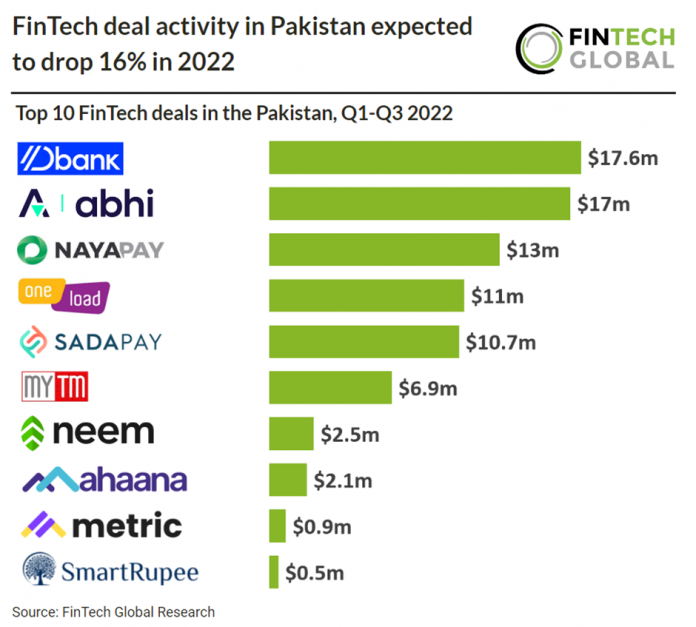

• Pakistani FinTech deal activity reached 24 deals from Q1-Q3 2022 and is on track to decrease 16% based on activity in the first three quarters of 2022. Investment in the country reached $82.4m from Q1-Q3 2022, a 14% drop from 2021 levels.

• Dbank, which offers lending and payment services, was the largest FinTech in Pakistan during the first three months of 2022 raising $17.6m in their Seed funding round led by Kleiner Perkins, Sequoia Capital and Surge. Dbank will use the funding to expand the reach of financial services in a “transparent and friendly” manner in Pakistan, taking on the informal credit system that tends to exploit those in need with exorbitant and unpredictable interest rates, said Tania Aidrus, co-founder of Dbank. Nearly half of the population of Pakistan, home to over 220 million people, currently don’t have bank accounts. “We want our users to be in control of their money and to make informed choices,” said Aidrus.

• The State Bank of Pakistan, Pakistan’s central bank, has deeply investigated ways to improve the country’s payments infrastructure, modernising the industry to increase financial inclusion. The country developed Raast, a real-time payments system, for instant digital transactions in Jan 2021 and also built NADRA, a digital identify platform in March 2000. The central bank has also introduced a new full banking digital license in Jan 2022, allowing more players to serve as banks that can take deposits from customers without having to have physical centres.

FinTech deal activity in Pakistan expected to drop 16% in 2022

Investors

The following investor(s) were tagged in this article.