This week saw a strong 37 deals take place, which showcased the continued attraction of the InsurTech industry, with growing attention being paid to pet insurance, as well as continued investment in Blockchain & Crypto, despite predictions this could be about to burst.

This week was another week in which performance of the InsurTech industry remained steadfast, with a total of nine deals in the sector. Three of those made it in to the top ten: travel insurer Omio, with $80m, Ledger Investing with $75m, and Openly also raising $75m.

One area to be watching, is the pet insurance sector, which is increasingly attracting attention.

New York-based aptly named Pawlicy Advisor landed $12m in Series B funding this week, but other pet insurers are attracting capital too. Paris-based pet insurer Dalma also raised €15m in Series A funding recently, and Swedish pet insurer Lassie secured €11m in a Series A round.

In another notable deal this week, JAB Holding Company (JAB) entered into an agreement to acquire all of Fairfax’s interests in US-based Crum & Forster Pet Insurance Group, in a deal worth $1.4bn. The deal will see Fairfax, a financial holding company engaged in the provision of property and casualty insurance, receive $1.4bn in the form of $1.15bn cash and $250m in seller notes.

The move signified the value of the pet insurance market in the US. JAB’s combined global pet insurance and ecosystem will be estimated to have written premiums and pet health services revenues of over $1.2bn by 2023, insuring more than 1.2 million pets.

It seems the lonely pandemic months fuelled a rise in pet ownership, leading to the “pandemic puppy” trend. Research conducted by the Royal Veterinary College (RVC), revealed that 86% of owners who purchased their puppies between March 23 and December 31 in 2020 said their decision to become a pet parent had been influenced by the pandemic and having more free time.

The sector is not only attracting investor attention, but InsurTechs which did not previously offer pet insurance, are now eyeing up offering such products. Earlier this year for example, Lemonade expanded its pet insurance offering, and Revolut marked its entrance into the InsurTech industry with a pet insurance offering.

There were also a handful of notable deals in the cryptocurrency sector. Namely, BlockFi, whose mobile app lets user buy, sell and earn crypto, scored a $250m revolving line of credit. Digital asset platform FalconX also raised $150m in Series D funding, propelling it to an eye-watering $8.5bn valuation. Following closely behind, was Prime Trust, which claims it has become a category leader in infrastructure services for some of the world’s leading crypto exchanges on ramps, wallet apps, broker dealers, banks and ATSs RIAs. The company raised $107m in Series B funding.

The cryptocurrency and digital asset industry also saw deals at the lower end of the spectrum, as well as at the top. For example, System 9, a digital asset market-making firm focused on alt-coins, raised $5.7m from a Series A funding round.

However, research by FinTech Global’s analysts has suggested the crypto bubble could be about to burst; investors are hesitant to fully embrace the market.

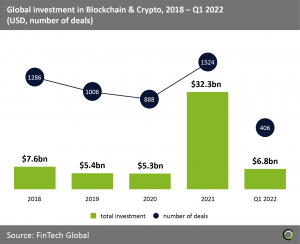

Although the first quarter of 2022 saw the highest number of deals closed than any prior quarter in the Blockchain & Crypto sector, there is reason to believe this will not last.

Current investment levels indicate that total investment will underperform 2021 by $5bn. This decrease is largely due to the sweeping drop in value across the digital asset market.

The overall market cap of crypto assets has dropped to less than $1tn from its November 2021 peak of $3tn. Bitcoin, the most frequently traded cryptocurrency has largely contributed to the drop in market value, having shed nearly 52% of its value year to date.

Other less frequently traded coins — better known as Altcoins — are experiencing similar rates of depreciation. The value of Avalanche and Waves, two of the most frequently traded Altcoins, has dropped 44% and 76%, respectively.

This week also saw three strong deals from companies recognising potential in the Asian markets.

Stashfin gained a place on the deal podium this week with the third biggest deal of $270m The Singapore-based neobank saw its valuation soar to between $700 and $800m as a result.

Launched in 2016 as a way to improve financial inclusion. Stashfin founder and chief executive Tushar Aggarwal explained that banks cannot afford to provide underserved individuals with cards due to high operational costs.

The neobank offers an all-in-one card, which lets users get quick access to personal loans, 1% cashback on online spending, flexible payment terms, and transparent pricing. Stashfin previously bagged $40m in a Series B extension back in April 2021.

