A total of $866m was invested into the FinTech sector in a relatively slow week, with just 24 deals completed.

The top ten deals were responsible for $803m of the capital raised by the sector this week.

Companies from the USA dominated the biggest deals of the week, with six companies from the country in the top ten. These were Alma, Solid, Boopos, Alloy, Fairmatic and Spectral. The rest of the top ten were from Denmark (Moneyflow), EarlySalary (India), Lightnet (Thailand) and Brazil (Caju Benefícios).

As for the most active sector, it was a mixed week for the top ten. There were two infrastructure and enterprise software companies, two marketplace lending, and two InsurTech companies in the top ten. The rest of the top list was composed of a company from each of the RegTech, PayTech, WealthTech and blockchain sectors.

Moneyflow raised the biggest round of the week, pulling in €250m in a debt financing round from banking-as-a-service provider Aion Bank. The company is using the funds to accelerate the deployment of its embedded finance service.

With the concerns of the financial sector, and some of the high-profile FinTech companies, such as Klarna, struggling, it is no surprise the total funding this week is not as high as it has been previously.

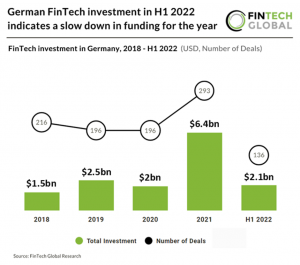

FinTech Global has released a couple of research pieces this week that have highlighted the trouble some markets have seen. For example, German FinTech investment in H1 2022 totalled $2.1bn in 136 deals. This is a 34% drop from 2021 levels.

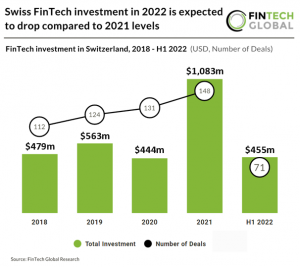

Similarly, Swiss FinTech funding is expected to drop this year. In the first six months of the year, a total of $455m has been invested through 71 deals. This means it is on track to drop 16% from last year, where a total of $1bn was raised through 148 deals in the whole of 2021.

Similarly, Swiss FinTech funding is expected to drop this year. In the first six months of the year, a total of $455m has been invested through 71 deals. This means it is on track to drop 16% from last year, where a total of $1bn was raised through 148 deals in the whole of 2021.

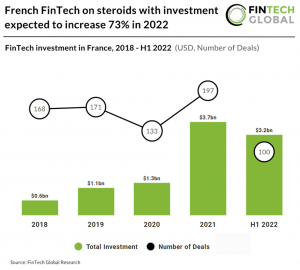

However, not all markets are seeing their FinTech funding levels stall. France has had a stellar start to the year. In the first half of 2022 a total of $3.2bn has been raised through 100 deals. This is already near the amount it raised in the whole of 2021, with the year closing with $3.7bn raised through 197 deals.

However, not all markets are seeing their FinTech funding levels stall. France has had a stellar start to the year. In the first half of 2022 a total of $3.2bn has been raised through 100 deals. This is already near the amount it raised in the whole of 2021, with the year closing with $3.7bn raised through 197 deals.

One of the companies to feature in the ten biggest deals this week was Caju Benefícios. The WealthTech platform, which offers a flexible benefits management platform, secured $25m from a Series B funding round.

One of the companies to feature in the ten biggest deals this week was Caju Benefícios. The WealthTech platform, which offers a flexible benefits management platform, secured $25m from a Series B funding round.

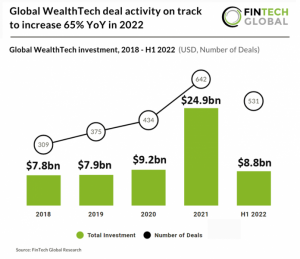

WealthTech is having a strong year. Based on the first half of the year, deal activity is on track to increase by 65%, compared to 2021. However, funding levels are a little lower, with just $8.8bn having been raised in the first six months – a total of $24.9bn was raised in the whole of 2021.

