This week the FinTech sector ticked along with a humble 32 deals taking place across a range of sectors. Insurance however, is having a moment, with six funding rounds being closed in total in the sector.

This week’s top deals were led by UK-based companies Sonovate and YuLife. Sonnovate develops embedded finance and payment solutions for the contingent workforce, aiming to simplify contract management, freelance worker placement and payment. The company landed £165m in a securitisation deal made with BNP Paribas and M&G Investments.

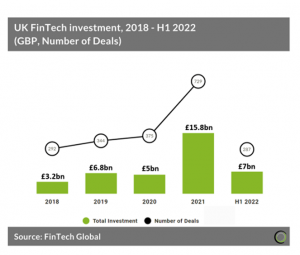

UK-based YuLife, a life insurance InsurTech, raised $120m. It is positive to see the two largest deals coming from UK companies, as research from FinTech Global has predicted that funding in the region is on track to decline by 12% in 2022.

UK FinTech investment is set to reach £14bn in 2022 based on the rate of investment in the first half of the year, a slight 12% decrease from 2021 which set a new investment record with £15.8bn.

FinTech deal activity in the country during the first half of the year reached 287 transactions in total and is on track to reach 584 for the whole year which would be a 21% decrease from last year.

The WealthTech sector was the most dominant FinTech sector in the UK for the first half of 2022 with 57 deals, a 19% share of total deals. The Blockchain & Crypto sector was second with a 17% share and PayTech was third with a 14% share.

It is safe to say InsurTech stole the show in this week’s deals, with six deals taking place in the sector. In addition to YuLife, these include the client experience platform Glovebox, Indonesian InsurTech Rey Assurance, which describes itself as “the pioneer of a new age of insurance in Indonesia,” and Paris-based InsurTech Orus which is on a mission to reinvent professional business insurance.

Here are the deals that took place this week.

Payment solution for on-demand workers Sonovate closes £165m securitisation deal

Sonovate, a developer of embedded finance and payment solutions for the contingent workforce, has bagged £165m in a securitisation deal.

This deal was made with BNP Paribas and M&G Investments, with the latter deploying £15m into the round.

The firms hope the capital will help Sonovate lend over £1.3bn in invoices this year. Sonovate expects to fund £2bn in invoices in 2023.

As a result of the securitisation, Sonovate will increase its capital efficiency and expand its customer base, especially in the enterprise space. It will also deliver added flexibility for export financing.

Since it was launched in 2014, the company has funded more than £2.75bn in invoices. Last year, the company recorded a 58% YoY increase in total funding.

The FinTech company provides the on-demand workforce with embedded finance and payment solutions. It serves recruitment businesses, consultancies and labour marketplaces that engage contractors and freelancers across the world.

Its API-driven technology aims to simplify contract management, freelance worker placement and payment.

YuLife rakes in $120m from Series C raise

YuLife, an InsurTech firm, has raised $120m from a Series C funding round headed by Dai-ichi Life Insurance Company.

According to Finextra, YuLife’s life insurance offering enables policyholders to complete everyday wellness activities in order to earn YuCoin, which they can use to buy gifts for themselves, friends or family, or to donate to charity.

The company claims that over a third of YuLife customers engage with the company every single day, compared to once a year for the average insurer. The firm now covers more than 500,000 policyholders across small to large businesses, with over $50bn of cover in place.

Yulife will use the funding to broaden its reach into new global markets and scale its product range.

Flexe pulls in $119m to boost logistics resilience

Flexe, the programmatic logistics leader, has raised $119m in Series D funding at a $1bn post-money valuation.

The round also included investment from BlackRock and follow-on investment from Activate Capital, Madrona Ventures, Prologis Ventures, Redpoint Ventures, funds and accounts advised by T. Rowe Price Associates, Inc. and T. Rowe Price Investment Management, Inc. and Tiger Global.

By integrating technology, open logistics networks, and elastic economic models, Flexe aims to solve the hardest omnichannel logistics problems for the world’s largest retailers and brands.

Founded in 2013, the company said it has recently seen accelerated demand for its logistics programmes. An uncertain macroeconomic environment, rapidly shifting consumer behaviours, forecast variability and supply chain gridlocks have led retailers and brands to strategically embrace logistics flexibility.