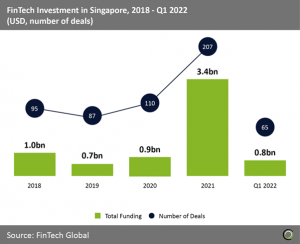

Singapore’s FinTech sector saw a nearly four-fold increase in funding last year driven by large deals, according to research by FinTech Global. While overall capital invested is on track to remain stable this year, a spike in deal activity in Q1 2022 indicates that 2022 will surpass last year’s levels to hit 260 in total.

Elsewhere in Asia, Vietnam-based digital investment platform Finhay raised $25m in a Series B round. Alongside the capital raise, Finhay also bolstered its market position with the acquisition of an unnamed securities brokerage. The firm claims this makes it the only licensed digital investment platform in Vietnam, which is suggestive of the vast potential to be had in the region.

Also gearing up for expansion in Asia, was India-based FinTech platform Finbox, which raised $15m in its Series A round. The company is now looking to expand into Vietnam, Indonesia and the Philippines. It also hopes to open an office in Mumbai and Hyderabad, adding to its current offices in Gurgaon and Bangalore.

Users of Finbox can find investments with the biggest upside through the stock screener tool that supports over 1,000 metrics. The user can then pick the best ideas from investment themes and portfolios of prominent investors and hedge funds.

Here are the 37 deals to keep an eye on this week.

SumUp bags €590m

Global payments platform SumUp has bagged €590m in a funding round that values the company at €8bn.

Bain Capital Tech Opportunities served as the lead investor, with commitments also coming from BlackRock, btov Partners, Centerbridge, Crestline, Fin Capital, and Sentinel Dome Partners, among others.

With the capital, the company plans to expand into new markets, seek value-add acquisitions, deepen its product ecosystem and more.

Founded in 2012, SumUp helps small merchants start, run and grow their business with fair, easy and reliable payment solutions. It supports in-person and remote payments seamlessly integrated with SumUp’s proprietary card terminals and point-of-sale registers.

Its Super App supplies merchants with a free business account and card, an online store, and an invoicing solution.

Stashfin bags $270m

Singapore-based neobank Stashfin has reportedly received $270m in a funding round comprising debt and equity.

The funding round, which values the neobank between $700m and $800m, was made up of $70m in equity and $200m in debt, according to a report from TechCrunch.

Uncorrelated Ventures, Abstract Ventures and Fassanara Capital served as the lead investors, with commitments also coming from Altara Ventures, Tencent, Kravis Investment Partners and Snow Leopard.

The neobank launched 2016 as a way to improve financial inclusion. Stashfin founder and chief executive Tushar Aggarwal explained that banks cannot afford to provide underserved individuals with cards due to high operational costs.

The neobank offers an all-in-one card, which lets users get quick access to personal loans, 1% cashback on online spending, flexible payment terms, and transparent pricing.

Stashfin previously bagged $40m in a Series B extension back in April 2021.

Crypto trading app BlockFi scores $250m

Cryptocurrency financial services platform BlockFi has scored a $250m revolving line of credit.

The credit facility was supplied by FTX, a cryptocurrency derivatives exchange.

This credit facility will help BlockFi bolster its balance sheet, underscoring long-term stability for the company.

Founded in 2017 by Zac Prince and Flori Marquez, BlockFi is building a bridge between cryptocurrencies and traditional financial and wealth management products to advance the overall digital asset ecosystem.

Its mobile app lets users buy, sell and earn crypto, with up to 1.5% back in cryptocurrency when making purchases with the BlockFi Rewards Visa Signature Card. It claims to have distributed over $15m in cryptocurrency rewards to date.

Other features include low-cost trading for leading cryptocurrencies, exclusive benefits for high net-worth clients and borrowing money at rates as low as 4.5% APR.

Personio pulls in extra $200m

Personio, a European HR software company for small and medium-sized businesses, has raised an additional $200m in its Series E round.

The funding brings the total capital raised through its Series E to $470m, valuing the company at $8.5bn.

Existing investor Greenoaks led the round.

Based in Munich, Berlin, Madrid, Barcelona, London, Dublin and Amsterdam, Personio’s mission is to make HR processes as transparent and efficient as possible. The company offers an all-in-one HR software that included human resources management, recruiting and payroll.

Personio said the funding will fuel the development of its People Workflow Automation solution, which is part of its vision to automate people processes across an organisation’s multiple departments and tools.