FinTech Global recently spoke to WealthTech leaders on whether no-code technology will be the future of the sector. Put simply, Stefan Willebrand, founder and CEO of SaaS financial services platform Bricknode, said “As with most things there is no silver bullet.” Willebrand stated it all depends on the problem that needs to be solved.

FinTech Global recently spoke to WealthTech leaders on whether no-code technology will be the future of the sector. Put simply, Stefan Willebrand, founder and CEO of SaaS financial services platform Bricknode, said “As with most things there is no silver bullet.” Willebrand stated it all depends on the problem that needs to be solved.

“I have always liked to combine working with no-code platforms with building my own custom components through coding. If you are only using no-code solutions, you will have a hard time creating unique experiences so I think that there are only so many shortcuts that you can take.”

Here are the 24 funding rounds to close this week.

Moneyflow secures €250m ($250m) debt financing

Danish FinTech Moneyflow has raised €250m in a debt financing agreement with banking-as-a-service provider Aion Bank.

According to Silicon Canals, Moneyflow and Aion Bank also intend to extend their cooperation into additional markets. Aion and Vodeno – its technology partner – will provide a number of banking services to Moneyflow.

Moneyflow provdes SMEs invoice funding and revenue funding within their current workflow platform, allowing brands to expand the offering. The company claims it has developed the most advanced underwriting engine on the market with advanced risk and payment predictions.

The company said it will use the funds to accelerate the roll-out of its embedded finance services across platform partners in the Nordics and broader Europe.

InsurTech Alma pulls in $130m from Thoma Bravo-led Series D

Alma, a membership-based network that helps mental health care providers accept insurance and build private practices, has scored $130m in a Series D.

The round was headed by Thoma Bravo and saw participation from Cigna Ventures, Insight Partners, Optum Ventures, Primary Venture Partners, Sound Ventures and Tusk Venture Partners.

Following this recent raise, Alma has raised a total of $220m since it was founded back in 2018.

Alma claims it helps providers meet the rising demand for mental health care by giving them the support and infrastructure they need to accept insurance and run their small businesses.

When providers join Alma, they secure access to insurance support, telepathy software, automated billing and scheduling tools and a community of clinicians that come together for education, training and events.

Over the last year, the firm has scaled its network over 3X to 8,000 mental health providers that are licensed in all 50 US states.

India’s largest lending FinTech EarlySalary raises $110m

EarlySalary, which claims to be India’s largest lending FinTech, has bagged $110m for its Series D round, which was led by TPG’s The Rise Fund and Norwest Venture Partners.

Other commitments came from existing investor Piramal Capital and Housing Finance Limited.

Founded in 2015, the lending FinTech provides financial solutions of up to INR 50,000 ($628) to working professionals. It recently expanded into the affordability segment and released buy now, pay later services to customers. It is focused on education, health and consumer product financing. It currently serves 150 cities.

EarlySalary’s mission is to give young and aspirational individuals a financial ecosystem. It stated that 80% of Indians use banking services, however, almost 50% of the Indian population doesn’t have access to credit due to various reasons. EarlySalary aims to be the safe and reliable credit platform to the underserved population in tier three and four cities.

With the capital, EarlySalary hopes to expand its BNPL segment and build an extensive network of partners across the healthcare and edtech segments.

FTV Capital backs Solid in $63m Series B

Solid, a FinTech-as-a-service platform that offers infrastructure to launch and scale FinTech products, has bagged $63m from a Series A round.

The round was led by FTV Capital and also saw participation from existing investor firm Headline.

FinTech programs that build and launch on Solid own the experience and have little or no regulatory overhead. The company said integration is a light technical lift – a matter of calling modern APIs and a few lines of code – facilitating speed to market.

Some of Solid’s programs include established FinTechs such as Plate IQ and Paystand and Shifl and Everflow. Startups such as Lumanu and Starlight have also been involved.

The company has recorded 10X growth in revenue, transactions and customer base over the last year, which has sped up the company’s path to profitability.

Lending platform Boopos raises $58m

Miami-based lending platform Boopos has reportedly raised $58m in its Series A round, composed of debt and equity.

The investment has $8m in equity and $50m in debt, according to a report from TechCrunch.

