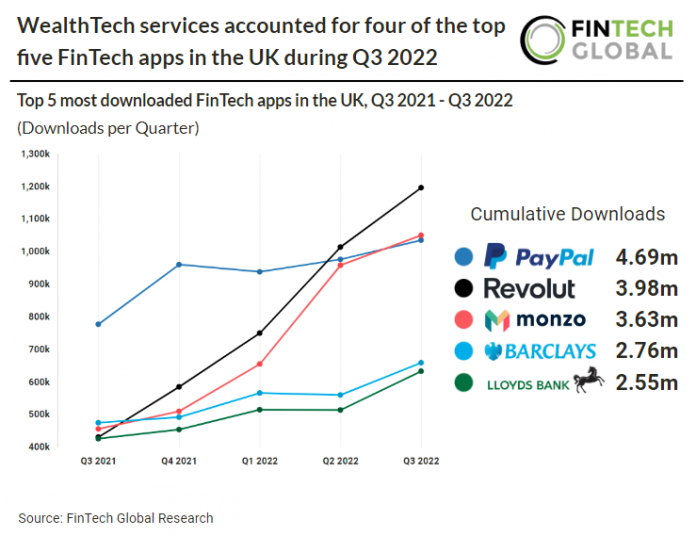

• WealthTech apps dominated in the UK FinTech app stores occupying four out of the five most downloaded spots in the country. Mobile banking adoption in the UK is estimated to reach 93% in 2022 up 7pp from 2021. As of January 2022, over a quarter of British adults have opened an account with a digital-only bank such as Revolut or Monzo listed above, equating to 14m people. An estimated 10% of British adults intend to open an account with a digital-only bank by the end of 2022, meaning the end of the year could see the number of Brits with a digital-only bank rise to 19m.

• PayPal, a payment service provider, had the most cumulative downloads in the UK from Q3 2021 to Q3 2022 with 4.69m downloads over the period. PayPal has been downloaded over 18m times in total which is more than one in four people in the UK (UK population is 67.22 m). PayPal downloads in Q4 may reduce as the company experienced backlash after the online payment service said it would fine users up to $2,500 (roughly £2,261) for spreading misinformation. Google searches for the phrase “delete PayPal ” skyrocketed by 1,392% in the wake of the controversy. A spokesperson for the company stated: “PayPal is not fining people for misinformation and this language was never intended to be inserted in our policy.” PayPal were going to introduce the new policy on November 3rd but have quickly made a U-turn on the plan. Shares in the company fell nearly 6% after the update.

WealthTech services accounted for four of the top five FinTech apps in the UK during Q3 2022

Investors

The following investor(s) were tagged in this article.