• African FinTech companies raised $94m in Q3 which is the lowest quarter so far this year. Deal activity has also dropped, pushing Africa’s expected total deals for 2022 to 228 which is 23pp lower than previous quarter predictions. Although the lack of deals and investment in the region is disappointing, seed deals accounted for 69% of total deals in Q3, which shows that Africa is producing a high number of innovative companies.

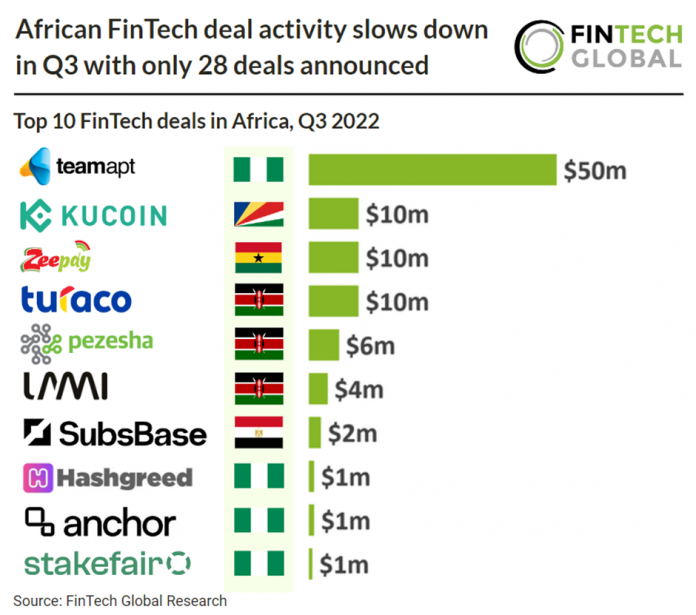

• TeamApt, a financial services platform provider, was the largest FinTech deal in Africa during the third quarter, raising $50m in their latest Series B funding round led by Novastar Ventures and QED Investors. According to the company, the funding will be utilised to expand its credit services, expand into new markets, and spread financial happiness by digitising Africa’s economy. Chief Executive Officer of TeamApt, Tosin Eniolorunda said: “We always approach our fundraising effort opportunistically and want to make sure the market context, cash needs of the business and investor profile match our strategic growth views. Given the overarching cautious market environment, we were not in active fundraising mode. As a profitable company, we did not need the cash, but we were happy to take an opportunity to add a new high-profile investor.”

• Nigeria was the most active FinTech country in Africa during Q3 2022 with 10 deals, a 37% share of total deals. Kenya was the second most active with an 18% share of total deals and Uganda was third with 15%.

• PayTech was the most active Fintech sector in Q3 2022 with 9 deals and accounted for 32% of total deals. Marketplace Lending was the second most active with a 22% share and Blockchain & Crypto was third with 15%.

African FinTech deal activity slowed down in Q3 with only 28 deals announced

Investors

The following investor(s) were tagged in this article.