CyberTech Swimlane pulls in $70m Series C

Swimlane, a security automation startup, has raised $70m in a Series C funding round headed by Activate Capital.

The round also saw participation from Energy Impact Partners and 3Lines Venture Capital. Following this round, Swimlane has raised a total of $170m since inception.

Colorado-based Swimlane claims it is the leader in cloud-scale, low-code security automation. The company offers an automation platform that unifies security operations and helps companies address security workflows across their environments.

The firm said its Turbine platform relies on low-code security automation to capture telemetry and combine it with human logic to transform it into actionable intelligence that can help speed up incident response.

Swimlane says its Turbine platform relies on low-code security automation to capture telemetry and combine it with human logic to transform it into actionable intelligence that can help accelerate incident response.

Swimlane plans to use the new capital to speed up growth and operations worldwide and to invest in platform innovations.

UAE-based digital bank YAP collects funding ahead

UAE-based digital bank YAP has reportedly collected $41m in fresh funding, with plans to expand into Saudi Arabia.

The capital injection was backed by Aljazira Capital, Abu Dawood Group, Astra Group and Audacia Capital, according to a report from Reuters.

YAP is looking to raise another $20m to support the expansion plans.

The digital bank is eyeing expansion into Saudi Arabia, Egypt, Pakistan and Ghana. YAP is already being piloted in Pakistan and Ghana, with plans to launch in the markets by the end of the year.

YAP is a financial services app and debit card, which provides consumers with a suite of digital banking tools. Banking services are provided by Rakbank.

Through the app, users can access granular analysis to monitor their spending by category and merchant. It also allows users to freeze the card, simplify bill payments, and receive real-time notifications on spending.

The company has a number of financial services packages coming soon. One of these is YAP Young, which lets users create a digital banking YAP account for kids to help boost their financial education.

Personal tax platform April closes Series A

Personal tax platform April has closed its Series A funding round on $30m.

The capital injection was supported by QED, Nyca Partners, Team8, Euclidean Capital and Atento Capital. Also joining the round was Treasury, a FinTech infrastructure focused fund established by the founders of Betterment and Acorns.

Capital from the round will help April bolster its research and development capabilities and increase operational capacity in preparation for next tax season.

April, which officially launched in January 2022, was co-founded by former Deloitte FinTech strategist Ben Borodach and Daniel Marcous, the former CTO of the navigation startup Waze. The company has now grown to a team of 30.

The company’s tax engine helps FinTechs perform tax calculations throughout the year, as data emerges. By embedding directly into a user’s banking app or website, April can proactively fill most information needed for tax filing, saving users time and money.

Since its launch earlier in the year, April has already served thousands of American taxpayers through partnerships with several financial institutions. It claims to help a user file their tax information in an average of 15 minutes.

Oxbury backs British farmers with additional £20m raise

Oxbury, an agricultural bank that lends to farmers, has raised £20m in funding following its £31m Series C funding round in March this year.

The extra funding takes Oxbury’s total capital raised to £68m, having only just opened its doors to customers in February 2021, a report by AltFi revealed.

The round saw participation from Frontier Agriculture and Hutchinsons Group, along with the bank’s existing investors Hambro Perks and Grosvenor Food & AgTech.

In January last year, FinTech Global reported that the agriculture-focused challenger bank secures £25m in new funding, as it prepared for its launch a month later.

Oxbury calls itself a champion of British agriculture, as it exclusively lends to farmers and the rural economy. The bank said this means farmers have access to the specialised lending they need to run their farm. Individuals and businesses can hold accounts with the bank that simultaneous boost their own savings and support British farmers.

Nigerian FinTech Moove gets backing from BII

Nigerian FinTech Moove has secured $20m from British International Investment (BII), the UK governments Development Finance Institution (DFI).

Moove is on a mission to mobilise capital and build self-sufficiency and market resilience in Nigeria, as well as improving access to inclusive economic opportunities whilst helping to catalyse the country’s boundless entrepreneurial ambition.

The company does this by democratising access to vehicle ownership and empower mobility entrepreneurs. It provides vehicle financing for cars, bikes and lorries to mobility entrepreneurs.

