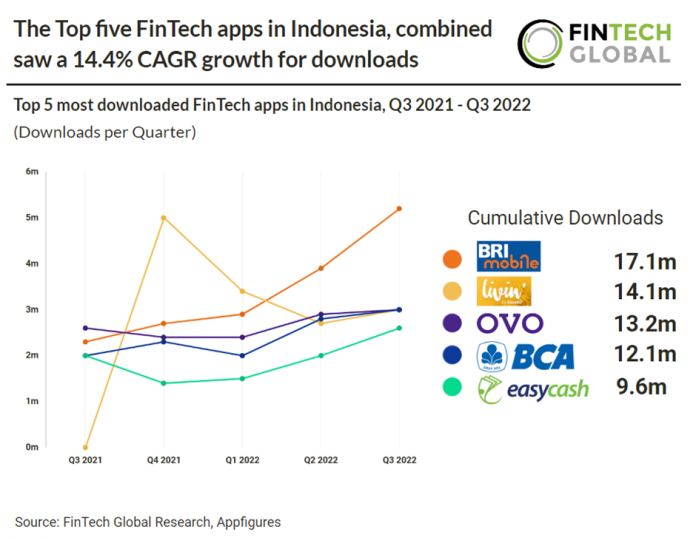

• FinTech apps downloads in Indonesia have seen consistent growth from Q3 2021 – Q3 2022, the top five FinTech apps grew at a combined CAGR of 14.4%. Indonesia, like many other countries in South East Asia, is ripe for FinTech adoption. The country has a very youthful population with 84% of the population under the age of 54 in 2020 (Indonesian population is 274m) and 83m people do not have a bank account. The country is also very tech savvy with a 67% of the population using the internet.

• BRI mobile (BRImo), an internet and mobile banking application, was the most cumulatively downloaded FinTech app in Indonesia with 17.1m downloads from Q3 2021 – Q3 2022. BRI mobile has been downloaded 76.1m times in total which is equivalent to 28% of the Indonesian population. According to Catur Budi Harto, Vice President Director of BRI, the platform has witnessed strong traction, reaching 11.7m users by the end of July 2021, up 86.7% year-on-year. BRImo allows users to transact, make QR code payments, cardless cash withdrawals, as well as tap advanced security features for their Internet and SMS-based banking capabilities to serve their daily needs. It’s available to both consumers and merchants, enabling, for instance, physical stores to accept cashless payments. The app supports full remote onboarding, requiring users to only perform e-KYC, eliminating the need to physically visit a branch.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global