FalconX closes $150m Series D

Digital assets platform FalconX has soared to $8bn valuation after closing its Series D round on $150m.

GIC served as the lead investor, with contributions also coming from Thoma Bravo, Wellington Management, Adams Street Partners and Tiger Global Management.

FalconX is a digital asset platform that empowers institutions to access and manage all of their crypto strategies via a single interface and seamless workflows. Its platform collates trading, credit and clearing into a single location.

Its crypto-as-a-service offering powers banks, FinTech institutions and investment applications to easily add crypto to their product offerings with a goal of enabling one billion users to join the crypto world.

The FinTech company claims to have experienced its strongest quarter of customer onboarding in Q1 2022.

This funding round has more than doubled FalconX’s valuation after its Series C round in August. The company was valued at $3.75bn after a $210m Series C.

FalconX has raised over $430m in funding and is one of the most valuable crypto prime brokerages in the world, it claims.

Prime Trust lands $107m to expand into new verticals

Prime Trust, a provider of financial infrastructure for FinTech and digital asset innovators, has raised $107m in Series B funding.

Participating in the round were FIS, Fin Capital, Mercato Partners, Kraken Ventures, William Blair & Company, Decasonic, Commerce Ventures, University Growth Fund, Seven Peaks Ventures, Gaingels and GateCap Ventures.

To date, Prime Trust has raised over $170m since inception. The company claims it has become a category leader in infrastructure services for some of the world’s leading crypto exchanges on ramps, wallet apps, broker dealers, banks and ATSs RIAs.

Prime Trust will use the newly raised capital to continue investing in its products and services as well as its infrastructure to serve its global client base. The funding will help the business launch new products, enhance its ability to support tokenised products and increase investment in the stability and security of its platform.

Since its $64m Series A raise in July 2021, Prime Trust claims it has focused on making key hires, onboarding customers in new market segments, and creating better systems for maximum efficiency.

Personal finance app Cleo collects $80m for chatbot app

Financial management app Cleo has reportedly raised $80m in funding from Sofina, a Belgium-based investment firm.

The funding round has increased Cleo’s valuation fivefold to around $500m, according to a report from City A.M.

Funds from the round will help Cleo expand its services and hire more staff.

Cleo is a personal finance app and chatbot that helps users budget better, build credit and escape overdrafts. It has various tools to make savings much easier for people. For example, it enables automated savings, rounding spends to the nearest dollar and saving the change, setting goals, and putting fines in to help avoid unwanted spending.

Cleo previously raised $44m in its Series B funding round in December 2020. The capital was supplied by EQT Ventures, Balderton Capital, LocalGlobe and SBI.

Omio rides the global travel wave with $80m fresh funding

Omio, a ground transportation platform and travel insurer, has raised $80m amid surging travel.

The round saw participation from Lazard Asset Management, Stack Capital Group, NEA, Temasek, and funds managed by Goldman Sachs Asset Management, amongst others.

Omio said it has been investing in its product, inventory and core business over the last two years. The company recently launched a self-service desk to allow customers to alter and cancel bookings themselves.

The company also operates in the insurance space, it arranges travel insurance in several countries in collaboration with Allianz Global Assistance Europe. In 2019 it partnered with Setoo to improve travel insurance solutions, and last year it announced a partnership with Cover Genius to embed a ticket protection offering.

The funding, Omio said, will be used to reinitiate global expansion activities including mergers & acquisitions, and leveraging its transportation data and inventory by scaling its partnerships, which include Kayak, Huawei, LNER (London North Eastern Railway) and others. It will also be used to build out the company’s product and services, and invest in its talent and work towards sustainable profitability.

InsurTech startup Ledger Investing lands $75m

InsurTech startup Ledger Investing has raised $75m in Series B funding led by WestCap to democratise insurance risk capital.

The round also saw participation from Teacher’s Venture Growth and Intact Ventures, and previous investors, SignalFire, MassMutual Ventures, Allegis Capital and Accel.

Ledger Investing is a marketplace connecting insurance risk with capital. It claims to address the biggest challenges that have historically hampered innovation in the insurance and capital markets.

For example, according to Ledger, insurance capital is inefficient. It said that every other financial sector has successfully used securitisation to access large pools of capital and eliminate unnecessary frictional costs, making consumer credit, mortgages, real estate, and other streams of cash flows into investable asset classes; insurance is next.

