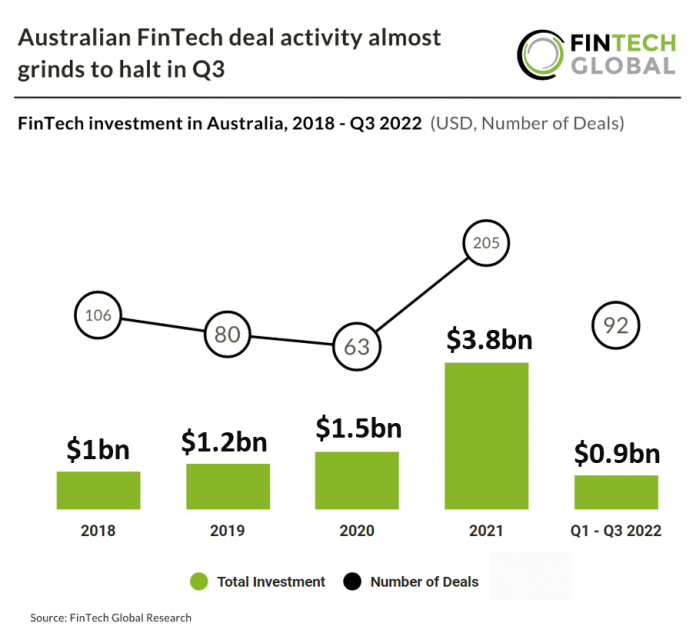

• Australian FinTech deal activity has dropped for the third consecutive quarter with only 18 deals announced in Q3 2022, a 25% decline compared to the previous quarter. Deal activity is now predicted to decrease by 40% in 2022 to 122 deals in total. At this rate Australian FinTech investment is dropping by a larger degree than countries such as the UK, which is projected to see a 24% reduction in deal activity.

• FinTech investment in the country also decreased with only $86m raised in total during Q3, a 43% drop from the previous quarter. Australian FinTech investment is now on track to reach $1.2bn for the whole of 2022, a 68% drop from last year’s levels.

• mx51, a white-label payment technology provider, was the largest FinTech deal in Australia during the third quarter of 2022 raising $32.5m in their latest Series B funding round which included investment from Rampersand, Mastercard, Commencer Capital, Artesian VC and Acorn Capital. mx51 CEO and Co-Founder Victor Zheng said: “Thanks to our partnerships to date, we estimate we now have the means to access a significant share of Australia’s merchant market. With this new capital, we’re poised for an aggressive rollout over the next few years, first in Australia and then abroad.“ In addition to expansion, mx51 will also use the funds to double down on its core in-store, online payments and merchant dashboard solutions. It will also develop further capabilities to assist with fraud prevention and data-driven customer insights.

• Sydney was the most active FinTech city in Australia during Q3 2022 with six deals in total, closely followed by Melbourne which had 4.

• PropTech, WealthTech and PayTech were jointly the most active sectors in Q3 2022 with three deals each.

Australian FinTech deal activity almost grinds to halt in Q3

Investors

The following investor(s) were tagged in this article.