In another strong week in the FinTech industry, FinTech Global reported on 29 funding rounds this week.

Heading the list of funding rounds was international payments firm Wise, who scored £300m from a syndicated debt facility.

InsurTech firm Kin also landed a considerable fortune this week, with the direct-to-consumer business raising $145m in a credit facility.

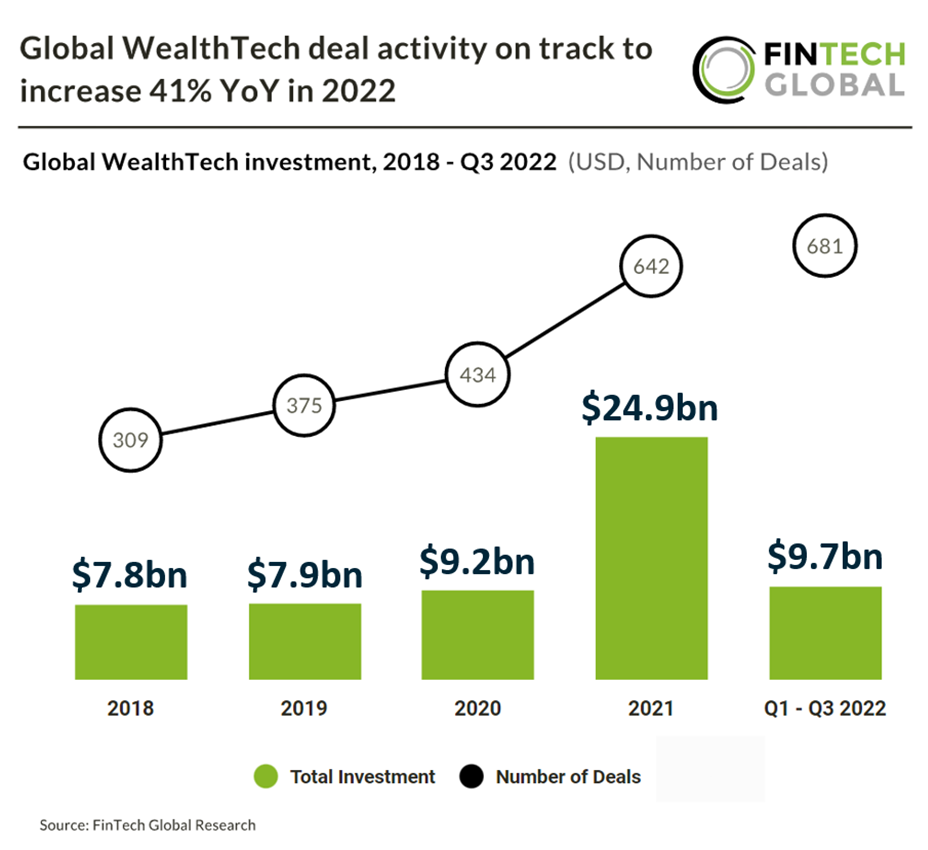

In other areas of FinTech, research this week by FinTech Global found that the WealthTech sector is expected to grow 41% year-on-year in 2022.

According to the research, global WealthTech deal activity is projected to have a record breaking year, reaching 908 deals in 2022 based on investment pace in the first nine months of the year.

Here are this week’s deals.

Wise scores £300m from syndicated debt facility

Wise, an international payments company, has secured £300m from a syndicated debt facility.

Silicon Valley Bank UK acted as lead arranger of the syndication, with six other banks participating in the new £300m capital facility to support Wise’s future growth plans.

The syndicated facility, which was led by Silicon Valley Bank UK’s Corporate Finance team, has a hold level of £100m.

Car financing company Lendbuzz secures $150m

Lendbuzz, which claims to be disrupting the car financing market through AI and machine learning, has secured a credit facility on $150m.

This credit facility will help Lendbuzz expand the number of borrows it serves.

Lendbuzz is an AI-powered auto finance platform that helps consumers get fair access to credit why buying a car. Its alternative data and machine learning algorithms mean Lendbuzz can assess the creditworthiness of consumers with limited credit history.

Through its dealership partners, Lendbuzz offers consumers attractive financing solutions, while opening opportunities for those dealerships to serve a more diversified client base.

InsurTech Kin scores $145m in debt financing

Kin, the direct-to-consumer InsurTech firm, has closed a $145m committed credit facility.