The company has placed over $400m in premium into the capital markets, and said it is on track to exceed $1bn by the end of the year. Managing General Agents (MGAs) and insurance carriers have leveraged the marketplace for multi-year underwriting capacity and access to alternative capital.

Openly secures $75m

Openly, a technology-enabled provider of premium homeowners’ insurance through independent agents, has raised $75m in Series C funding.

The round involves a mix of current and new investors, including Advance Venture Partners, Clocktower Ventures, Obvious Ventures, Gradient Ventures, PJC Ventures, Techstars, and Mtech Capital.

Launched two years and a half years ago, Openly’s goal is to empower independent insurance agents to deliver a superior customer experience.

The company said its founders, Ty Harris and Matt Wielbut, saw a gap in the market: while consumers are increasingly buying home insurance through independent agents, the products those agents can offer have not kept up with what’s possible, resulting in wasted time, wasted money, and outdated risk underwriting.

Openly offers products in 19 states in the US through a network of over 17,000 independent insurance agents. Its technology is powered by algorithms, which the company said allows its rating models to provide more accurate coverage options.

The company said it will use the Series C capital to expand its home insurance product to more states and agencies, and to enhance its technology and product offering.

Playter collects $55m

B2B buy now pay later platform Playter has reportedly collected $55m in funding, which was mixed with debt and equity.

The funds were deployed by Adit Ventures, Fasanara Capital, Fin Capital, Act Venture Capital and 1818 Ventures, according to a report from TechCrunch.

It was not revealed what the split between debt and equity was.

This funding comes just months after PLayter’s seed round, which closed on $1.7m in March 2022.

Playter is a B2B BNPL platform that helps companies improve their cashflow by spreading payments across six to 12 months.

Accounting platform Autobooks scores $50m Series C

Payment and accounting platform Autobooks has collected $50m in its Series C funding round.

Macquarie Capital Principal Finance served as the lead investor, with commitment also coming from Baird Capital, Commerce Ventures, Draper Triangle, Mission OG and TD Bank.

Autobooks claims to be the leading embedded receivables platform for small businesses. Its platform supports digital invoices, payment acceptance and automated accounting directly within internet and mobile banking.

Over the past year, Autobooks has increased its bank deployments by 800% to reach 840 instals. The increase also enabled a 700% rise in small business customer adoption, with over 60,000 businesses now on the platform, it said.

INSTANDA bags $45m from Toscafund-backed funding round

INSTANDA, a no-code insurance platform provider and InsurTech100 company, has secured $45m in a funding round led by growth equity investment firm Toscafund.

The round also saw participation from existing investor Dale Ventures. According to INSTANDA, the funding will be used to grow the firm’s geographical presence in Europe, US, Japan and the United Arab Emirates.

Furthermore, INSTANDA will also look to rapidly augment platform capabilities including developing the existing ecosystem into a future-proofed marketplace.

Through INSTANDA, companies can now amend rates, questions, documents, customer journeys in minutes and new products can be launched in days and weeks. They claim return on investment is delivered in weeks via dramatically reduced product manufacturing, underwriting and distribution costs.

Last year, INSTANDA inked a partnership with digital consulting firm ADROSONIC to empower insurers to price risk better.

Germany-based investment API Upvest scores $42m

Germany-based investment API developer Upvest has reportedly collected $42m in its Series B funding round.

The capital injection was led by Bessemer Venture Partners, with commitments also coming from Earlybird, ABN AMRO Ventures, Notion Capital, Partech, 10x Group, Speedinvest and N26 co-founder Maximilian Tayenthal, according to a report from Sifted.

With the close of the round, the company plans to focus on European clients.

In addition to this, the company plans to grow its team to 150 people by the end of the year. It currently has 100 staff members.

Upvest has built an investment API that enables businesses to create innovative investment experiences for users and tailored to their needs.

It supports investments from as little as €1, with the option to make fractional orders in real-time. Users can create their own portfolios of stocks and ETFs, with crypto asset support coming soon.

Cyberint lands $40m to boost go-to-market efforts

Cyberint, a threat intelligence firm, has scored $40m in a financing round headed by StageOne Late Stage Arm.

Following this round, Cyberint has raked in $68m since it was founded. The company is competing in the attack surface management category.

Cyberint fuses threat intelligence with attack surface management, providing organisations with extensive integrated visibility into their external risk exposure. Leveraging autonomous discovery of all external-facing assets, coupled with open, deep & dark web intelligence, the solution allows cybersecurity teams to uncover their most relevant known and unknown digital risks earlier than usual.

