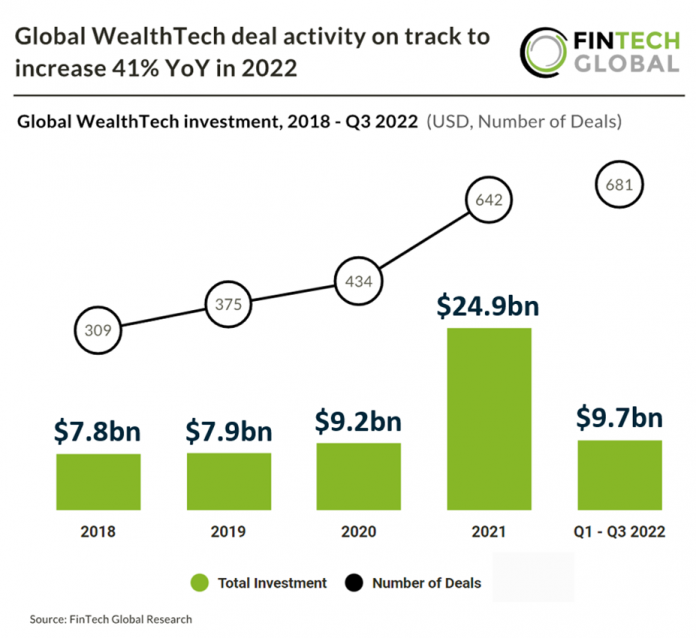

• Global WealthTech deal activity is projected to have a record breaking year, reaching 908 deals in 2022 based on investment pace in the first nine months of the year, a 41% increase from the previous year. Investment however is the opposite and is expected to fall considerably to $12.9bn, a 49% decrease from 2021 levels and average deal size is expected to change from $38m to $14m from. Investment in Q3 2022 only reached $0.9bn, an 83% drop from Q1 2022.

• Smart, a British company which provides a global retirement platform called Keystone, was the largest WealthTech deal in Q3 2022 raising $47.4m in its latest Private Equity funding round led by CIBC Innovation Banking. Smart will use the capital to expand its market growth, accelerate the launch of strategic products, and undertake acquisitions. “We’re delighted to have CIBC Innovation Banking support Smart, helping us accelerate our near-term growth ambitions, increase our presence in core markets, and roll out product initiatives to transform retirement across the world,” said Eoin Corcoran, Chief Financial Officer of Smart.

Global WealthTech deal activity on track to set new annual record despite FinTech funding slowdown

Investors

The following investor(s) were tagged in this article.