The new facility was led by Runway Growth Capital and the Avenue Venture Opportunities Fund. Additional capital was also provided to to support the expansion of the Kin Interinsurance Network, a reciprocal exchange.

Runway and Avenue were joined by Aquarian Investments, Group 1001 and Skyline Capital on the facility, of which a total of $100 million was funded at close.

The remaining funds will be available to Kin in two tranches as the company reaches certain agreed-upon milestones. Armentum Partners was the financial advisor to Kin for the debt transaction.

Indian B2B marketplace Udaan scores $120m

Udaan, a B2B marketplace with a vision to “transform the way trade is done in India leveraging technology”, has raised $120m as it eyes going public.

Established in 2016 by former Flipkart employees Amod Malviya, Sujeet Kumar and Vaibhav Gupta, Udaan aims to bring traders, wholesalers, retailers and manufacturers together on a platform to find clients, suppliers and products across categories.

The Bengaluru-headquartered also aims to help merchants secure working capital. The startup currently serves more than 3 million retailers and small and medium-sized businesses.

SASE platform Versa Networks closes pre-IPO funds

Versa Networks, a single-vendor secure access service edge (SASE) platform, has raised $120m in pre-IPO funding.

This equity burst will allow Versa to expand go-to-market strategies. It will also empower the RegTech to bolster its position in the market while it prepares for its IPO.

Versa is a single-vendor SASE platform that helps integrate and deliver services via the cloud, on-premises or as a combination of both.

Its services include secure SD-WAN, next-generation firewall, unified threat management, advanced threat protection, secure web gateway, zero trust network access, cloud access security broker, data loss prevention, remote browser isolation and user and entity behaviour analytics.

Dwight Funding bags $100m credit facility

Dwight Funding, a New York-based lender, has received a $100m asset-based revolving credit facility from private and commercial bank IDB Bank.

The FinTech company claims to have been one of the first capital providers to focus on high growth, digitally native brands. It also declares that it leads the broader consumer packaged goods (CPG) space, through asset-based lines of credit and equipment financing.

It will use the financing to bolster its growth and invest into its technology.

IDB was the sole lead arranger and administrative agent for Dwight’s facility.

Embedded InsurTech Cover Genius lands $70m

Cover Genius, a global InsurTech for embedded insurance, has raised $70m in Series D funding.

Cover Genius offers embedded protection to multiple industries including airlines, travel and rental companies, retail, financial services, real estate, logistics, ticketing, gig economy and benefit companies and more.

Cover Genius said the raise will assist in its rapid business growth and expansion of its award-winning global insurance distribution platform, XCover.

Since then, the company has experienced a year of immense growth, reaching $1.1m in daily Gross Written Premium (GWP), nearly tripling its year-over-year revenue. The InsurTech has also doubled its partnership base with new logos including leading American travel app, Hopper, two of the world’s largest airlines, Ryanair and Turkish Airlines, buy-now, pay later leader, Zip; and Indian gig economy platforms, Ola and Betterplace.

Zest AI bags $50m

Zest AI, which automates underwriting with better lending insights, has closed a growth round on $50m.

This fresh capital will enable Zest AI to expand access to AI-automated credit underwriting for all lenders. By doing this, Zest AI hopes to fuel more accurate and consistent underwriting decisions, which will create a level playing field for borrowers and a more inclusive economy, it said.

Zest AI is on track to nearly double its customer base in 2022, having tripled it in 2021. Its clients include Citibank, First National Bank of Omaha, Truist, Golden 1 Credit Union, Suncoast Credit Union, and Hawaii USA Federal Credit Union. The company has built over 250 AI-underwriting models.

Founded in 2009, helps automate underwriting by leverages AI to identify, predict and remove inherent biases and render more consistent and equitable lending decisions.

Plend raises £40m to help end financial exclusion

UK-based ethical lender Plend has reportedly raised £40m in a seed funding round, as it looks to put an end to financial exclusion.

The investment was support by Active Partners, Velocity Juice, Sivo and the founders from Monzo, Starling Bank and Oodle Car Finance, according to a report from FF News. Other commitments came from existing backers Ascension, Tomahawk VC, DD Venture Capital and Haatch.

Plend’s mission is to rebuild the credit system, which it believes discriminates applications based on their historic and limited data, rather than assessing what they can really afford.

Since its launch in July 2022, it has already processed over £40m loan applications and its loan book is increasing by 20% month-over-month. The company is planning to more than double its lending output by the end of the year.