The company currently has locations in Tel Aviv, New York, London and Singapore.

Cyberint said that the latest funding gives the company runway to build its technology that fuses threat intelligence with attack surface reconnaissance to help organisations manage external risk exposure.

The firm plans to use the funding on research and development and to ramp up go-to-market efforts by expanding sales and marketing teams.

B2B buy now, pay later service Hokodo collects $40m

B2B buy now, pay later service provider Hokodo has picked up $40m in funding as it looks to expand into new European markets and build new products.

Notion Capital led the funding round, with participation also coming from European investors Korelya Capital, Mundi Ventures and Opera Tech Ventures. Existing Hokodo backers Anthemis and Mosaic Ventures also joined the round.

It is currently exploring solutions for telesales and in-store purchases, as well as new verticals “currently underserved by payments companies.â€

The funding comes a year after its Series A, which closed on $12.5m in June 2021.

UK-based Hokodo offers buy now, pay later solutions to the B2B market, providing customers with instant, frictionless, interest-free payment terms.

UAE-based PropTech Huspy closes Series A

Huspy, an EMEA PropTech startup, has collected $37m in its Series A funding round, which was led by Sequoia Capital India.

Other commitments to the round came from Founders Fund and Fifth Wall, which made their first investment into a company in the Middle East. Chimera Capital, Breyer Capital, VentureFriends, COTU, Venture Souq and BY Venture Partners also joined the Series A.

This capital injection will help Huspy bolster its investment into technology development, push growth in the UAE and Spain, and expand across Europe.

Launched in 2020, Huspy aims to digitally transform and reimagine the home ownership journey.

Over the past two years, the company has reached $2bn in annualised GMV, growing at a pace of 25% month-over-month.

The PropTech platform provides real-time updates about mortgage applications, find multiple personalised offers from top UAE banks and complete the entire purchase process online. Users can also search for properties through the app.

Ghana-based FinTech Fido raises Series A round

Ghana-based FinTech company Fido has reportedly raised $30m in a Series A round, as well as an undisclosed amount in debt funding.

The capital injection was led by Israel-based investor Fortissimo Capital, according to a report from TechCrunch. Also joining the round was Yard Ventures.

Fido aims to empower individuals and entrepreneurs to capture financial opportunities. Its mobile app helps users quickly apply for loans.

Since its launch, Fido has distributed 1.5 million loans, with a total value exceeding $150m, to 340,000 customers.

Sustainability data platform ESG Book closes Series B

Sustainability data and technology company ESG Book has closed its Series B round on $25m, as it looks to respond to the growing demand of technology enabled ESG data solutions.

Energy Impact Partners, a global investment firm leading the transition to a sustainable future, served as the lead investor. Other commitments came from Meridiam and Allianz X.

This fresh capital has been earmarked to advance ESG Book’s next-generation technology capabilities to help clients meet increasingly complex sustainability requirements. It also hopes to bolster its expansion to meet rising customer demand and foster the adoption and expansion of its product suite.

ESG Book claims the ESG data and services market is expected to grow to $5bn by 2025.

The company’s cloud-based platform aims to make ESG data accessible, consistent and transparent so financial markets can allocate capital to more sustainable and higher impact assets.

It covers over 25,000 companies globally and enables companies to be custodians of their own data, giving them framework-neutral sustainability information in real-time, and promotes transparency.

Digital investment platform Finhay sweeps up $25m

Finhay, a Vietnamese digital investment platform, has secured $25m in a Series B round co-led by Openspace Ventures and VIG.

Also taking part in the round were TVS, Insignia, Headline, IVC and TNBAura. The company claims the new funding will be used to invest in business expansion, talent acquisition and tech development.

Founded in 2017, Finhay was created with the purpose of providing Vietnamese consumers with easy digital access to financial services. The company has already amassed more than 2.7 million registered users, making it the country’s leading digital investment platform.

In 2021, the company gained 150% more users following the launch of four new products: cash-wrapped accounts, gold trading, stock trading and a 12-month saving product.

Finhay has doubled its team size in the last 12 months, with 50 new employees joining the firm.

Application detection and response service RevealSecurity nets $23m

RevealSecurity, an application detection and response solution, has reportedly closed its Series A funding round on $23m.

