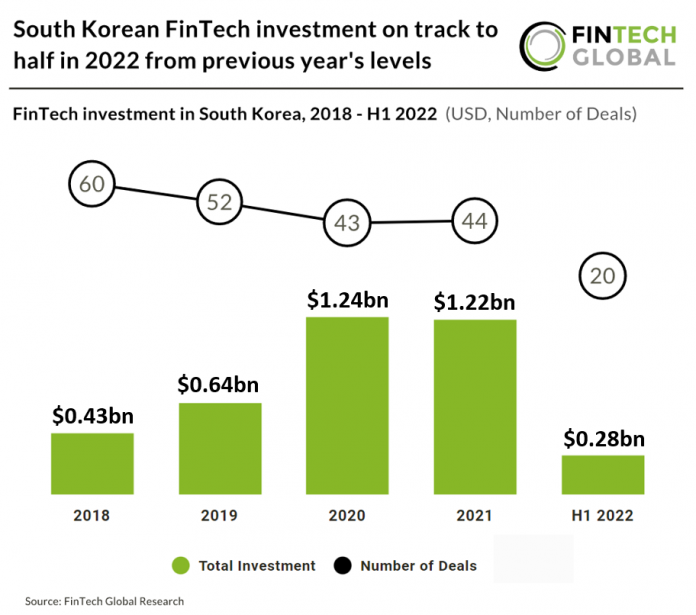

· FinTech investment in South Korea is expected to drop 54% in 2022 based on investment in the first half of the year although deal activity is set to reach similar levels with a 9% reduction indicating a higher drop in deal sizes rather than FinTech activity. The most active FinTech sector was Blockchain & Crypto which accounted for 35% of deals in H1 2022.

· Qraft, which provides an investment process driven by AI, was the largest FinTech deal in H1 2022 raising $146m in their latest Series C funding round led by SoftBank Group International. The funds will be used to accelerate its global business by hiring top-talents and opening new offices across New York, San Francisco as well as Hong Kong. Qraft and SoftBank will also embark upon strategic projects that aim to pursue the possibilities of developing AI-enabled public portfolio management systems for SoftBank. Qraft’s $146m deal represented 52% of South Korea’s FinTech investment in H1 2022.

· The South Korean financial regulatory authorities have implemented “The Guidelines” on FinTech Investment of Financial Companies which promotes FinTech investment by financial companies. The Guidelines allow financial companies to apply for approval of investment in FinTech companies and to engage in the FinTech industry as an incidental business unless there is a specific statutory restriction. The Guidelines also reduces sanctions against officers and employees of financial companies in a situation of failure.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global