UK FinTech giant Revout has launched its first hardware device as it moves into the in-person payment solution market.

Its Revolut Reader solution will be available in the UK and Ireland. This product is a lightweight card reader that lets merchants of all kinds accept payments anywhere, whether their business is in-person or on-the-go.

The Fintech company claims payments will become as easy as cash with the Revolut Reader solution. It accepts instant and secure transactions made through debit and credit cards, as well as contactless payments.

It can be adapted to other POS systems already in place.

Revolut product owner acquiring Maria Garcia Marti said, “When designing new products, our team always has customer needs in mind: a fast and easy to use solution that will not slow business down, easy access to funds, and receiving payments faster than the industry standard of 2-3 business days.

“Plus, the security and long battery-life of a small pocket-sized device, capable of streamlining operations without the need to manage multiple accounts and systems. This is exactly what Revolut Reader is offering our business customers: really tap into business growth.”

The product has a 0.8% + £/€0.02 per transaction fee and a one-off cost or customised pricing for the business dealing with high volumes.

Last month, Revolut announced it was planning to launch its services into five new markets. Its app will soon be available in Sri Lanka, Chile, Ecuador, Azerbaijan and Oman.

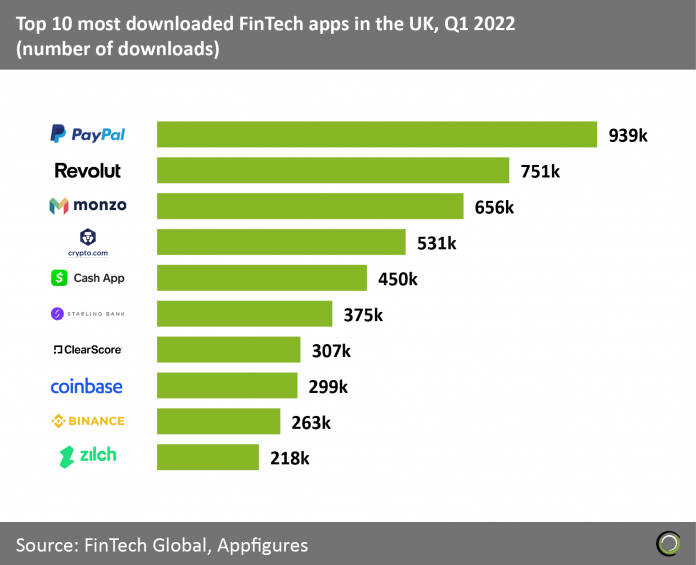

In the first quarter of 2022, Revolut was the second most downloaded FinTech app.

Copyright © 2022 FinTech Global

Copyright © 2022 FinTech Global