With the capital, RevealSecurity plans to bolster its global expansion and product development efforts, according to a report from PYMNTS.

RevealSecurity helps detect malicious insiders and imposters by monitoring user journeys in enterprise applications. Its platform aims to reduce the number of false positives and false negatives.

Rivet pulls in $20.5m in Series B raise

Rivet, a healthcare billing platform, has scored $20.5m in a Series B round led by Catalyst Investors.

The round also saw participation from Ankona Capital, Menlo Ventures, Lux Capital and Pelion Venture Partners.

Established in 2018, Rivet’s revenue cycle operating platform is used by healthcare providers across the US to collect what they are owed from payers and bring greater price transparency to patients.

Rivet currently offers three software products, which are patient cost estimates, underpayment detection workflow and denials appeal management.

According to Rivet, the newly raised capital will be used to build out its team and continue investing in the platform.

India-based FinTech FinBox scores $15m

India-based FinTech platform FinBox has reportedly collected $15m in its Series A, as it gears up for expansion across Southeast Asia.

A91 Partners served as the lead investor, with commitments also coming from Aditya Birla Ventures, Flipkart Ventures and Arali Ventures, according to a report from TechinAsia.

This capital injection will help FinBox expand into Vietnam, Indonesia and the Philippines. It also hopes to open an office in Mumbai and Hyderabad, adding to its current offices in Gurgaon and Bangalore.

FinBox hopes to double its team of 85 by the end of the year.

The FinTech company claims to be the toolbox that outsmarts the market.

Users can find investments with the biggest upside through the stock screener tool that supports over 1,000 metrics. The user can then pick the best ideas from investment themes and portfolios of prominent investors and hedge funds.

Additionally, users can track stocks through intelligent watchlists and customisable views that show specific metrics.

With the close of the round, the company has raised a total of $60m in funding.

Laka nets $13.5m

Bicycle insurance startup Laka has netted $13.5m in its Series A funding round as it gears up for European expansion.

Autotech Ventures served as the lead investor, with commitments also coming from Ponooc, a Dutch sustainable mobility investor, and ABN AMRO.

Porsche Ventures, Creandum, LocalGlobe, 1818 Ventures and Elkstone Partners also joined the round.

The company claims to be in a unique position and first-to-market with no major European player currently supporting the cycling and e-mobility insurance space.

Laka is looking to expand its product suite to include e-scooters, e-mopeds and, eventually, e-cars. It is also expanding to cover commercial fleets across Europe.

Laka is exploring opportunities with the Porsche Ventures portfolio.

It is initially partnering with German cycling brand Cyklaer to offer new and existing customers with digital insurance products.

The InsurTech company offers collective insurance policies for cyclists. It protects delivery fleet riders, cyclists, e-cargo bike drivers and commuters.

Its policies do not have a fixed monthly charge. Instead, premiums are calculated based on the cost of claims that month. This means payments could drop if no one claims. Maximum contributions are capped.

Pawlicy Advisor lands $12m for pet insurance education

Pet insurance marketplace Pawlicy Advisor, has raised $12m in Series B funding and expanded into veterinary corporate groups in an effort to transform pet insurance education.

The round was led by StepStone Group, with participation from Defy Partners, Rho Ignition, Slow Ventures, and ERA’s Remarkable Ventures Fund. This brings the company’s total funds raised to approximately $20m.

Pawlicy Advisor offers personalised pet insurance comparisons based on breed-specific attributed and total cost predictions for the lifetime of the pet. Pawlicy Advisor said its data-driven model brings transparency and simplicity to shopping across top pet insurance providers.

The company said it will use the capital to further serve the veterinary community, grow its pet insurance marketplace

The company said this latest round of funding builds on its growth. In February 2021, Pawlicy raised $6.5m in a Series A round. The company has also recently partnered with consumer financial services company Synchrony to help consumers better plan for expenses regarding their pet.

Digital gratuity software Kickfin picks up $11m

Gratuity management software Kickfin has picked up $11m in its seed round.

Silverton Partners, a Texas-based early-stage venture capital firm, served as the lead investor. Acronym Venture Capital also joined the round.

Launched in 2017, Kickfin eliminates the operational burdens of cash tips for hospitality outlets. Its software sends cashless tips to the employee’s bank of choice in real-time.

Kickfin claims that by digitising tip payouts and distributing them in real-time, employers can eliminate bank runs, reduce theft and human error, and streamline reporting.

