IBISA, an Agri-InsurTech on a mission to provide innovative weather protection insurance, has raised seed funding.

A report by Entrepreneur revealed that the capital was raised from Ankur Capital, an early-stage venture capital fund focused on transformative technologies in deeptech and climate tech.

Founded in 2019, IBISA began operations in India to provide parametric insurance against drought coverage in Tamil Nadu.

Now, the company is scaling its operations in India with operations in Odisha, Karnataka, and Telangana for coverage against excess rainfall and wind speed and drought.

IBISA builds, distributes and operates climate insurance solutions for agriculture in a cost-efficient, scalable and innovative way. Configurable Weather Parametric insurance with affordable premiums and rapid payouts sit in a digitalised, transparent platform.

According to some reports, 70% of the global food supply comes from smallholder farmers and more than 50% of the Indian workforce is into agriculture and allied sectors that contribute to just 20% of India’s GDP.

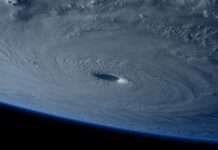

With climate-change related extreme weather events occurring more frequently and more unpredictably, smallholder farmers are more vulnerable than ever. Although insurance solutions are available, it is often argued that these are not adequate because they are not affordable or sufficient to the farmers’ needs.

Ritu Verma, partner at Ankur Capital, said, “The unavailability of data has hampered the growth of the agricultural insurance industry in developing countries for decades. Legacy crop insurance involved long manual processes making them impractical for developing markets where smallholder farming is the norm, and parametric insurance has historically been unviable due to the lack of detailed climate-related datasets.

“We are excited to partner with IBISA to transform the scale of available parametric insurance options in countries like India with a vast addressable market.”

At the end of last year, IBISA raised €1.5m in a seed round led by InsurTech Gateway. Other strategic co-investors also participated in the round, including Rockstart’s AgriFood fund.

Copyright © 2022 FinTech Global