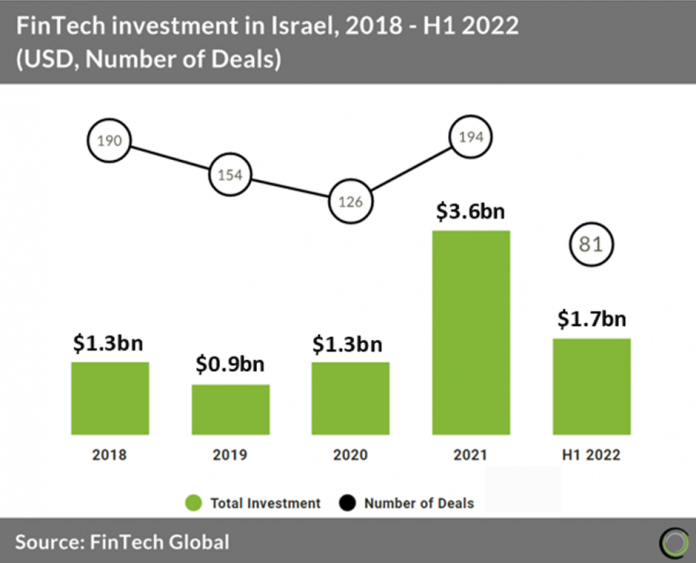

• Israeli FinTech investment is on track to reach $3.4bn in 2022, based on the first half of 2022, which would yield a 5.5% drop from 2021 levels. Israeli FinTech has resisted the global 24% drop in FinTech investment from Q1 to Q2 2022 instead increasing by 7.6% due to its dominating CyberTech industry. Deal activity in the country is expected to fall slightly in 2022 to 162 deals in total, a 17% drop from 2021.

• CyberTech was the most active sector in Israel accounting for 40% of the deals in H1 2022 and WealthTech was the second most active sector accounting for 10% of total deal activity in the first six months. Global CyberTech deal activity is expected to rise 7.4% based on Q1 2022 results and Israel is poised to benefit accounting for 8.5% of these deals.

• Cheq, a Go-to-Market Security platform, was the largest Israeli FinTech deal in H1 2022 raising a sizeable $150m in its latest Series C funding round led by Tiger Global Management. The company said that the new funding will be used to expand its R&D, and sales and marketing teams. CHEQ is used by over 50,000 websites worldwide and the company aims to nearly triple its growth in 2022 across its key markets in North America, EMEA and APAC.

Check out Nordic Fintech investment in H1 2022 here

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global