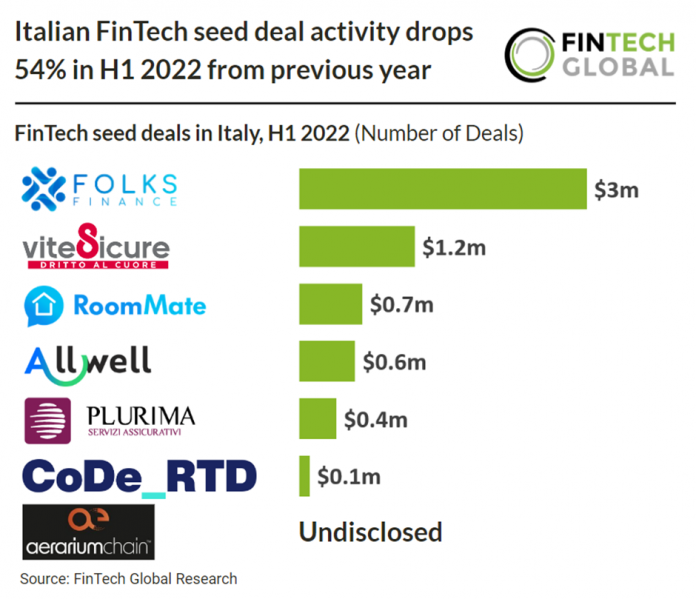

• Italian FinTech seed deal activity has declined considerably in 2022 with only seven deals announced in total for the first half of 2022. In total 27 FinTech seed deals occurred in 2021, signalling a drawback from VC firms backing seed deals in the country. More positively, Italian FinTech funding is on track to more than double in 2022 and is set to surpass the $900m mark which indicates continued growth and a maturing sector. The InsurTech sector accounted for the most Italian FinTech seed deals during the first half of the year with three in total.

• Folks Finance, a capital markets protocol for borrowing and lending built on the top of the Algorand blockchain, was the largest Italian FinTech seed deal in H1 2022, raising $3m in their seed round led by Borderless Capital. Folks Finance will use the funding to expand operations and accelerate growth.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global