The FinTech has also become the first business to qualify for BII’s BOLD (Black Ownership and Leadership Development) and 2X qualifications, which are both geared towards establishing a more inclusive approach towards investing.

Ladi Delano, co-founder and co-CEO at Moove, said, “We’re incredibly proud to welcome onboard a world-class partner such as BII, whose strategic support will play a key role in our mission to build the world’s largest integrated vehicle financing platform for mobility entrepreneurs.

“With our new funding, we are now in an even stronger position to use our technology and productivity data in creating a more inclusive financing ecosystem, whilst also tackling the unemployment problem affecting over a third of Nigerians by generating the opportunity for more seamless and sustainable employment.”

Iceland-based Lucinity scores $17m to bolster its anti-fraud services

Lucinity, which supplies banks with productivity tools to fight financial crime, has closed its Series B funding round on $17m.

Keen Venture Partners served as the lead backer, with commitments also coming from Crowberry Capital, Karma Ventures and byFounders.

Lucinity is on a mission to “Make Money Good” by leveraging human AI. Through its user-centric compliance systems, which are augmented by AI, Lucinity claims to have helped banks and FinTech increase compliance productivity by 50%.

Based in Iceland, Lucinity offers an AML software that learns from each interaction and continues to improve, providing fewer false positives and saving time.

The FinTech company recently signed a partnership with Experian and Seon. It is providing credit reporting company Experian with know your business and risk assessment tools. While it is providing risk scoring solution Seon with AML and fraud prevention services.

Accounts receivable management platform Tesorio closes Series B

Tesorio, an accounts receivable management platform, has scored $17m in its Series B funding round, which was led by BAMCAP Ventures.

Other commitments came from existing investors Madrona Venture Group, First Round Capital, Floodgate, FundersClub, Hillsven, Mango Capital and Xplorer Capital. Susan and Anne Wojcicki and Carao Ventures also joined the round, making their first investments into Tesorio.

With the funds, the company hopes to expand its go-to-market efforts with new leadership staff. One of these is its new chief sales officer Mark Bartlett, who has over 20 years sales experience at Concur, BlackLine, SAP and Navis.

This investment comes after a third consecutive year of triple-digit revenue growth. It claims that companies manage over $23bn in invoices a year with Tesorio.

The company enables customers to turn their revenue into cash. Accounts receivable teams at companies like Slack, Box, Veeva Systems, Twilio and Domo leverage Tesorio to connect to their ERP and CRM in minutes.

Tesorio’s platform offers collection automation, a comprehensive collections dashboard, customisable dunning, dynamic workplace functionality and streamlined payments.

BKN301 rakes in €15m Series A financing

BKN301, a startup in the payments and BaaS space, has bagged €15m in a Series A funding round headed by Abalone Group.

The round also saw participation from Azimut Digitech Fund, GNB Swiss Investments, CRIF and PayU. Following this round, BKN301 is valued at €63m.

BKN301 enables third parties to offer financial, payment and token issuance services. Currently, the firm is

BaaS provider Griffin closes $15.5m round

Banking-as-a-service platform Griffin has raised $15.5m in fresh funding to support the launch of the operating system for embedded finance.

Notion Capital led the round, with capital also coming from EQT Ventures, and several angel investors, including Plaid co-founder William Hockey Wise VP of Growth Nilan Peiris, Liberis CEO Rob Straathof and Mollie CEO Shane Happach.

Alongside the investment, Notion Capital co-founder and managing partner Stephen Chandler has joined the Griffin board of directors.

The fresh funds will help Griffin grow its leadership and operational teams and continue to build its core banking platform.

It also said it is keen to protect the company culture as it scales, stating that its culture is based on trust, kindness and transparency and underpins its goal of becoming the bank for builders and innovators.

Griffin previously raised $6.5m in funding back in November 2020 and since then it has tripled in size.

The company is building a full-stack vertically integrated banking-as-a-service platform.

Its services include, compliance-as-a-service, business banking, banking infrastructure, payment tools and credit solutions.

Finalis bags $10.7m from seed raise

Finalis, a private securities brokerage technology platform, has raised $10.7m in a seed funding round.