The company offers affordable loans ranging from £1,000 to £10,000, with up to 25% APR.

MDR platform Binary Defense Systems grabs $36m

Binary Defense Systems, a managed detection and response (MDR) and enterprise defence provider, has raised $36m for its first institutional growth equity funding round.

With the funds, Binary Defense Systems plans to accelerate its sales and marketing efforts and broaden its partner ecosystem. It also hopes to expand its machine learning capabilities and create a world-class managed open XDR offering.

Binary Defense Systems, which was previously bootstrapped, was founded by David Kennedy and Mike Valentine.

The company provides customers with remotely delivered security operations centre functions. These functions allow users to quickly detect,

B2B payment platform Fintecture nets €36m

Fintecture, a B2B payment platform, has raised €36m in its Series A round, as it looks to grow its team.

Fintecture helps around 7,000 businesses to collect payments, with over 250,000 buyers having already paid with Fintecture through multiple sales channels, including e-commerce, in-store, remote sales or billing cycle. The FinTech company launched in 2020.

Fintecture claims that the B2B transactions market is huge, with over 130 trillion euros exchanged each year between companies. Despite this, over 90% of transactions are done offline and over 50% are still paid through manual or paper-based solutions.

This is where Fintecture steps in. Its platform helps businesses digitise their payments and sync their data with billing and accounting processes to make their business run better.

Egypt’s MoneyFellows raises $31m

Egyptian FinTech platform MoneyFellows, which offers a mobile-based platform to digitise rotating savings and credit associations (ROSCAs), has closed its Series B funding round on $31m.

This capital injection will enable the company to accelerate its growth by releasing new services and expanding its current product offerings across the B2C and B2B segments.

It stated that these ROSCAs are known as Gameya in Egypt and other Arab countries. MoneyFellows claims to be the first to offer next generation digital RoSCAs globally.

Through the app, users can manage and plan their financial obligations and achieve their financial goals. It also offers a secured and convenient alternative to traditional finance that is more social, culturally favourable, affordable, and incentivising, it said.

ShipIn Systems bags $24m to make the maritime industry safer

ShipIn Systems, a visual fleet management platform, has raised $24m in Series A funding in a bid to make the maritime industry safer.

Founded in 2019 by Osher Perry and Ilan Naslavsky, ShipIn’s platform proactively alerts shipowners, managers, and seafarers to onboard events in real-time, reducing losses by 40% and increasing productivity by 8%.

ShipIns said its platform makes it easier to process maritime insurance claims with an objective record of all events onboard.

ShipIn said the investment will power its mission to improve safety, security, and productivity in the global maritime industry with patented AI technology.

The company said it will use the funding to scale across the industry and expand its visual analytics platform.

Cloud-native payment technology provider Form3 raises debt

Cloud-native payment technology provider Form3 has closed a venture debt facility on €23m to support its rapid global expansion.

The venture debt funding was supplied by Atempo Growth. With the funds, Form3 hopes to explore acquisitions, launch into new markets and bolster its product growth.

Form3 is an API-based cloud technology solution developer that helps financial institutions offer mission-critical payments.

It claims to be revolutionising how payments work from channel to payment scheme. It has an enterprise-grade, managed, payment technology platform that can integrate across multiple payment schemes and easily connects into local payment systems.

WalletConnect snares $12.5m in ecosystem round

WalletConnect, a web3 communications protocol firm, has raised $12.5m in an ecosystem round.

The ecosystem round, the firm claims, will lay the groundwork for WalletConnect’s future development, forging the strategic partnerships that will contribute to the creation of the WalletConnect Network, a decentralized communications network anchored in the WalletConnect protocol.

Founded with the mission to connect web3 devices, the firm establishes an end-to-end encrypted connection between a wallet and an app, enabling the wallet user to securely interact with the app and carry out actions such as transaction signing and token authentication.

So far, the company has been integrated by more than 210 consumer and institutional wallets. Currently, WalletConnect is utilized by users in 157 countries to connect with web3 wallets and apps. It is also expanding its product suite with new communications APIs built on its interoperability infrastructure.

FLX Networks bags $10m

FLX Networks, which is modernising the engagement between asset and wealth management firms, has collected $10m in funding.

With the funds, the company hopes to bolster its technology and hire more staff.

The FinTech company has achieved several milestones recently. It achieved over $1bn in investment product saves, saved member asset managers more than $10m in discretionary costs and surpassed 1,000 in overall industry membership.

