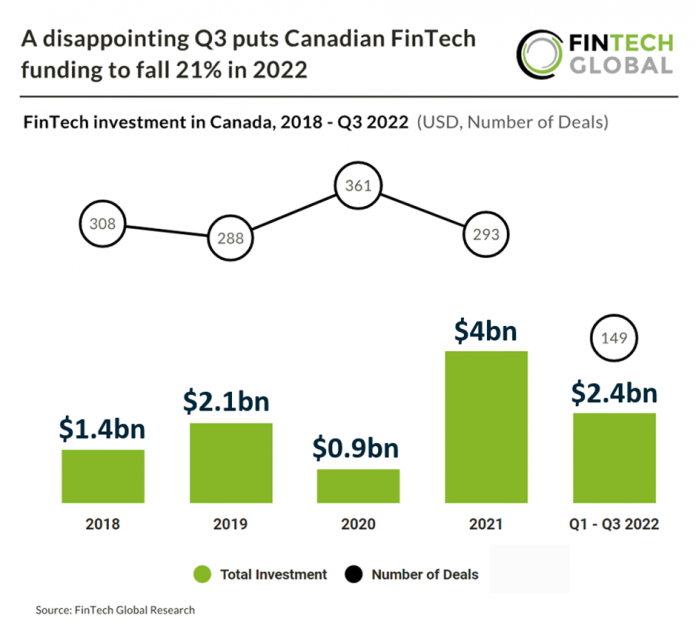

• Canadian FinTech investment reached $280m in Q3 2022, a 36% increase from Q2 but overall fell well short of investment in the opening quarter of the year which reached $1.9bn. Deal activity in Canada is also faltering with 42 deals in Q3 2022, which puts the industry on track to reach 198 deals in total for 2022, a worrisome 32% decrease from 2021. This will put the year end deal activity in Canada at its lowest level for the past 5 years.

• Insurance Supermarket, a digital life insurance provider, was the largest Canadian FinTech deal in Q3 2022 raising $100m in their latest private equity funding round led by Gallatin Point Capital. This transaction represents Insurance Supermarket’s first institutional equity round since launching its digital distribution and administration platform in 2015. The proceeds will be used to accelerate Insurance Supermarket’s profitable growth in life insurance across North America and to scale its technology-driven platform services and distribution channels.

• In Canada FinTech business can voluntarily disclose information about their ESG policies and performance. In January 2022 the Canadian Securities Administrators provided guidance on the disclosure practices of investment funds as they relate to ESG considerations. FinTech businesses, can expect to be subject to more ESG-related legislative and regulatory changes in the coming years.

A disappointing Q3 puts Canadian FinTech funding to fall 21% in 2022

Investors

The following investor(s) were tagged in this article.