The round was backed by investors including Ulu Ventures, Animo Ventures, Tribe Capital, The Fund and Chaac Ventures.

Founded in 2020, Finalis has developed the Finalis Hub, which is an integrated private securities brokerage technology platform. The company claims it already manages billions in deal volume and has over 700 active mandates in market and supports over 150 investment banks and placement agencies across the US.

The company introduced a marketplace earlier this year that enables dealmakers on the hub to promote deal collaboration and execution with other dealmakers in real time.

The proceeds from the funding raise will be used by the company for technology development and expansion overseas.

MarketWolf bags $10m from Series A

MarketWolf, a FinTech stock trading platform, has raised $10m from a Series A fundraise led by Jungle Ventures and Dream Capital.

Exisiting investors in the round include 9Unicorns, iSeed, Riverwalk and Crescent. This brings the total raised by the company to $17.4m.

To date, MarketWolf has over 1.5m app downloads in India in the last 18 months. The app aims to make the trading experience as easy and jargon-free as possible while ensuring protection against market volatility through its robust in-built risk management system, practice and learn modules and low-ticket size investment options.

MarketWolf intends to use the newly raised capital to build out its product suite and to hire top talent across product, marketing and engineering functions.

Singapore-based CyberTech watchTowr collects pre-Series A

Singapore-based cybersecurity platform watchTowr has collected $8m for its pre-Series A funding round.

Prosus Ventures and Vulcan Capital served as the co-lead investors to the round.

With the capital injection, the company hopes to enhance its technology and capitalise on growth opportunities in Southeast Asia.

watchTowr, which launched its services in late 2021, provides organisations with a continuous, real-time view of their external attack surface “through the eyes of an attacker”. By pairing technology and cybersecurity experts, it claims to give companies the ability to find their vulnerabilities.

Its services are used by companies in the banking, insurance, technology and e-commerce sectors.

Raylo raises €7.5m for the “responsible evolution” of BNPL

Raylo, a London-based subscription payment platform, has raised €7.5m.

According to a report by EU Startups, the round included a strategic investment from Wayra UK, as well as existing investors Octopus Ventures and Macquarie.

Raylo’s mission it to make products more accessible in a way that’s better for consumers, better for business and better for the environment.

The company’s platform can stand alone or sit alongside a merchants traditional buy now, pay later (BNPL) options.

Raylo Pay adds a subscription option to a merchants’ checkout, the merchant gets paid upfront by the company, and Raylo collects the monthly subscription from the consumers, hence carrying the risk.

This method, according to the company, is ideally suited to larger ticket items. Whereas the more well-known BNPL model, whereby consumers usually pay in three installments, offered by the likes of Klarna and Zilch are most popular for small and mid-sized purchased in fashion and beauty retailers

Stablecoined-settled trading platform Thalex closes funding

Thalex, which offers stablecoin-settled crypto options and future, has closed its Series A on €7.5m.

The round was backed by Bitfinex, Bitstamp, Flow Traders, IMC, QCP and Wintermute.

These funds will help Thalex support its mission of enabling on-exchange trading of crypto derivatives at scale by removing friction.

Some of the key features of the Thalex trading platform include linear BTC and ETH contracts with multi-collateral support, anchored trading fees, future rolls with dedicated order books and RFQs for multi-leg options and futures strategies, in any size.

The company is also partnering with Bitfinex and Bitstamp to enable their customers to access the full suite of Thalex derivatives from their own user interface. Positions on Thalex can be opened with collateral held with the partner exchange after an instant and free transfer to a dedicated Thalex margin account.

Adaptive secures $7.25m to handle financial admin of construction companies

Adaptive, a startup on a mission to save construction teams time and money, has raised $7.25m in a seed round led by Andreessen Horowitz (a16z).

“We started Adaptive to save construction teams time and money and to help them grow,” the company said in a statement on its website. It does this by automated bills, invoicing and reporting, powered by artificial intelligence.

According to the company, actively managing cash flow is paramount to building a big, profitable business in construction, however this is easier said than done. In part this is due to the fact that construction companies have a lot of costs, and so need to manage hundreds of bills.