FLX Networks launched in 2019, and claims to transform engagement for asset and wealth management firms and financial advisors. Its community members have access to thought leadership, investment ideas, business resources and industry connectivity in a centralised destination.

Cyber defence platform BluSapphire raises $9.2m

BluSapphire Cyber Systems, a unified advanced cyber defence platform, has reportedly raised $9.2m for its Series A funding round.

With the funds, the CyberTech company plans to grow its presence across North America and India.

The CyberTech company claims to go beyond Extended detection and response and stylises itself as the only cybersecurity platform a company needs.

Its cloud native, unified platform boasts threat detection, response, remediation and protection services. Features include threat hunting, threat intel, anti-ransomware, predictive intelligence, behaviour analysis, and much more.

SparkPlug lands $8m in Series A haul

SparkPlug, a US-based provider of an incentive management and wage supplementation platform, has bagged $8m in its Series A.

In areas like beauty, electronics, and outdoor gear, many customers rely on the product recommendation of point-of-purchase experts up to 92% of the time.

Founded in 2018, SparkPlug allows brands to directly reward these key influencers for every sale they generate with cash via gamified commissions, contests, and goals.

The firm drives more revenue for brands, improves employee performance for retailers, and empowers frontline workers across the world with fair compensation and economic equality, all based on the sales revenue they generate each day.

The company plans to use the newly raised war chest to accelerate its growth plans which include key executive hires and investments into data, development, and behavioural science expertise to continue expanding its platform.

InterPrice raises $7.3m for its transparent financing tool

InterPrice Technologies, which aims to create a transparent financing tool, has closed its Series A funding round on $7.3m.

InterPrice Technologies is on a mission to provide corporate treasures with a transparent financing tool and enable all stakeholders to make decisions with accuracy, speed and precision.

The platform allows treasurers to abandon Excel sheets that track funding costs. Instead, its platform collects CP run rates and new issue bond indications provided by the bank into intuitive user dashboards and scenarios. The user can then export into Excel to create charts and reports.

Other benefits of InterPrice Technologies is an instant comparison of relationship banks’ proposed funding alternatives, support to justify financing decisions and more.

Smart wallet Kudos secures $7m

Kudos, a smart wallet that maximises consumer rewards and benefits while shopping online, has raised $7m in seed funding.

Founded in 2021, Kudos is a smart wallet that works everywhere users shop online and helps them save time and earn money whenever they shop.

The Kudos smart wallet helps users maximize their credit card rewards and hidden benefits like purchase protection and travel insurance when shopping online. Kudos said it speeds up checkout by auto filling card details, including CVV, on every site users shop at.

Alongside the funding, the company has also launched its mobile and desktop extension to the public.

Kudos said the capital will enable it to further develop its first product, a smart wallet that helps users simplify checkout and maximize their credit card rewards whenever they shop online.

Retirable bags extra $6m

Retirable, a holistic retirement solution with the ongoing care of an advisor, has raised an additional $6m in seed funding and launched a retirement income and investing offering.

The company offers ongoing management from a fiduciary advisor to help clients spend retirement income efficiently, make savings last, and navigate key decisions throughout retirement.

The majority of middle class Americans have not had the opportunity to obtain professional advice, Retirable said, let alone advice that centres their needs and lifestyle. This is what Retirable is on a mission to change.

For example, Retirable’s income service helps clients effectively decumulate their retirement savings by sending monthly direct paychecks aligned with the planned amount to sustain their lifestyle.

In addition to a dedicated advisor, Retirable clients receive personalised investment portfolios that balance short-term income with long-term growth. Retirable allocates an individual’s assets into three distinct buckets: cash, stability and growth, designed to produce reliable monthly income for the duration of their retirement.

Lumiq lands $5.5m Series A

Lumiq, a data and analytics business, has raised $5.5m in a Series A round headed by Info Edge Ventures.

Lumiq is an end-to-end data transformation partner for modern financial services and insurance companies. The firm said it helping them build the Right Data DNA which powers their competitive edge and future growth.

The funding will be used to further develop Lumiq’s presence in international markets – US and SEA, and strengthen their FSI-focused product line.

Lumiq’s flagship product – empOWER FSI Data Platform – enables financial enterprises to manage, leverage, and monetize their data seamlessly. With over 70 ready-to-deploy AI ML data models already live for 20+ financial and insurance enterprises, the platform has so far analyzed over 1 billion customer interactions.

