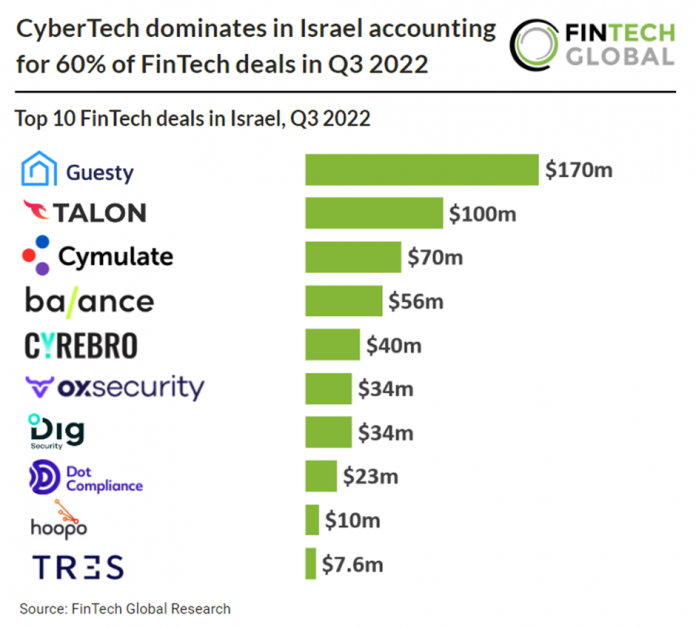

• CyberTech was the most active FinTech sector in Israel during Q3 2022 with 13 deals, a 60% share of total deals. Israeli FinTech companies raised a total of $572m in Q3 2022 across 22 deals. Based on this investment in Q3, total funding from Israeli FinTech is expected to reach $3bn in 2022, a 15% decrease from 2021 levels. Israeli deal activity is on track to reach 137 deals, a 29% drop from last year’s levels.

• Guesty, a property management platform, was the largest FinTech deals in Israel during Q3 raising $170m in their latest Series E funding round led by Apax Digital, MSD Partners and Sixth Street Partners. The funds will be used to expand its presence internationally. It is currently active in the US and Canadian markets and plans to bolster its business in the UK followed by mainland Europe. The company counts Airbnb, Expedia and Booking.com among its clients.

• The Israeli government announced in Feb 2022 that it will join the Inter-American Development Bank (IDB) to establish a new cybersecurity initiative, committing $2m to help strengthen cybersecurity capabilities in Latin America and the Caribbean. Israel’s funding would aid in building cyber capacity across the region by giving officials and policymakers access to forefront practices and world-leading knowledge and expertise, the government stated. “The cybersecurity initiative is paving the way for the safe and secure digitalization of Latin America and the Caribbean, one of the key elements for growth in the post-COVID era,” said Matan Lev-Ari, Israel’s representative on the IDB’s Board.

CyberTech dominates in Israel accounting for 60% of FinTech deals in Q3 2022

Investors

The following investor(s) were tagged in this article.