Adaptive said most construction companies manage this process manually, involving a combination of email, shared files, spreadsheets, and clunky accounting software. This takes up time and can lead to mistakes.

By tapping into artificial intelligence and document scanning technology, Adaptive is looking to eliminate the majority of the day-to-day manual data entry and provide real-time financial reporting.

Small business payment management solution Finli scores $6m

Payment management platform Finli has collected $6m in its seed funding round, which was led by Urban Innovation Fund.

Motley Fool Ventures, M13, Alumni Ventures also joined the round, as did all Finli’s existing backers.

With the capital, Finli plans to expand its team and business banking capabilities.

The US Small Business Administration Office of Advocacy states that 99.9% of US businesses are small businesses. However, Finli claims existing banking and administrative platforms are not built for small businesses, many of whom are using five or more services to manage client billing and payments.

Finli’s platform was designed for businesses to manage all aspects of invoicing and payments communications, letting them use familiar tools and customers to easily pay outstanding invoices through their mobile devices.

Small businesses can use the platform to send invoices, search customer information, create recurring invoices and check payment status.

UK-based PropTech startup Hammock swoops up $5.5m

UK-based PropTech platform Hammock has reportedly raised $5.5m in fresh funding, as it strengthens its market position with landlords and accountants.

The investment was led by Fuel Ventures, a UK-based seed venture capital firm, according to a report from Tech Funding News. Other backers included Second Century Ventures and Ascension Ventures.

Hammock is a property financing platform for UK landlords, which has the aim of removing stress from the process.

Through the platform, users can connect multiple bank accounts so they can track all payments in real-time. It also boasts real-time bookkeeping services, such as automated reconciliation of rent payments and property expenses, and tax tools.

GloveBox secures $5.5m for its insurance client experience platform

GloveBox, a client experience platform for insurance agents and carriers, has raised $5.5m in Series A funding.

The round was led by Panoramic Ventures with follow-on participation from Heffernan Insurance Brokers and a top tier insurance carrier.

Founded in 2019, Denver-based GloveBox provides a platform that delivers a self-service mobile and web app for policyholders, a reactive dashboard for agencies, and a robust system full of carrier and agency management system integrations. The company said the digital experience is greatly enhanced between all three stakeholders: policyholder, agency, and carrier.

GloveBox considers itself the insurance industry’s only client experience platform.

The company said it will use the new funding to further build out its technology which focuses on helping the independent insurance channel attract and retain customers more effectively and efficiently.

Ranger lands seed fund for “agent first” offering

According to a report from TechCrunch, the round was led by Lerer Hippeau, with participation from Alex Rodriguez, FirstMinute Capital, Slow Ventures, Global Founders Capital, Raven1 Ventures and Montauk Ventures.

Ranger was founded by Philip Krim, ex CEO of Casper, and its CEO Greg Garrison, an insurance veteran with 15 years of experience. The company aims to lift up the agents in the insurance industry by providing them will tools to respond more quickly to customers, generate better leads, maximise cross-sell to other products and personalise client services.

By centring agents in the process, Ranger believes this will allow them to do the selling instead of spending on marketing.

The company will launch in the autumn of 2022 with a home insurance offering and acting as an MGA.

Accounts Payable company Xelix lands $5m

Xelix, a London-based accounts payable FinTech that is looking to transform finance departments, has raised $5m in Series A funding.

The round was led by FINTOP Capital, with participation from its existing investors Passion Capital and LocalGlobal.

Xelix’s products suite comprises three modules and re-designed core accounts payable processes. This includes Xelix Protect, a machine learning payment audit to identify high risk transactions, Xelix Supplier Statement Reconciliation, an automated workflow to ensure accounting accuracy and compliance, and Xelix Insight, a self-service business intelligence tool enabling rapid insights from payables data.

Paris InsurTech Orus lands €5m for business insurance

Paris-based InsurTech Orus has raised €5m in funding for its mission of reinventing professional insurance.

The round saw participation from Frst, Partech, Portage Ventures and around twenty angel investors, including Pierre-Olivier Desaulle (ex-CEO of Hiscox Europe), Rapha Vullierme (CEO of Luko), Christophe Triquet (ex-founder of MeilleurAssurance) and Arthur Waller (CEO of Pennylane).

