology data from behavioural assessment such as DISC and Enneagram and helps coach team members through communication and collaboration tools they use every day, such as Google Workplace, Slack, and Microsoft Teams.

The company said it will use this latest round to accelerate its mission through investing in product and technology, specifically the improve contextualisation and integration points, as well as to expand coaching content.

CyberTech startup RapidFort collects $8.5m

RapidFort, a software attack service optimisation platform, has reportedly collected $8.5m in its seed funding round.

Alongside the funding round, the CyberTech company has launched a free tier of its offering. The tier includes vulnerability scans, 20 containers each month, CI/CD templates, rapid risk scores, export reports and more. This version only has email support.

RapidFort automatically optimises containers and reduces vulnerabilities and patch management queues.

The platform profiles containers to understand what components are needed to run. It can then identify which packages are needed.

Some of the benefits of using RapidFort, according to its website, include reducing vulnerabilities to be remediated by 60% and 90%, reduce patch management backlogs by 90%, address compliance issues upstream, achieve compliance quicker, spend less time tracking licenses and updates, and more.

Indian InsurTech Pazcare raises $8m Series A

India-based employee benefits platform Pazcare has reportedly collected $8m in its Series A funding round, which was led by JAS Fund.

According to Fintrackr’s estimation, the funding round valued Pazcare at $48m.

Pazcare offers employee health insurance solutions, with policies include group health insurance, group personal accident insurance and group term life insurance.

It also offers curated wellness and health packages, which include mental wellness tools, virtual doctor consultations, regular health checkups, dental treatments, personalised fitness plans and more.

evolutionQ scores $5.5m Series A

Canada-based quantum-safe cybersecurity product developer evolutionQ has raised $5.5m in its Series A funding round.

This capital injection will help evolutionQ develop its products, expand its service offerings and boost its sales across Europe and North America. It also plans to hire staff and expand its German and Canadian teams.

Its flagship product BasejumpQDN is a quantum-safe software that allows organisations to build a network based on quantum key distribution devices to easily deploy and manage quantum technologies across their network.

Alongside building cybersecurity products that protect against quantum computers, it also supplies risk assessments to help clients better safeguard their digital infrastructure.

Request Finance collects $5.5m seed funding

Crypto payments startup Request Finance has closed its seed round on $5.5m, as it looks to capitalise on popularity of crypto.

With the funds, the company deepen its in-app services and hire more staff.

Request Finance simplifies and automates invoicing, expenses, payroll and accounting in crypto. Since its launch in January 2021, $203m in crypto invoices have been paid in the app.

Request Finance was spawned from the idea of giving businesses a better way to pay and be paid in crypto. The founders also felt that by solving a few serious issues, more businesses would start using cryptos. For example, making crypto payments by copy and pasting wallet addresses from a spreadsheet is not efficient and is prone to human error. Similarly, keeping proper financial record of crypto transactions was tricky.

Swoop scores £5.4m in Series A financing

Swoop, a one-stop money shop for companies, has bagged £5.4m in a Series A funding round.

The round included investment from VC firm Velocity, Arab Bank Ventures, WeHo Ventures and IAG.

Swoop claims that more than 75,000 firms have used its software platform to investigate and access a wide range of funding sources, including equity, grants, loans and tax credits. The company said it will have 80 staff by the end of this summer, up from 60 currently.

The funding will be used to speed up international expansion and help more companies to access an array of financing options. The announcement follows a surge in demand for SME financing, with revenues at the company forecast to increase by 450% this year.

Bits of Stock lands $4.4m in seed financing

Bits of Stock, a rewards platform that enables shoppers to automatically earn fractional shares, has bagged $4.4m in seed funding.

The Bits of Stock app is focused on replacing the traditional points, cashback programmes and loyalty with stock assets that can grow in value over time. Shoppers enrol a credit card in the company’s app to automatically begin earning fractional shares and crypto rewards for everyday purchases.

The company has also recently unveiled an API that enables clients such as neobanks and retailers to embed the rewards experience into their own apps.

With the new funding, Bits of Stock has claimed it wants to add over 200 more companies in the next year.

Webio reels in $4m from Series A

Webio, a conversational AI leader in the area of credit, collections and payments, has scored $4m in a Series A round led by Finch Capital.

Webio claims its technology has enabled UK and European firms to communicate conversationally with customers throughout their credit and collections journey. Customers are able to ask questions, change payment dates, or organise new repayment schedules, all done through conversational AI and automation.

The company said it is primed to scale-up following the digital shift during the pandemic and the uncertain economic climate to make difficult conversations about payments easy through their conversation AI.

Webio will use the capital to deepen its capabilities in conversational AI and additional digital offerings. They plan to triple the firm’s R&D team, expand its sales and marketing teams and expand its customer success teams to deal with UK and European market demand.

Opply pulls in $4m seed funding

Opply, an automated B2B supply chain platform, has raked in $4m in funding from a seed investment round.

Opply claims it revolutionises how SME food and beverage brands find, communicate and order from suppliers. It stated that it is the first personalised end-to-end supply platform that covers everything from sourcing to simplified workflows to payment systems.

The company said its technology uses AI to match brands with the right suppliers instantly. It focuses on the most innovative brands and suppliers, with the aim of becoming the leading platform and data leader in consumer goods innovation, powering anyone to start and scale their own successful brand.