Bonsai Partners served as the lead investor. Fasanara Capital, which led Boopos’ $30m seed round, also joined the Series A, along with Noa Capital Partners, K Fund and Actyus.

The debt line will ensure Boopos will have the funds to lend. The equity will help Boopos hire more staff, with the plan to double its team of 25 over the next 12 months.

Boopos also plans to launch a mobile app, which is described as a business owner dashboard. It will allow users to explore and decide what businesses to buy and when a decision is made, they can add the business into their portfolio. Here they can view how the business is doing in terms of revenue and how the debt is going down.

While the specific numbers were not given, Boopos’s valuation is doubling from its seed round, and revenue has grown by between 30% and 50% month-over-month since late 2021.

The lending platform was founded in 2020 by Garcia Braschi to help business owners that use acquisitions as a way to grow their companies. These small business acquisitions often fail to qualify for bank financing, he said, which is where Boopos helps.

According to the TechCrunch report, Boopos qualifies buyers through an application and their LinkedIn profiles to ensure they have the risk skills and track record to succeed in business ownership.

It claims it can underwrite online businesses in under 48 hours.

Alloy lands $52m in funding haul

Alloy, a US firm that has developed an operating system that helps FinTechs and banks make fraud, credit, and compliance decisions, has raised $52m.

The round was led by Lightspeed Venture Partners and Avenir Growth and saw participation from Bessemer Venture Partners, Felicis Ventures, Avid Ventures and Canapi Ventures. Following the raise, Alloy has raised $1.55bn since inception.

According to Finextra, over 300 companies use Alloy’s API-based platform to connect to more than 160 data sources, automate identity decisions during account orgination, and monitor them on an ongoing basis.

Alloy claims it will use the funding for a global expansion taking in 40 countries across North America, EMEA, Asia Pacific and Latin America.

Lightnet bags $50m for its cross-border remittance infrastructure

The Lightnet Group, which develops cross-border remittance infrastructure, has secured a $50m capital commitment from LDA Capital.

With the funds, the FinTech company plans to w its infrastructure and operations, and expand its technological partner’s (Velo Labs Technology) blockchain technology. The capital will also help facilitate web 3.0 payment and blockchain ledger-based remittance services focused across Asia Pacific and globally.

Lightnet also has the option to increase the investment to a total commitment of up to $100m over the next three years.

Headquartered in Singapore, Lightnet is aimed at improving the lives of the unbanked and underbanked populations throughout Asia Pacific through advancement in cross-border remittance infrastructure.

With its partner Velo Labs, the company hopes to establish the first real-time blockchain settlement flow for remittance and payments between Money Transfer Operators and banking institutions under regulatory supervision and support.

It plans to pilot programs that enable remittance backed by distributed ledger technology through multiple channels, including the use of stable coins, bypassing the traditional SWIFT settlement process.

Through Velo, Lightnet will also be able to connect to a multitude of payment partners across the globe.

InsurTech 2.0 firm Fairmatic snaps up $42m in Series A

Fairmatic, an InsurTech 2.0 firm that claims it is pioneering an unconventional approach to fleet insurance, has secured $42m in a Series A raise.

The round was led by Foundation Capital and Aquiline Technology Growth. Also taking aprt were a number of angel investors such as Yahoo co-founder Jerry Yang, Oren Zeev – a one-man VC – and Hippo Insurance co-founder Assaf Wand amongst others.

Fairmatic claims it is focused on enabling savings for safer fleets and improving road safety for all. The company has set out to approach risk and underwriting by harnessing data and AI to introduce a more personalised insurance option that incentivises safety with savings.

Fairmatic’s AI-powered risk and pricing models have been trained with almost 200 billion miles of driving data and tested over five years of operations, demonstrating a proven way to help fleets manage and improve safety issues with actionable insights.

The firm said a simple behavioural shift can result in meaningful cost savings, leading to a more sustainable fleet business with safer drivers, lower attrition rates and more competitive insurance pricing.

Fairmatic said that the team leverages the best of both technology and insurance to improve the entire insurance value chain from risk selection, underwriting and distribution all the way to risk mitigation and claims. The company is also planning to grow its global team with hubs in India, Israel and the US.

