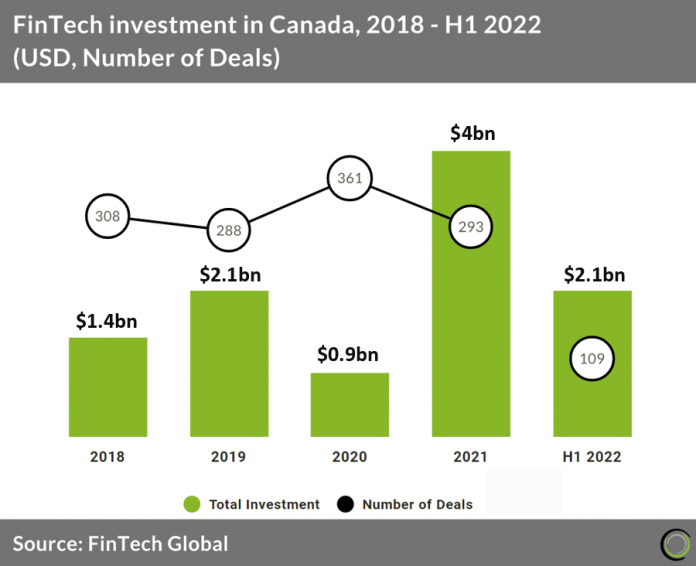

• Canadian FinTech companies raised $0.21bn in the second quarter of 2022, an 89% reduction from Q1 2022, however, large deals that bolstered Q1 2022 total investment have not occurred in the second quarter. Total Investment in 2022 is still expected to surpass 2021 levels by 5% based on H1 2022 results.

• 1 password, a password management platform, was the largest Canadian FinTech deal in H1 2022 raising a huge $620m in January. The largest deal in Q2 2022 came from Delphia, an investment platform that provides Wall Street-calibre algorithms, which raised $60m in their latest Series A funding round led by Multicoin Capital. Delphia stated that the funding will enable us to share our algorithmic breakthroughs with anyone willing to contribute data or dollars, no matter how big or small.

• Canada recently announced their first artificial intelligence (AI) legislation which could directly impact FinTech companies. The Digital Charter Implementation Act was introduced in June 2022 and if passed will affect the design, development, use, and provision of AI systems. The legislation also enables Canada to audit and request information and records about an AI system.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global