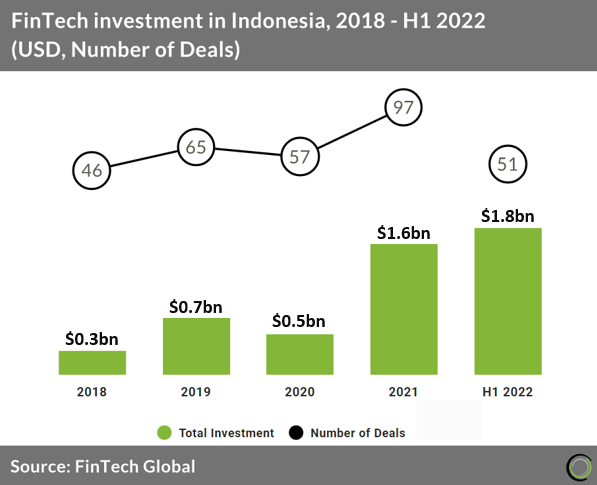

• FinTech investment in Indonesia is expected to reach $3.6bn in 2022 based on investment in the first half of the year. This is in contrast to global FinTech investment trends which point to a significant fall in funding this year, based on a 24% drop from Q1 to Q2 2022. Deal activity in the country is also expected to increase slightly by 5% reaching 102 deals in 2022. The Marketplace Lending sector was the most active in Indonesia in H1 2022 with 15 deals, a 29% share of total deals.

• Xendit, a single integration payment gateway, was the largest deal in H1 2022 raising a huge $300m in their latest Series D funding, led by Coatue and Insight Partners and intends to use the funds to expand operations and its business reach. In 2021 the company tripled annualized transactions from 65m to 200m and increased total payments value from $6.5bn to $15bn. It now serves more than 3,000 customers. Xendit is also making strategic investments that serve startups and SMEs in Southeast Asian countries.

• Indonesian FinTech regulation is regulated mainly by two authorities, Bank Indonesia and the Financial Services Authority (OJK). In 2017 Bank Indonesia announced their first regulation which included a regulatory sandbox as a limited trial place to test FinTech Providers’ technologies, services, products, and/or business models.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global