Benefits management platform Caju Benefícios lands $25m

Caju Benefícios, a flexible benefits management platform, has secured $25m from a Series B funding round.

The round was led by K1 Investment Management and saw participants ranging from Valor Capital Group, FJ Labs, Clocktower Ventures and Caravela Capital.

Caju claims its mission is to transform companies’ HR functions through technology. Currently, Brazilian labour law requires employers to provide monthly benefits to employees – demonstrating the vitality of Caju to the Brazilian workforce.

The company claims that thousands of companies currently use Caju’s solutions to offer a variety of benefits to their workers and hundreds of thousands of individuals use Caju’s card.

Caju claims it has seen ‘significant growth’ in the past year and has started this year with 70 people employed – the company has now doubled its headcount to 190. The firm plans to expand its bench further to further its mission to reach one million users by the end of the year.

With the new funding, Caju plans to increase the efficiency of its solutions and invest in developing new products for the HR segment in Latin America. The firm also plans to expand its offerings to enterprise customers without detriment to the personalised service it provides to existing clients.

DeFi FinTech Spectral lands $23m

Spectral, a company specialising in the decentralised finance space, has raised $23m from a funding round.

The round was led by General Catalyse and SocialCapital and also saw participation from Samsung Next, Gradient Ventures, Franklin Templeton, Section 32, Circle, Jump Crypto and Shrug Capital amongst others.

Spectral offers MACRO score, which it describes as a multi-asset credit risk oracle. The MACRO score is calculated using many different pieces of on-chain transaction data.

Spectral claims the newly raised capital will help the company fund its vision of a decentralised platform of Machine Learning models that can transform credit scoring into an open and publicly accessible network.

WealthTech VRGL nets $15m for automated data extraction

VRGL, which offers wealth managers institutional-grade analytics and automated data extraction tools, has collected $15m for its Series A round.

MissionOG and FINTOP Capital served as the lead investors. Other commitments came from Sallyport Investments, Checchi Capital, Dynasty Financial Partners, Northwestern Mutual Future Ventures, Flyover Capital, Fin Capital and The Compound Capital.

This capital burst will enable VRGL to boost its sales and partnership capabilities and execute its product and marketing roadmap.

The company was founded by Josh Smith, CEO, and Josh Zimmerman, COO. Smith and Zimmerman have experience building multi-asset class analytics and SaaS-based platforms. Smith was previously the co-founder and CEO of Solovis, an institutional investment management technology platform.

VRGL claims to be the first client acquisition, proposal management and retention tool designed to increase time to revenue and initial check size.

Wealth managers can build trust faster by bringing transparency, visibility and collaboration across the client lifecycle through automated data extraction, institutional-grade analytics, and the ability to seamlessly generate PDF proposals.

Its analytics solution5 Pillar AnalyticsTM covers performance, risk, diversification, taxes, and fees, and statement extraction functionality.

Pezesha scores $11m funding in pre-Series A

Pezesha, a Pan-African embedded finance firm, has raised a pre-series A investment of $11m.

The round was a mix of $6m in equity and $5m in debt and was led by Women’s World Banking Capital Partners.

Pezesha claims it offers a B2B digital lending infrastructure that is focused on providing affordable working capital to financially excluded SMEs in Sub-Saharan Africa.

Headquartered in Kenya, the company said it has been focusing on solving hard infrastructure problems that exclude MSMEs in the ‘missing middle’. The company has become a leader in embedded finance in Africa, and offers productive credit to tech-enabled platforms such as Twiga Foods, Jumia and Marketforce amongst others.

Partners of Pezesha are able to integrate with its APIs and offer credit among other financial services to their merchant network at the point of sale. The firm’s credit scoring APIs act as an engine of a process where MSMEs receive real-time loan offers to purchase stock and pay later.

In addition, the business offers financial literacy courses and debt counselling to MSMEs who do not qualify for loans in order to improve their credit scoring.

Pezesha said it will use the funding to significantly scale operations in its core markets and grow its new markets within Sub Saharan Africa, as well as expanding its digital lending infrastructure to the West African market.