Its services are used by Marco’s Pizza, Twin Peaks, Melting Pot, Walk-On’s Sports Bistreaux and Sport Clips.

According to data by Visa, Kickfin was ranked number one in transaction count and volume for tip disbursements in 2021.

Banyan lands $8.2m for sustainable investments

Banyan, an investment facilitator for sustainable infrastructure headquartered in San Francisco, has raised $8.2m in Series A funding, seeing the company valued at $47m.

The round was led by VoLo Earth Ventures with several notable venture capital firms joining the round.

Banyan said that despite the advances in availability of asset and financial data, investing in sustainable infrastructure remains a largely manual and inefficient set of processes relying heavily on spreadsheets and disconnected systems.

The company’s platform for project finance and sustainable infrastructure teams, sets out to tackle this issue by providing online checklists and scorecards, approval-based workflow automation, APIs to existing data sources, a centralised data vault to complement existing virtual datarooms, and a self-service client portal.

Since its inception, Banyan has helped to deploy and manage over $1bn of capital towards sustainable infrastructure developments. However, set against the backdrop of rising climate concerns, as well as a more concerted global effort by major institutions and nation states to address environmental challenges, the demand for such projects continues to rise.

Banyan said the funding will enable it to further scale its market engine and enhance the support its able to offer its customers.

Artificial Labs pulls in £9.5m for better underwriting

Artificial Labs, an insurance software company that provides an algorithmic underwriting platform, has raised £9.5m in Series A funding.

The round was led by Force Over Mass Capital with participation from existing and new investors, including Mundi Ventures, No.9 and MS&AD Ventures.

Artificial Labs said its technology enables an insurer to accept, refer or decline submissions based not only on the characteristics of a risk, but also its value in relation to a target portfolio.

The company’s platform can be integrated with brokers and insurers on any data set, system or application, normalising data and allowing underwriters to either approve or decline risks in seconds and therefore free them up to focus on high-value decision making.

Some of the company’s strategic partnerships include global insurers and brokers such as Convex, Chaucer, Aon, AXIS, and Ed Broking.

System 9 rakes in $5.7m Series A

System 9, a digital asset market-making firm focused on alt-coins, has raised $5.7m from a Series A funding round.

Investors in the round included Capital6 Eagle, Kronos Asset Management, C2 Ventures, Ascendex Ventures, Gate Ventures and a range of other blockchain investors.

Founded in 2017, System 9 claims it is market-maker for the crypto altcoin market and stated that it ‘has built an impressive team’ and is ‘deeply immersed’ in the crypto ecosystem.

The firm works with token issuers to build liquidity in their tokens adding stability and price discovery that may have not existed prior to market maker engagement.

The newly raised capital of System 9 will be used to further scale its technology infrastructure and business operations supporting its market-making, as well as to expand its service offerings.

CalTier opens Series A funding round on $5m

CalTier, a FinTech crowdfunding platform, has launched its Series A round of funding at $5m.

According to FinTech Finance, the recent round will help CalTier improve its platform, offer additional services and expand its widening investor community.

CalTier CEO and founder Matt Belcher said, “We are really excited about the growth of the company and our mission to give as many people as possible access to these historically hard to reach investments. This next round of funding will help us improve our platform and get the CalTier service out to the masses.”

DeepTech firm Cosmian bags $4.4m

Cosmian, a company that specialises in encryption, has scored $4.4m from a funding round led by La Banque Postale.

The round also saw participation from previous investor Elaia Partners. Following this round, Cosmian has raised a total of $5.9m since inception.

According to Security Week, Cosmian provides privacy-by-default solutions that are easy to deploy and can protect data, algorithms and applications in the cloud. The company’s platform keeps data encrypted even when in use to ensure continuous protection.

Cosmian, which currently has 20 employees, plans to use the newly raised capital to expand its team.

Future Fund bags $3.8m from private sale round

Future Fund, a company building a blockchain micro-investment platform, has pocketed $3.8m from a private sale round.

Future Fund is building the micro-investment platform that will be fuelled by cashback rewards – credit or debit card bonuses that refund cardholders small percentages of the amounts spent on purchases.

Funds gathered by customers through cashback rewards will be collected in individual accounts on the Future Fund platform and then invested by a specialised investment fund.

Future Fund claims that further funding rounds are planned for the second half of this year. Currently, the business is developing an MVP app, building its community, and creating a network of partnerships required to create a fully operational Future Fund ecosystem.