Opply claims it will use the new funding to build out the engineering and commercial teams that will help deliver its go-to-market strategy on the back of work conducted under its pre-seed raise.

Quickpass Cybersecurity bags $3m

Quickpass Cybersecurity, a privileged access management (PAM) platform, has collected an additional $3m to bring its Series A round to $7m.

With the capital, Quickpass hopes to improve the security for managed service providers (MSPs) and their customers.

The CyberTech company offers PAM and help desk security automation. Its PAM platform empowers MSPs to rotate their privileged account passwords across AD and Azure AD, inject technician credentials into the most popular RMMs and enforce a zero standing privileges policy across all customers.

Its Help Desk solution automates the resolution of password reset tickets and leverages biometrics to identify who is calling the help desk. It currently has over 400 MSP partners, it said.

India’s HostBooks closes $3m Series A

India-based HostBooks has closed its Series A funding round on $3m, which was led by payment gateway Razorpay.

The capital will help HostBooks build new features to complement its order management, neo-banking, advanced inventory & production management and AI-based business decision making tools. Funds will also help the company build new products, including a deep learning-based business intelligence system and an AI-based posting and recommendation system.

Founded in 2017, HostBooks offers MSMEs and SMES a cloud-based financial platform with end-to-end solutions that cater to the full value chain of businesses and enable them to automate their business processes.

Its solution supports tax, electronic invoicing, POS, accounting banking, inventory management, order management, billing and invoicing, cash and bank management, business intelligence, payroll and more.

The platform aims to streamline and reduce business leakages by building intelligence into the routine business processes from sourcing/purchasing to invoicing, accounting and cash flow tracking.

Identity management platform ZITADEL collects $2.5m seed

Identity management platform ZITADEL has collected $2.5m in its seed funding round, which was led by Nexus Venture Partners.

ZITADEL was founded on the idea of a streamlined, cloud-native identity management platform that can accelerate time-to-market for software projects. Its system includes ready-to-use self-service features, customisable and secure logins, and more.

It claims that clients can quickly implement new authentication and authorisation systems, with easy-to-use integrations in multiple languages and frameworks.

Some of its new capabilities include multi-tenancy, unlimited audit trails, improved ability to self-host, and support for serverless deployments and more.

Monzo founder backs Mast in £1.2m funding round

Mast, a cloud-native mortgage origination platform, has raised £1.2m in a funding round headed by Antler VC.

Backers in the round included founders of Monzo, ThirdFort and Booking.com. Senior executives from Pivotal, VMWare, Airwallex, Jones Lang Lasalle and Thought Machine also took part.

Mast is building cloud-native mortgage technology infrastructure to help lenders increase capacity, reduce costs and strengthen operational controls.

The new funding will be used to enable Mast to continue the development of its customisable underwriting workflows tools and policy engine to help automate more of the origination journey.

Nigerian BNPL service CredPal raises backing from CASF

Nigerian FinTech buy now, pay later service CredPal has received an investment from the Cairo Angels Syndicate Fund (CASF).

This investment marks CASF’s first investment into Nigeria. CASF is an early-stage venture capital firm focused on the Middle East and Africa.

With the fresh funds, CredPal plans to expand across Africa, with a focus on Egypt, Kenya, Ghana and Cameroon.

CredPal, which launched in 2018, offers consumers a flexible payment option that spreads a payment across two to six months. There is also an option to pay in 30 days with 0% interest.

Severe weather protection InsurTech BirdsEyeView closes seed

InsurTech startup BirdsEyeView, which leverages satellite data for parametric solutions, has reportedly closed its seed round.

The capital was supplied by SFC Capital and the European Space Agency, according to a report from Business Cloud.

With the funds, the InsurTech company hopes to hire more staff, enhance its technology and more.

BirdsEyeView’s website claims it is still in stealth, with an announcement and updated website coming soon.

InsurTech AgencyKPI secures Series B funding

AgencyKPI, an InsurTech based in Austin that provides business intelligence platform for the insurance industry, has secured Series B funding.

In 2019, AgencyKPI emerged from stealth with $3m in seed and strategic-round funding raised from insurance networks, carriers, independent agencies, and C-level executives in the insurance industry.

The company’s platform is designed to address and manage the overabundance of data produced across the insurance industry, and aims to give insurance carriers, networks and independent agencies a deeper understanding of their data.

AgencyKPI said it will use the Series B capital to hire more software developers, data scientists and personnel to accelerate the development of cloud-based software that strengthens the ability of independent insurance agencies, insurance carriers, brokers and networks to assess data to “remain nimble and profitable.”

Genstar backs AmeriLife Group’s vision

AmeriLife Group, a provider of life and health insurance annuities and retirement planning solutions, has received an investment from Genstar Capital, a private equity firm.

Genstar will join AmeriLife’s current private investor, Thomas H. Lee Partners, as an equal investor.

AmeriLife’s mission is to provide insurance and retirement solutions to help people live longer, healthier lives across the US. For more than 50 years, the company has partnered with top insurance carriers to provide value and quality to customers served through a national distribution network of over 300,000 insurance agents and advisors, more than 50 marketing organisations and 50 insurance agency locations.

The partnership between the two private equity firms, AmeriLife said, is testament to its strong growth, and creates a strong foundation for continued nationwide expansion.

Copyright © 2022 FinTech Global