Real estate investment platform Stake bags $8m

Real estate investment platform Stake has raised $8m in its oversubscribed pre-Series A funding round.

The investment was backed by MEVP, BY Ventures, Vivium Holding and Combined Growth Real Estate.

Stake will use the fresh capital to deepen its technology and product, upscale its brand and expand operations in the MENA region.

Based in Dubai, Stake’s mission is to enable a borderless, liquid and accessible market for quality real estate investments. The company boasts 42,000 users from over 80 countries and 150 nationalities.

It also experienced an average 17% monthly growth rate in both investors and AUM, and a 500% overall growth in AUM in the past 12 months.

Users can invest in real estate from as little as AED 500 ($136) and have the ability to buy shares in prime rental properties and manage a diversified portfolio through a mobile app or web platform.

The real estate investment platform stated that it plans to enter Saudi Arabia and Egypt by Q1 2023. It aims to direct the Kingdom’s proactive investors and encourage young Egyptians to tap into the rapidly growing asset class created in their domestic markets, it said.

FX HedgePool rakes in $8m Series A

FX HedgePool, a peer-to-peer matching platform for institutional foreign exchange transactions, has bagged $8m in Series A funding.

The round was led by Information Venture Partners and saw participation from NAventures and Fidelity International Strategic Ventures.

Established in 2020, FX HedgePool has facilitated over $4trn in matched foreign exchange trades for dozens of firms since inception.

FX HedgePool said it is guided by a ‘10X innovation philosphy’ that has allowed the company to react to market demand by delivering thirty product releases annually, compared to an average of three achieved by most incumbents.

This agility, the firm claims, has enabled it to design and develop its first platform prototype in just four weeks back in 2019. Over the following 16 weeks, it delivered the minimum viable product that facilitated the first ever live peer-to-peer FX swaps trades in January 2020 – the platform has rapidly evolved with new releases every 1 to 2 weeks.

FX HedgePool recently revealed its plans to launch an FX spot matching service by the end of the year to meet growing demand from its expanding community of buy-side participants. This will help to further reduce market impact, tracking error, cost transparency and operational ineffencies for buy-side participants in the foreign exchange market, the company claimed.

The newly raised capital will help FX HedgePool speed up its multi-product strategy aimed at delivered further efficiencies for its growing network of investment managers and banks. The company is also launching the FXHP Innovation Pool, a community in which leaders in finance collaborate to address industry challenges by pushing the boundaries of technology to revolutionize the world’s largest financial marketplace.

FX HedgePool recently announced its intentions to launch an FX spot matching service by year-end to meet growing demand from its expanding community of buy-side participants. This natural extension of the company’s product offering will serve to further reduce market impact, tracking error, cost transparency and operational inefficiencies for buy-side participants in the foreign exchange market.

Singaporean FinTech banco rakes in $6.7m Series A

Singapore-based FinTech banco has raised $6.7m in a Series A funding round led by SBI Group.

The round also saw participation from Sumitomo Mitsui Banking Corporation, KZM & Company, R3, Savills and a number of other investors.

Founded in 2018, banco has developed a platform that leverages the digital capabilities of the RABC group’s expertise in micro, small and medium enterprises lending and close industry partnerships in order to develop sector-focused and sustainable financial solutions for MSMEs.

With this influx of new capital, banco claims it will look towards recruiting talents with tech and business development expertise as well as undertaking market expansion within the region of southeast Asia.

Nigerian B2B payments platform Duplo raises $4.3m

Nigerian B2B payments platform Duplo has raised $4.3m in its seed round, which was supplied by a coalition of investors and angels.

A total of 45 investors joined the round, including Liquid2 Ventures, Soma Capital, Tribe Capital, Commerce Ventures, Basecamp Fund and Y Combinator. Existing Duplo investor, Oui Capital, also joined the seed round.

This capital injection comes after a strong period of growth for the company, having increased the number of businesses on its platform by 1,000%. In the last five months, total payment volume has increased by 4,200%.