Centrifuge raises funds to bring real-world assets to crypto

Centrifuge, which claims to be the first DeFi protocol to finance real-world assets (RWAs) on the blockchain, has closed a $4m funding round.

Centrifuge stated that Covid-19 and the DeFi Summer of 2020 introduced many new investors, both individual and institutional, to crypto. However, crypto has dropped in 2022 and many of these investors are looking for products that offer real value and generate sustainable yield.

This is what Centrifuge aims to do. It brings off chain assets into DeFi, enabling a range of businesses to access financing without banks or third party intermediaries. As a result, Centrifuge acts as a bridge to connect real-world assets to DeFi liquidity with their integrations into Maker and Aave.

Through Centrifuge, businesses tokenise non-crypto assets, such as mortgages, invoices and consumer credit to create asset-backed pools. Once on the chain, these assets are unlocked and transact directly with investors.

CyberTech Protexxa lands $4m in seed funding

Protexxa, a cybersecurity startup, has raised CAD$4m in a seed funding round headed by BKR Capital.

Protexxa is a B2B SaaS cybersecurity platform that leverages AI to rapidly identify, evaluate, predict, and resolve cyber issues for employees.

According to Help Net Security, with 43% of cyberattacks aimed at small businesses, cyber solutions for businesses of all sizes are needed now more than ever.

The funds will be used to build out the cybersecurity platform with assisted remediation technology, facilitate pilots with global customers, and prepare to scale its operations. The company is currently in the process of filing several patents.

Tags scores $3.5m in pre-seed raise

Tags, a business that generates instant checkouts points, has landed $3.5m in pre-seed investment.

When a buyer activates a Tag, they experience a pre-loaded shopping cart with one-click functionality, eliminating several traditional purchasing steps. Each of them is encoded, like a transactional barcode and comes in different formats to support all media types.

QR Tags can be used for instant purchasing at physical locations, on products for repurchasing or on-print materials, like magazines or brochures. Link Tags can be used on social media as link stickers or as bio links.

Text Tags are used for live shopping, podcasts and other types of conversational commerce. Tap Tags are fast and easy for consumers to engage with via websites, AR, VR or the metaverse.

Pasito bags $3.25m to simplify employee benefits

Pasito, an employee benefits tech startup, has raised $3.25m in seed funding to simplify health and wealth benefits.

Pasito is on a mission to simplify health and wealth benefits for employees while saving companies and families money.

The company’s technology integrated directly with a company’s HR systems and processes census, health, financial and family data to guide employees through benefits selection and engagement throughout the year.

According to Pasito, the funding will be used to drive product development, additional data and HRIS integrations, and hire engineering resources.

All Gravy closes seed on €3.2m

All Gravy, which helps bolster their employee happiness, has closed its seed round on €3,2m.

The investment was led by Moonfire Ventures, an investor focused on early-stage founders.

Following the close of the round, All Gravy plans to enhance its employee focused app and develop more tools for its platform. Additionally, it is seeking to hire more people to join its team and launch in the UK.

Founded in Denmark in 2020, All Gravy helps businesses understand, motivate and retain their hourly paid employees. It offers actionable insights, such as employee turnover, happiness and location performance. It also streamlines employees taking shifts across different branches.

Fursure gets its claws into $3m

Fursure, a leading pet insurance marketplace and mobile banking platform for pet parents, has raised $3m in a seed financing raise.

Established in 2020, Fursure offers a marketplace that makes it simpler to find and compare pet insurance policies. The company has helped over 60,000 pet parents get access to the care they need since its inception.

Fursure said the success of its marketplace led it to develop a first-of-its-kind Pet Rewards Debit Card that helps pet parents save for their pet’s healthcare. Fursure Card holders earn supercharged points on everyday spend that can be redeemed towards the cost of veterinary bills.

Krepling lands $1m in pre-seed financing

Krepling, a US-based e-commerce dev platform provider, has recently raised $1m in a pre-seed financing round.

Krepling claims it is the world’s first no-code composable platform built for commerce. The company enables merchants to build and unify their entire e-commerce stack and build brilliant, end-to-end, purchasing and automation channels beyond a simple storefront.

Users can also integrate with applications to create better buying experiences, automate marketing-based operations and sell products in a borderless environment. The company was founded by Travis and Liam JE Gerada.

Krepling plans to use the newly raised capital to speed up growth and expand its operational side.

Last week, the PayTech sector represented five of the top ten deals in the FinTech sector.

Copyright © 2022 FinTech Global