CyberTech firm Binarly pockets $3.6m seed funding

Binarly, a CyberTech firm seeking to address ongoing security failures in the firmware supply chain, has landed $3.6m in seed financing.

The round was backed by Westwave Capital and Acrobator Ventures. A range of angel investors also took part in the round.

Binarly has built a SaaS platform for analysing, understanding and responding to silent, currently undetectable security threats at the firmware layer. Through a combination of machine learning and deep code inspection, Binarly enables security teams to have visibility into hardware and firmware failures and a simple way to recover from sophisticated attacks.

The company has also developed its own technology for vulnerability management and protecting the firmware supply chain from repeatable failures. Binarly’s approach uses semantic properties of the binary code to improve detection accuracy by limiting the number of false positives.

French PayTech Formance rakes in $3.1m

Formance, a company that offers companies a low-code template for tracking payment flows, has reeled in $3.1m in funding.

The round saw participation from Hoxton Ventures, Frst, Y Combinator and a range of different business angels.

Established in 2021, Formaance provides pre-built, fully customisable use-case templates to help users to track payment flows between pay-ins and payouts.

According to Finextra, the package, which features an open-source modelling language and ledger and a library of pre-built use cases, is designed to help companies keep track of increasing volumes of money flows and pivot to take advantage of new opportunities as they arise.

Formance is currently piloting its package with an undisclosed FinTech and claims it plans to use the new funds to chase up a number of pipeline prospects among SMEs and marketplace businesses.

Allthenticate closes $3m seed for mission to destroy passwords

Allthenticate, a unified authentication and access control startup, has bagged $3m in seed funding as it hopes to rid the world of passwords.

Silverton Partners, an early-stage venture capital firm, served as the lead investor. Contributions also came from Amplify and Ping Identity.

With the funds, the company hopes to expand its engineering efforts and commercial operations. It will also create strategic partnerships and integrations.

Allthenticate’s mission is to “make security products that are fun, easy to use, and ridiculously secure.”

Its current services enable organisations to use their smartphones to unlock and log in to everything, including computers, websites, servers and even doors. Its technology improves security infrastructure and visibility into the organisation.

The company’s core technology, which was developed at MIT, removes single points of failure and distributes trust across the ecosystem, it claims. Each user has full control of their cryptographic keys, which are securely stored in their phone;s hardware, and each organization controls their own small piece of the network.

AI FinTech Aveni snares £2.75m funding

Aveni.ai, a Scottish AI FinTech firm, has raised £2.75m in a funding round headed by The TRICAPITAL Syndicate and Par Equity.

There was also participation from Scottish Enterprise. The company’s product ,Aveni Detect, uses the latest advances in AI and Natural Language Processing – to draw intelligence and automate processes directly from the customer voice and other communication channels.

Aveni claims this allows companies to achieve greater efficiencies in quality assurance while significantly improving client experience, sales performance, staff training and the ability to identify vulnerable customers.

According to Aveni, the investment will speed up Aveni’s growth and see it move beyond financial services into other regulated industries such as utilities while also building a team to support rapid UK expansion.

review and transforming the management of regulatory and reputational risk.

Zero-knowledge data security platform Bunkyr collects $1m

Bunkyr, a zero-knowledge security API developer, has collected $1m in pre-seed funding to support the development and delivery of its products.

The round was supported by Y Combinator, Soma Capital, Protocol Labs, seasoned entrepreneur Justin Kan, as well as several others.

The CyberTech company offers easy-to-integrate APIs that provide reliable, secure and familiar recovery options for cryptocurrency wallets and other encrypted applications.

The first challenge the platform wanted to solve is what happens to data when a password Is forgotten or access to an authorised device is lost. This data is still there, and the service provider simply restores access once identity is verified. However, this leaves service providers at risk of losing data to attackers.

The current solution to this problem is that the service you are using never has access to the data, with it either stored encrypted or stored on a user’s device. However, if the device or password are lost, the data is gone forever.

Bunkyr offers a unique service to fix this challenge through its API’s which are powered by cryptographic hardware. It helps keep data invisible to end users with a simple sign-in through a social login provider (Google, Apple, Facebook), protecting people against data breaches and lost passwords.

Bunkyr recently launched its public API documentation and is currently getting feedback from customers through its pilot program.

Copyright © 2022 FinTech Global