The Nigerian B2B payments platform offers an end-to-end solution that automates the back-office processes of generating and processing invoices, receiving and approving bills, collecting and disbursing funds and completing account reconciliation. Duplo is aimed at helping African businesses grow through simplified payments.

It works with all major accounting and ERP platforms, including Microsoft, Dynamics, SAP, QuickBooks and Sage, and payments processed through Duplo are automatically synced in real-time.

Duplo claims businesses can reduce admin tasks by up to 50% and reduce payment-related costs by up to 85%.

The Nigerian B2B payments platform recently released a report, which included the surveyed opinions of over 1,000 business owners from Kenya, Nigeria, South Africa and Egypt. It found that 44% of businesses still have to wait more than 24 hours to receive payments from business customers and partners.

It also found that 34% take up to seven days to receive payments, 17% take up to 30 days and 3% take more than 30 days to receive business payments.

Germany’s Justhome bags seed to build home financing tools

Justhome, a next generation home financing startup, has collected €3.3m in its pre-seed round.

The investment was led by Target Global, with capital also coming from APX and Porsche.

With the capital, the company plans to expand its home financing platform and develop its own financing solutions.

The platform launched earlier this year to simplify the homebuying process. Its digital service helps people afford homes in a challenging economic backdrop.

Justhome stated that home ownership in Germany is the lowest among other EU countries, with a rate of around 45%. Based on research by the German Economic Institute, Justhome estimates over 300,000 first-time prospective homebuyers are unable to access the market each year.

The Berlin-based startup supplies homebuyers with a digital experience for the mortgage process, with the chance of finding pre-approved mortgage options from 700 lenders.

Its vision is more than improved brokerage. Currently, it is building financing solutions of its own that are aimed at first-time homebuyers.

Canada’s SureBright closes pre-seed for insurance-as-a-service

Canadian InsurTech SureBright, which offers an insurance-as-a-service platform, has reportedly collected $2.5m in its pre-seed round.

Motivate Ventures served as the lead investor, with commitments also coming from Panache Ventures, according to a report from Coverager.

Founded in 2021, the insurance-as-a-service platform enables any company to embed insurance and warranty products on their website. It allows users to connect, embed and increase average order value by 14%, its website claims.

The platform is no-code and claims to increase revenue, improve purchase conversion and offer hassle-free management. In terms of claims, users can quickly handle it through the app or web portal.

Other investors in SureBright are Plug and Play, Simplex and InsurTech NY.

Motivate Ventures is no stranger to the FinTech sector. It recently led the $2.8m seed funding round of digital payments network iink Payments. The company helps people get paid up to 60-times faster for insurance restoration work.

Muninn boosts its AI-driven cybersecurity tech with seed round

AI-driven cybersecurity platform Muninn has raised €2.5m in its seed funding round, which was led by Luminar Ventures.

The round was also backed by previous investor PreSeed Ventures.

With the capital, the CyberTech company plans to bolster its product and go-to-market teams.

The AI-driven cybersecurity company has experienced strong growth over the past six months, including its revenue tripling. It is expecting the revenue to triple again over the next 12 months.

Muninn, which is based in Copenhagen, offers a proactive threat detection system that learns network behaviour and reveals persistent threat actors. It can proactively predict, track and block network threats in real-time, whilst precisely diagnosing the actions to take to prevent an intrusion.

Its website states, “In Norse mythology the raven Muninn oversees the world and reports important events back to the god Odin. The Muninn AI platform oversees your entire digital infrastructure and protects critical business assets from disruptive cyber-attacks.”

The AI-driven cybersecurity company claims that 37% of businesses are affected by ransomware each year. In Denmark alone, six out of ten businesses are threatened each year.

FinTech Grey lands $2m seed funding

Grey, a FinTech focused on simplifying sending and receiving foreign payments for Africans, has secured $2m in seed funding.

The funding round saw participation from Y Combinator, Soma Capital, Heirloom Fund, True Culture Fund as well as a number of angel investors.

Grey claims the service it offers enables customers to have virtual international bank accounts for free and enjoy a seamless foreign payment process.