Founded in 2021, Orus’ goal is to enable professionals to develop their business with complete peace of mind, without spending too much time on administration, namely, obtaining insurance.

The InsurTech said whilst the activity of professionals and the tools at their disposal have been able to transform to make this as seamless as possible, the same cannot unfortunately be said of their insurance, which has not really evolved.

According to Orus, this is because traditional insurers generally consider that companies are too small to be able to create tailor-made products, adapted to each activity.

Orus however, offers products tailored to each sector of activity, accessible 100% online. Its first offer for example is aimed at restaurant owners.

Sydney startup Upcover secures $4.7m for SMB insurance

Sydney-based insurance startup Upcover has raised $4.7m in a seed funding round to further its mission to simplify insurance for Australian small businesses.

Business News Australia revealed that the funding comprises $2.7m equity and $2m debt.

The round saw support from early-stage venture capital firms Antler Australia and Betterlabs, as well as QBE Insurance general manager Patricia Priest, Etika CFO Raf Uy, Bricks and Agent co-founder and CEO Rafael Niesten, and Global Life APAC ex-CEO Colin Morgan.

Upcover was founded by Anish Sinha and Skye Theodorou in 2019, with a vision to transform the small business insurance landscape in Australia by changing how the small businesses, startups and independent contractors working with enterprises and on-demand platforms protect themselves.

The platform empowers any online business, brand or marketplace to become distributors of insurance products.

Having recently launched four new insurance products, Upcover has reportedly experience significant growth, growing 20% month-on-month on insurance premiums and policies underwritten.

Upcover will use the capital on customer acquisition and product development for the technology platform.

Indonesian InsurTech Rey Assurance rakes in $4.2m

Rey Assurance, an Indonesia-based integrated health, life and critical illness InsurTech, has raised $4.2m in seed funding.

The round saw participation from Trans-Pacific Technology Fund (TPTF), Genesia Ventures, and RDS.

Headquartered in Jakarta, Rey describes itself as “the pioneer of a new age of insurance in Indonesia.”

The InsurTech said it has redesigned the end-to-end insurance value chain by blending its technology platform, including AI, big data analytics, and cashless claim payments, with its proprietary health, life and critical illness insurance policies bundled into subscription-based offers for individuals and groups.

Alongside the fresh funding, Rey is launching a suite of outpatient and inpatient products that have received approval from the Indonesian insurance regulator, Otoritas Jasa Keuangan (OJK).

The products will enable Rey’s members to personalised service with the level of cover that best matches their needs. Rey’s products are linked to the company’s proprietary cashless claims system, so this also eliminates the tedious admission and discharging process at all healthcare providers.

Rey said the funding will advance its digital health products and technology platform.

Streamlined invoicing service Peakflo bags seed funding

Peakflo, which develops automation software to streamline invoicing, has nabbed $4.1m in its seed round.

Commitments to the round came from Y Combinator, Rebel Fund, Amino Capital, Soma Capital, GMO Fintech Fund, CE Fintech Capital, GFC and EF. Several angel investors also joined the round, including Oliver Jung, Amrish Rau, Alexander Kudlich and XA network.

The FinTech company launched in 2021 and provides businesses with a unified workspace with integrations and automated workflows that streamline invoice collections and bill payments.

Its services are currently used by 50 startups and mid-sized companies in Southeast Asia. Peakflo claims these clients have been able to be paid faster by up to 20% and cut bill pay times in half.

The platform enables teams to create purchase quotes and streamline approval processes before sending to the vendor. It also automatically captures invoice details.

InsurTech startup Konsileo closes Series A

Commercial insurance broker and risk management adviser Konsileo has closed its Series A on £4.7m.

This investment was led by existing Konsileo backer Growth Tech VC Committed Capital. The firm deployed £3.23m into the Series A.

The remaining £900,000 came from UK-based venture firm ACF Investors and unnamed angel investors.

Konsileo, which doubled in size during 2021, plans to use the funds to accelerate the hiring of insurance brokers and bolster the development of its technology.

