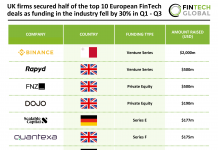

PropTech platform Nokkel, which helps homebuyers and homeowners with the selling process, has received an investment from wealth management firm FNZ.

This investment is part of a wider partnership between the two, which sees Nokkel’s solutions integrated into FNZ’s global wealth management platform. This will help FNZ further open wealth by empowering all people to create wealth through personal investment.

By integrating Nokkel data into their platforms, financial institutions can offer customers a holistic view of their asset portfolio.

With the capital, Nokkel plans to hire more staff and establish a standardised property information infrastructure by connecting the traditionally siloed property and wider financial services worlds. In accessing deeper data, Nokkel will help users do more with their property, whether that is investing in it, taking equity out or increasing its value.

Nokkel’s mission is to transform the buying, selling and owning of property. It consolidates property market data and has created a profile for nearly all of the UK’s 28 million residential properties, which owners can personalise, expand and use to track important information including the value of their home.

Through this, buyers can search within a larger pool of properties and receive alerts when their favourite properties come onto the market. Owners are also equipped to access more financial services, such as registering the value they added to their home, making use of value inherent in their property to get a better mortgage or attract motivated buyers without putting their house on the market.

FNZ CEO and founder Adrian Durham said, “Property is a natural extension of FNZ’s holistic approach to providing wealth solutions to financial institutions across the full wealth management spectrum. For many of us, our home is our most valuable asset – and one of the only assets where we can influence its value – and it shouldn’t be a portfolio afterthought.

“By investing in Nokkel we want to provide greater control and transparency over this asset – in line with what we have over our bank accounts, investments, and pensions. The aim is to enable our customers to better capture this asset class allowing them to deliver personalized financial advice and a set of solutions to as many people as possible, furthering our mission of opening up wealth.”

FNZ recently spoke to FinTech Global about how it is improving the foundations of a three lines of defence model. Read the article here.

Copyright © 2022 FinTech Global