With Grey, users can create a foreign USD, GBP and EUR bank account for free, send money to the UK and Europe and receive payments from over 88 countries. The company also offers conversion directly to a users’ local currency so that they can spend it easily on the app, as well as allow users to receive foreign payments in their preferred foreign currency and withdraw directly to mobile money on their local bank account.

Grey intends to use the new funding to launch into new markets and extend their product suite to include not just remittances but also person-to-person and business-to-business payments so every African can enjoy seamless cross-border payments with low fees.

The company has also recently announced its expansion into East Africa, beginning in the Kenyan market.

Ryft bags seed round for PSD2 compliant payments system

Ryft, a PSD2 compliant payments system, has closed a seed round, which was led by UK-based investor SFC Capital.

Other backers to the round include the ex-founder of Shutterstock and the founder of LoveFilm.

Ryft enables automated next day payouts for marketplace businesses and their merchants, for a single flat fee per transaction.

The idea for the PSD2 compliant payments system came whilst co-founders Sadra Hosseini and Alex Mackenzie were working at their first business getbutlr.com. This was a mobile ordering marketplace app for pubs and bars.

Hosseini and Mackenzie scaled this business during the pandemic, reaching over one million customers and 500 active venues at their peak. The duo identified a gap in the market for the profitability of microtransactions and fast payouts. This led to the creation of Ryft.

The Ryft platform processes payments and automatically diverts funds to merchants and sub-merchants the next working day. This end-to-end solution, which is a fully PSD2 compliant payments system, handles everything from accepting online payments, verifying and onboarding merchants, to splitting up the payments however a business wants.

This is all completed through an easy-to-use API documentation to remove complexity and fast track the development cycle.

AccuRisk backs personalised live engagement startup MyHealthMath

AccuRisk, a developer of health solutions, has invested into MyHealthMath, an InsurTech company that combines big data and mathematical modelling with personalised live engagement.

The size of the investment was not disclosed.

MyHealthMath offers its personalised live engagement services to give employers, carriers and consultants unparalleled healthcare benefits decision support.

Based in the US, the company offers personalised reports based on each employee’s specific needs and allows the employees access to live analysts for support. It has three core products, Decision Doc, Benefits Optimisation System and Health Benefit Equity.

The Decision Doc takes employees through a series of questions about their health needs and then gives them a personalised health plan, as well as guidance for dental and vision.

GreenTrade bags pre-seed to launch carbon credits service

Berlin-based GreenTrade has reportedly closed its pre-seed round, as it builds its blockchain-based marketplace for carbon credits and impact claims.

The company raised the capital from Cerulean Ventures, which acted as the lead investor, according to a report from EU Startups. Other commitments came from Draft Ventures, Allegory and Flori Ventures.

Several angel investors also joined the round, including Tom O’Keefe and Climate Capital founder Sundeep Ahuja.

While the exact size of the investment was not disclosed, it is a ‘near-seven-figure’ deal.

This capital injection will allow GreenTrade to expand and accelerate its effort of mitigating the impact of climate change.

Founded in 2022, GreenTrade is on a mission to realise the supply of one billion tonnes of CO2 by 2030. It is doing this by helping developers realise new offsetting projects while empowering companies to fulfil their Net Zero commitments.

GreenTrade connects pricing stability and supply guarantee for businesses while developers can access liquidity at an early stage and accelerate their growth of carbon projects.

The company has built a marketplace for carbon credits from sustainable and transparent environmental projects. The creation of carbon credits and their transactions are recorded on the blockchain. This token protocol also lets project developers and third-party. Verifiers to enter measurement and verification information about carbon projects.

FinTech Tortoise collects funding raise

Tortoise, a FinTech that specialises in the ‘save now, buy later’ space, has raised an undisclosed amount of capital in a funding round.

The funding was provided by the CEO’s of Swiggy and ZestMoney, Sriharsha Majety and Lizze Chapman respectively.

According to Financial IT, Tortoise allows users to save up for large purchases and rewards them for those savings. The savings plan offers weekly and monthly savings plans ranging from a few months to a year.

Consumers are able to make small deposits over a few months to a year for a particular product on the Tortoise app and then use those to buy the product with assured cashback up to Rs 10,000.