The InsurTech company has built a proprietary broking platform with built-in compliance checks and policy administration that frees brokers from unnecessary repetitive tasks.

South Korean crypto trading app League of Traders closes pre-Series A

South Korea-based social trading platform League of Traders has closed its pre-Series A funding round on $2.4m.

The capital injection was led by C3 VC Fund, a Frankfurt-based venture capital firm. Other commitments came from Mirana Ventures, the Venture Partner of Bybit and Cadenza Capital Management.

With the backing, the FinTech company hopes to expand its user offerings and improve current copy trading features, with new features on the horizon.

Founded in 2019, the company attempts to encourage novices to engage in crypto trading by letting them copy the portfolio and trades of more advanced traders. Its app also offers a competitive side, with users able to compete in trading leagues, with cash prizes given to the leaders.

South Korea’s government recently revealed plans to enforce all-inclusive regulations for the digital currency industry in 2024. The aim is to strengthen investor confidence. The government will also review the Bank of Korea Act that introduces issuing a central bank digital currency under the plan.

UK gets first regulated stablecoin after blackfridge launches poundtoken

Isle of Man-based FinTech company blackfridge has secured its pre-Series A as it launches the first British-regulated stablecoin.

blackfridge plans to launch the poundtoken, which is fully backed by 1:1 by pound sterling.

The size of the investment was not disclosed, but the capital was supplied by FunFair Ventures and Gate Ventures. Alongside its investment, FunFair will supply blackfridge with blockchain technology expertise, as well as commercial, marketing, event, and corporate support.

Gate Ventures will also support bloackfridge by listing the poundtoken on its exchange Gate.io. It will also help with PR activities to support growth.

Another funding round is planned for later in the year.

Poundtoken is designed to allow international transactions 24/7, without delays or costly fees. It guarantees holders that they can redeem their currency for GDP at any moment.

It was recently announced that Circle Internet Financial, the issuer of the USD Coin dollar-pegged stablecoin, is set to introduce a new stablecoin backed by the single European currency.

Swedish bill splitting app Steven exceeds crowdfunding target

Bill splitting app Steven has closed its crowdfunding campaign above its initial target of €600,000.

The company raised €752,960 via Crowdcube, with 496 investors deploying funds into Steven.

Its round was a convertible, which means it will convert at a 20% discount to a new financing round or on the sale of the company with a valuation cap of €15m. Otherwise conversion will happen at a valuation of €9m.

Steven tracks costs shared between friends and family, and on a mission to become the number one solution for controlling personal finances in Sweden. It claims to have 165,000 users, with over 100,000 expenses shared in the app each month.

The company’s goal is to reach over 250,000 users by the end of the year and to expand into new markets.

To support its growth, Steven recently launched a new card in collaboration with Mastercard. Anything that is purchased with the card is automatically added to the app, reducing the number of steps to add an expense.

The FinTech company recently signed a partnership with embedded FinTech firm Minna Technologies. Through the deal, Steven users will be able to identify and manage their subscription-based costs, with the ability to cancel and manage recurring expenses through the app.

TikTok inspired investing app Zeed closes funds ahead of launch

TikTok inspired investment platform Zeed has secured a £205,000 pre-seed investment to help produce exclusive content.

The funding round was led by SFC Capital, a UK-based early-stage investment firm.

With the capital, Zeed plans to hire more staff and bolster its product.

Zeed was co-founded by Salman Hussain and Rohan Regmi, Imperial College London and UCL graduates, respectively. Whilst at university, they built Finance-Focused, a 5,000+ member community for early careers in the financial services industry.

A survey of Finance-Focused found that 87% of its members, the majority of which were Gen Z, felt that a lack of access to information prevented them from making an investment. It also found that their preferred way to ingest information was through short videos. This led to the creation of Zeed.

The FinTech company claims that one in three Gen Z individuals learn about personal finance through TikTok and YouTube. They are also five-times more likely to make an investment decision based on what they see on social media.

Zeed’s mobile app, which will launch later this month, will enable users to watch educational video content on investment trends and general financial knowledge.

In the future, the company plans to allow users to invest directly in UK and US equities in a TikTok-style feed.

Copyright © 2022 FinTech Global